— By Brett Silverstein — With uncertainty looming large and terms like risk, crash and recession swirling around the industry, it comes as no surprise that some investors are clinging to their cash reserves. But savvy investors go back to the fundamentals of the real estate cycle. While the economic conditions that influence the cycle are often different, such as the Dot-Com bubble, the Global Financial Crisis and, most recently, COVID, the predictability of the real estate cycle is consistent. In my opinion, a sound acquisitions strategy today is one grounded in acquiring high-quality assets below replacement cost in Intermountain West markets that exhibit strong fundamentals, such as outsized rent growth, continued strong household formation patterns and limited future supply growth. Distress leads to discounts Amidst the prevailing market turbulence, the acquisition of existing assets at a discount to the cost of building new ones becomes an even more compelling proposition. Replacement cost alone may not suffice as an investment metric, but the combination of discounted prices and robust market fundamentals creates the secret sauce of sound investment decisions. Housing is an essential good that is always in demand and has historically inflated over time. The foundational concept of “heads …

Western Feature Archive

Converting Office to Life Sciences Offers Lucrative Alternative to Residential Reuse Projects

by Jeff Shaw

— By Julian Freeman, Dave Wensley and Gabe Pitassi — With steep vacancy rates impacting traditional office markets due to the headwinds of higher interest rates, short-term economic uncertainty and long-term remote/hybrid work uncertainties, underutilized traditional office buildings may become liabilities before the end of their anticipated economic life. Owners of these properties may consider a conversion — an adaptive reuse or repurposing — to access higher rents and occupancy rates. In view of nationwide housing shortages, especially in California, converting office to multifamily has received much attention as a logical move. However, such a conversion is not always viable from a financial, structural, legal or location perspective. An alternative option may be to repurpose an office building for life sciences use. Such a conversion, while posing its own unique challenges, may provide more realistic options than a conversion to residential use for many owners and properties. Challenges in converting to residential Converting an office building to residential use presents challenges on multiple fronts. Zoning laws vary based on property location and usage, and the property may need to be rezoned to a different classification to allow multifamily uses. Rezoning requires local government approval and public hearings, which can take months …

FeaturesHeartland Feature ArchiveMultifamily & Affordable Housing Feature ArchiveNortheast Feature ArchiveSoutheast Feature ArchiveTexas & Oklahoma Feature ArchiveWestern Feature Archive

Forecast Survey: What’s Your Take on Commercial Real Estate in 2024?

by John Nelson

The editors of REBusinessOnline.com are conducting a brief online survey to gauge market conditions in 2024, and we welcome your participation. The survey should only take a few minutes to complete. Questions range from property sectors that you are most bullish on heading into 2024 to trends in deal volume to your outlook for interest rates. The results of our 13th annual survey will be compiled and published in the January issues of our regional magazines. Conducting these surveys is part of our mission at France Media to provide readers with indispensable information, and we couldn’t do it without your help. To participate in our broker/agent survey, click here. To participate in our developer/owner/manager survey, click here. To participate in our lender/financial intermediary survey, click here. (Note: Please remember to click on “done” to properly submit the survey.)

By Dan Spiegel of Coldwell Banker Commercial As we enter an age where online shopping dominates the retail landscape, a recurring discussion in commercial real estate is what part malls play in this new world, if any part at all. More and more malls are “dying out,” which creates a difficult challenge for property owners as conventional indoor malls are no longer a commodity due to constantly evolving shopping trends. My team and I work with retail property owners and buyers at Coldwell Banker Commercial to address these difficulties and help build a new future for successful mall properties. Thankfully, there are a few key strategies property owners can implement to save their shopping centers from becoming obsolete. One of these strategies includes renovating a mall to create new stores and experiences, repositioning the space as a social destination for recreation. Another involves transforming shopping centers into mixed-use spaces, adding apartments and multifamily units to increase foot traffic and provide people with access to shopping, housing and other essential services. Older Properties, New Market The Reno Public Market in Reno, Nev., is a great case study that demonstrates one of the ways in which property owners can adapt to current …

— By Bob Lisauskas, Principal, RDC in Long Beach, Calif. — Daily patterns of life have been turned upside down since 2020. Three years since the disruption of quarantine living, it’s becoming clear what was temporary and what has been permanently changed. The good news: our cities have the potential to come back healthier than ever. Cities are resilient places and are finding ways to adapt and transform. Building owners, municipalities, architects and other stakeholders are actively collaborating on ways to repair the city fabric. While some of these companies and individuals have fled to the suburbs, many are more committed than ever to preserve urban living. This is often because they love the city where they own their property, and are personally motivated to breathe life into the area. Another wrinkle driving urban transformation is the housing crisis. It’s an urgent reality that we need more housing at every price point in our urban centers. This is something that’s of paramount concern, particularly in California, as rents and property values rise. These, along with other trends and market disruptors, are pushing cities toward a primarily mixed-use future in which new developments serve the entire 24-hour cycle: living, working, shopping …

FeaturesHeartland Feature ArchiveNortheast Feature ArchiveOtherSoutheast Feature ArchiveTexas & Oklahoma Feature ArchiveWestern Feature Archive

Forecast Survey: What’s Your Take on Commercial Real Estate in 2023?

by John Nelson

The editors of REBusinessOnline.com are conducting a brief online survey to gauge market conditions in 2023, and we welcome your participation. The survey should only take a few minutes to complete. Questions range from property sectors that you are most bullish on heading into 2023 to trends in deal volume to your outlook for interest rates. The results of our 12th annual survey will be collated and published in the January issues of our regional magazines. Conducting these surveys is part of our mission at France Media to provide readers with indispensable information, and we couldn’t do it without your help. To participate in our broker/agent survey, click here. To participate in our developer/owner/manager survey, click here. To participate in our lender/financial intermediary survey, click here. (Note: Please remember to click on “done” to properly submit the survey.)

By Barry Manuel, CIO, MEB Management Services Did you know that 39 percent of energy-related carbon dioxide emissions are generated through manufactured buildings? We spend the majority of our lives using indoor spaces to gather, work, socialize and live, which means multifamily developers and managers need to consider environmentally friendly options that don’t contribute to the global climate crisis. It’s the right thing to do, and we’re not the only ones who know that. Residents are getting wise to the impact their buildings play in the climate crisis. Creating A Solution With this in mind, we recently created the MEB Sustainability Committee to address environmental issues and adapt sustainability practices for our multifamily properties throughout Arizona and New Mexico. Our goal is to have at least 75 percent of all MEB properties engaged in energy-saving initiatives. MEB is taking a two-pronged approach. We’re using ESG ratings to measure long-term environmental, social and governance risks while educating and sharing sustainable practices with our residents and management teams. Through a collaborative effort, we’re reducing emissions by making changes to both new and existing apartment buildings. Part of our strategy and collaboration involves partnering with one of the most sustainably conscious builders in Arizona …

By Michael Brumley, Project Executive, Kiewit Building Group AT The pandemic sent ripple effects throughout the construction industry. Along the way, it also heavily influenced and impacted the way employees in the workforce now operate and interact. With COVID prompting a shift in remote work, many are wondering if it’s beneficial to go back to the office full-time, adopt a hybrid approach or forgo investing in office space altogether. There are many justifications for investing in office space when you consider variables like productivity, industry-specific jobs or trades, and overall employee satisfaction and benefits. The distinction is you need to invest in spaces that are successful for employers and employees alike. It’s All About the Benefits The pandemic proved work can be done anywhere as long as Wi-Fi is available. So, how can companies entice employees to work at an office once the investments have been poured into developing the physical space? According to a survey from McKinsey on consumer interest and purchasing power, 79 percent of respondents said they believe wellness is important while 42 percent consider it a top priority. Consumers in each market studied reported a substantial increase in the prioritization of wellness over the past two to three …

By Carol Cole, director of interior design, DAHLIN Group Architecture AT Intergenerational households are growing at a faster pace than they were pre-pandemic. Generations United, a nonprofit dedicated to supporting intergenerational programs and policies, estimates that 66.7 million U.S. adults live in a multigenerational household, with nearly 57 percent of this statistic spurred by COVID. Even after the immediate impacts of the pandemic subside, intergenerational living will remain prevalent for a variety of reasons. These can range from the need for child and/or elder care to cultural expectations and economic-related factors, such as loss of a job, high educational expenses or housing availability. Considering this trend and recognizing that more than 16 million Americans are currently over the age of 65, the movement toward incorporating universal design strategies on residential projects is key for creating aesthetic living spaces that are usable by everyone to the greatest extent possible. Already a standard in the healthcare community, universal design is the design and composition of a space set up to meet the needs of all users, not as a special requirement to benefit only a small fraction of a population. The practice results in inclusive environments that support high-functioning, independent living for …

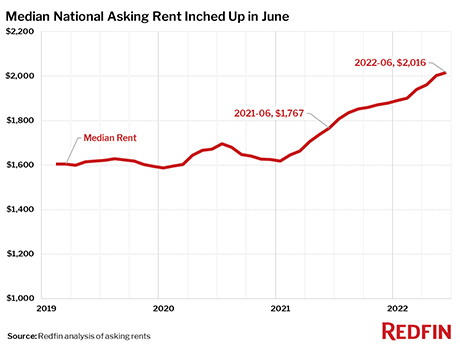

SEATTLE — Redfin, the residential real estate brokerage giant, has reported that the national median asking rent in June is $2,016 per month, a 14.1 percent increase year-over-year. The Seattle-based company analyzed data from 20,000 separate multifamily and single-family properties from its RentPath platform across the top 50 U.S. metro areas. The June figure is a slight increase from May at 0.7 percent, which represents the smallest month-over-month gain since the start of the year. The median asking rate is also the smallest annual increase since October 2021. Daryl Fairweather, Redfin’s chief economist, says while still elevated, the current slowdown in rent growth could be anticipatory on the part of landlords in reaction to overall inflation. (The Consumer Price Index saw its biggest annual gain since 1981 in May, according to the U.S. Bureau of Labor Statistics). “Rent growth is likely slowing because landlords are seeing demand start to ease as renters get pinched by inflation,” says Fairweather. “With the cost of gas, food and other products soaring, renters have less money to spend on housing.” “This slowdown in rent increases is likely to continue, however rents are still climbing at unprecedented rates in strong job markets like New York …