MELBOURNE, FLA. — Marcus & Millichap has arranged the sale of Melbourne, Florida Storage Opportunity, an 89,250-square-foot self-storage facility located in Melbourne, roughly 70 miles southeast of Orlando on Florida’s Space Coast. The property, which features 66,547 square feet of rentable space and 662 climate-controlled units, was acquired by an undisclosed limited liability company. Meir Perlmuter, Nathan Coe, Brett Hatcher and Gabriel Coe of Marcus & Millichap marketed the property on behalf of the seller, also an undisclosed limited liability company, and secured and represented the buyer in the transaction. Ryan Nee, the firm’s Florida broker of record, assisted in closing the sale. The sales price was not disclosed.

Florida

ALTAMONTE SPRINGS, FLA. — Atlanta-based Coro Realty Advisors has sold Wekiva Square, a 175,175-square-foot shopping center located at 945 Semoran Blvd. in Altamonte Springs, a suburb of Orlando. V3 Capital Group purchased the property for $23.5 million. Brad Peterson, Whitaker Leonhardt and Tommy Isola of JLL represented Coro Realty in the transaction. Built in 1981 and most recently renovated this year, Wekiva Square was 99.1 percent leased at the time of sale to tenants including HomeGoods, Dollar Tree, Fancy Fruit and San Jose Mexican Restaurant. The center also includes a Kohl’s store that has a separately parceled ground lease.

Joint Venture Begins Construction on 502-Unit Multifamily Project in Lakewood Ranch, Florida

by John Nelson

LAKEWOOD RANCH, FLA. — A joint venture between Ryan Cos. US Inc., PGIM Real Estate and ParkSprings Development has begun construction on Renata at Lakewood Ranch, a 502-unit multifamily project within the 33,000-acre master-planned Lakewood Ranch community, which is located between Sarasota and Tampa. The project, which will span 37 acres, is slated for completion in 2024, with preleasing to start next year. Renata at Lakewood Ranch will consist of a series of four-story walk-up apartment buildings comprising a mix of one-, two- and three-bedroom floor plans with an average unit size of approximately 985 square feet. Amenities will include resort-style pool, spinning room, yoga room, free weights, bar games, a golf simulator, putting green, dog spa and dog park, lawn sports, multiple barbecue areas, walking trail around the property’s central lake, sand volleyball courts, conference and office rooms for remote workers and a private beach. Ryan and ParkSprings are co-developers, and Ryan is the general contractor. PGIM Real Estate is the equity partner on the deal, and Wells Fargo is providing debt financing. Renata at Lakewood Ranch is Ryan’s third project within Lakewood Ranch.

Housing Trust Group, AM Affordable Housing Break Ground on $44M Seniors Housing Project in Miami

by John Nelson

MIAMI — Housing Trust Group (HTG) and AM Affordable Housing have broken ground on Tucker Tower, a $44 million affordable housing community in Miami for seniors aged 62 and older. Located at 9940 W. Hibiscus St. in the city’s Perrine neighborhood, the eight-story property’s apartments will be reserved for income-qualifying residents who earn at or below 25, 30 and 60 percent of area median income (AMI), with rents ranging from $457 to $1,317 per month. Amenities will include a fitness center, business center with computer stations, swimming pool, pet grooming station, lighted pathways along accessible routes and a library. The property is scheduled to deliver in early 2024. The project team for Tucker Tower includes general contractor BDI Construction; engineer HSQ Group LLC; architect Corwil Architects; landscaper Witkin Hults; and interior designer B. Pila Design Studio. Tucker Tower is the fifth affordable housing collaboration between HTG and AM Affordable Housing, a nonprofit developer founded by former NBA player Alonzo Mourning. Capital sources for Tucker Tower include $28.4 million in 9 percent Low Income Housing Tax Credit (LIHTC) equity syndicated through Raymond James and purchased by Bank of America; a $30 million construction loan from Bank of America; a $9.5 million …

LAKELAND, FLA. — Atlanta-based Carter has partnered with El Paso, Texas-based Hunt Cos. Inc. to build a mixed-use development in Lakeland’s west downtown district. Carter recently closed on the purchase of the 22-acre site, which fronts Lake Wire and is proximate to the new 168-acre Bonnet Springs Park and RP Funding Center. Situated within an opportunity zone, the project will be built in two phases, the first phase of which will include 300 multifamily units and more than 15,000 square feet of street-level retail space. Patterson Real Estate Advisory Group assisted Carter in arranging the construction financing for the project through Citizens Bank. David Bunch and Lisa Parks Abberger of Hauger-Bunch Inc. represented the undisclosed seller in the land transaction.

Cushman & Wakefield Arranges $18M Land Sale in Daytona Beach, Buyer Plans 777,200 SF Industrial Project

by John Nelson

DAYTONA BEACH, FLA. — Cushman & Wakefield has arranged the $18 million sale of a 67-acre industrial land site located at 1094 S. Williamson Blvd. in Daytona Beach. The buyer, Karis, expects to deliver three Class A buildings totaling 777,200 square feet on the site by late 2023. Jared Bonshire, David Perez, Taylor Zambito and Matthew Trone of Cushman & Wakefield represented the buyer in the transaction. The sellers, John Schnebly and Craig Wells, are successor co-trustees of the Berrien H Becks Sr Revocable Trust. Karis has retained the Cushman & Wakefield team to lease the development, which will be located at the intersection of I-4 and I-95. The buildings will feature cross-dock configurations, up to 100 dock doors, 40-foot clear heights, large truck courts and ample off-dock trailer parking.

NORTH MIAMI, FLA. — Integra Investments has received final approval from the City of North Miami to build a 338-unit mixed-use multifamily community located at 13855 N.W. 17th Ave. Called NoMi Square, the project will sit on 7.6 acres and take the form of a seven-story building comprising apartment homes in one-, two- and three-bedroom layouts, as well as four live/work units with commercial space. The property will also feature a 528-foot-long linear public park. Other amenities will include a courtyard with a pool deck and pavilion and a clubhouse with a coffee bar, clubroom, business center, fitness center and yoga and spin room. Designed by Anillo Toledo Lopez Architecture, the project is scheduled to begin construction in 2023, with an 18-month timeline. Integra Investments is investing over $100 million in the community, which will generate 500 jobs during its construction phase.

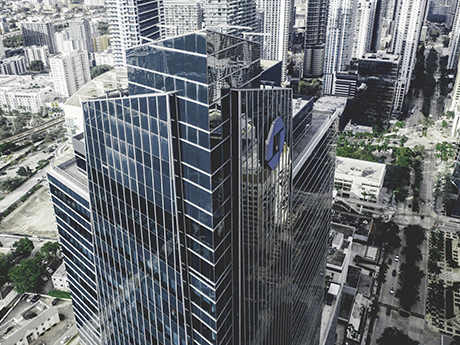

MIAMI — Law firm Bilzin Sumberg has renewed its office lease at 1450 Brickell office tower in Miami’s Brickell district. Barbara Black, Matthew Goodman and Jeff Gordon of JLL represented Bilzin Sumberg. The firm occupies 84,000 square feet of space at the 625,000-square-foot tower. Tere Blanca and Danet Linares of Blanca Commercial Real Estate represented the building owner, an entity doing business as 1450 Brickell LLC.

SARASOTA, FLA. — HomeSense will open a 30,000-square-foot store at University Town Center (UTC) in Sarasota, marking the home furnishing retailer’s first location in the state. Benderson Development’s UTC is a mixed-use property comprising over 250 specialty stores, more than 80 restaurants, three hotels and over 250,000 square feet of office space. HomeSense, part of the TJX Cos. portfolio, is scheduled to open its store on Nov. 10. Other soon-to-open retailers at the 4 million-square-foot UTC property include Christmas Tree Shops, Rocco’s Tacos and Tequila Bar, Yard House, Foxtail Coffee Co., 3Natives Acai and Juicery, Anna Maria Oyster Bar, Kelly’s Roast Beef, Post Kitchen & Bar and The Breakfast Company.

Cushman & Wakefield Arranges 200,147 SF Lease for Warehouse Underway in South Florida

by John Nelson

TAMARAC, FLA. — Cushman & Wakefield has arranged a new lease totaling 200,147 square feet for Sonny’s Enterprises LLC to fully occupy a new industrial warehouse being developed at Tamarac Business Center. Sonny’s Enterprises is the parent company of car wash chain Sonny’s The CarWash Factory. The locally based company already leases 345,000 square feet of space within Tamarac Business Center. Upon completion in 2023, the industrial warehouse will sit on a 12-acre site located at 5601 N Hiatus Rd. in Tamarac. The land currently houses a 100,000-square-foot office building that will be demolished. Chris Metzger, Rick Etner Jr., Christopher Thomson and Matt McAllister of Cushman & Wakefield’s South Florida Industrial Team represented the landlord, Hiatus Industrial Venture LLC, which is a joint venture between BlackRock and Butters Construction & Development.