FORT MYERS, FLA. — McDowell Housing Partners, an affordable housing developer and investor with offices in Miami and Dallas, plans to develop Ekos on Evans, a 144-unit community in Fort Myers. The firm recently closed on the acquisition of the 9.3-acre site at 3501 Evans Ave., which is situated less than two miles from downtown Fort Myers. Set for completion in fourth-quarter 2026, Ekos on Evans will feature five garden-style apartment buildings housing one-, two- and three-bedroom units ranging in size from 644 to 1,161 square feet. The units will be income-restricted for households earning 30, 60 and 70 percent of the area median income (AMI). Amenities will include a clubhouse, computer room, fitness room, terrace, grills, swimming pool, playground/tot lot and a dog park. McDowell Housing is receiving $17 million in support through Lee County’s Community Development Block Grant-Disaster Recovery funding, which is designated for areas impacted by Hurricane Ian. The developer is also using 4 percent low-income housing tax credits (LIHTC) to fund the development.

Florida

NAVARRE, FLA. — CBRE has arranged a $47 million loan for the refinancing of Elevate Navarre, a 332-unit apartment community located at 1900 Elevate Ave. in Navarre, a beach city situated near Pensacola, Fla. Blake Cohen of CBRE Capital Markets’ Debt & Structured Finance team in Atlanta arranged the three-year, fixed-rate, interest-only loan on behalf of the sponsor and developer, Branch Properties. Voya Investment Management provided the loan, which the Atlanta-based sponsor will use to refinance its existing construction loan. Built in 2022 adjacent to a Publix-anchored shopping center, Elevate Navarre features 11 three-story residential buildings and a clubhouse/leasing center. The property offers one-, two- and three-bedroom apartments with five different floor plans averaging 893 square feet in size. Amenities include a resort-style pool with sun deck, club room with lounge area and billiards, outdoor kitchen/dining area, fitness center with Peloton bikes, pet spa and 565 surface-level parking spaces.

MIAMI — South Florida-based developer 13th Floor Investments, in partnership with Barings, has received a $125 million construction loan for the second phase of Link at Douglas, a transit-oriented multifamily development in Miami. A syndicate of Santander Bank and TD Bank provided the loan. Known as Cadence, the project marks the third multifamily building at Link at Douglas, a 7-acre development located at the confluence of Miami’s Coral Gables and Coconut Grove neighborhoods. Now under construction, the 35-story tower will include 432 market-rate apartments, 12.5 percent of which will be set aside as workforce housing units. The project is adjacent to Miami-Dade County’s Douglas Road Metrorail Station. Construction is estimated to take 33 months to complete. “Securing this construction financing marks a major milestone in bringing the next phase of Link at Douglas to life,” says Daryl Shevin, CFO of 13th Floor. “It reflects strong confidence in our vision and the demand for well-located, high-quality transit-oriented housing in South Florida.” The first phase of Link at Douglas, which was completed in 2023, encompasses two fully leased multifamily towers with a total of 733 apartments. More than 30,000 square feet of retail space anchored by a Milam’s Market accompanies the 312-unit …

BRADFORDVILLE, FLA. — Mesa Capital Partners has broken ground on The Bradbury at Bannerman Village, an apartment community located on a 14-acre site in Bradfordville, a city located north of downtown Tallahassee. The property will be located at Bannerman and Bull Headley roads within the Bannerman Village master-planned community. Situated near a Publix and the Landon Hill for-sale homes, The Bradbury will comprise two-story carriage homes and three-story walk-up buildings. Amenities will include a clubhouse, fitness center, sundry market, resort-style pool with grilling stations, dog park, EV charging stations and garage parking. Cadence Bank and SouthState Bank provided an undisclosed amount of construction financing to Mesa Capital Partners for the project, which will begin leasing in mid-2026 and be fully delivered in early 2027. The design-build team includes general contractor The Crown Group and architect The Coursey Group.

GRAND ISLAND, FLA. — Spartan Investment Group has opened FreeUp Storage Eustis, a 660-unit self-storage facility located at 36536 S. Fish Camp Road near Lake Eustis in Grand Island, about 47 miles northwest of Orlando. Spartan Construction Management, a general contractor affiliate of the Colorado-based developer, broke ground on the facility in June 2024. FreeUp Storage Eustis features 340 climate-controlled units and 266 non-climate-controlled units across nearly 67,000 rentable square feet.

Marcus & Millichap Brokers $6.2M Sale of Multifamily Community in Royal Palm Beach, Florida

by John Nelson

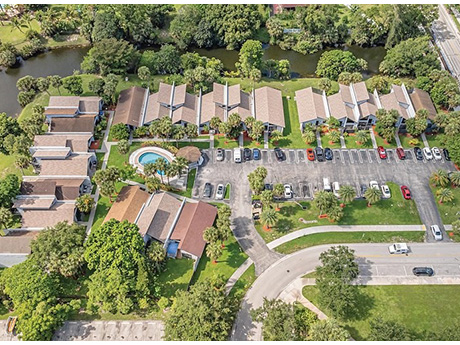

ROYAL PALM BEACH, FLA. — Marcus & Millichap has brokered the $6.2 million sale of Timbercreek Townhomes and Villas, a 20-unit multifamily community located at 100 Sparrow Drive in Royal Palm Beach, about 12 miles west of West Palm Beach. Evan Kristol and Brandon Rex of Marcus & Millichap represented the seller, a private syndicator, and procured the buyer, a California-based investment group, in the transaction. The buyer purchased the community as part of a 1031 exchange. Both parties requested anonymity. Built in 1980, Timbercreek Townhomes and Villas features a gated swimming pool, gazebo and landscaped grounds.

MIAMI — Los Angeles-based investment firm CIM Group and its development partners have officially opened Miami Worldcenter, a $6 billion mixed-use development in downtown Miami. CIM Group partnered on the project with Miami Worldcenter Associates, a development entity founded by Art Falcone and Nitin Motwani. The development spans 27 acres across 10 city blocks in the city’s Park West neighborhood and has generated nearly 9,000 jobs over the course of its construction and operation. The site formerly housed blighted properties and surface parking lots. The Miami Worldcenter master plan includes approximately $100 million in completed infrastructure; 100,000 square feet of new public space; 300,000 square feet of retail, restaurant and entertainment space; and 16 high-rise towers for residential and hospitality uses, many of which are completed or underway. The development will bring approximately 11,000 residences and more than 1,000 hotel rooms to downtown Miami. “Miami Worldcenter is a game-changing development that has revitalized a dormant and distressed area of downtown Miami and repositioned it as a vital contributor to the community and the local economy,” says Shaul Kuba, co-founder and principal of CIM Group. “We joined partners Art Falcone and Nitin Motwani as the master developers in 2011 and have proudly …

PALMETTO, FLA. — The Collier Cos. has begun leasing Stafford at Artisan Lakes, a 300-unit multifamily development located in the Sarasota suburb of Palmetto. The gated community offers one-, two- and three-bedroom floorplans, ranging from 705 square feet to 1,326 square feet in size, according to Apartments.com. Monthly rental rates for the Stafford at Artisan Lakes begin at $1,599 for a one-bedroom apartment. Amenities include a resort-style pool, fitness center, outdoor yoga lawn, game room, pickleball court and pet spa, as well as rental garages and electric vehicle charging stations. Select apartments also offer lake views and private backyards.

ST. JOHNS, FLA. — Madison Communities has opened Madison Fountains, a 276-unit apartment community located in the Jacksonville suburb of St. Johns. BenCo, the project’s general contractor, is an affiliate of Madison Capital Group Holdings. The development features studios, one-, two- and three-bedroom floorplans, ranging from 708 square feet to 1,363 square feet in size, according to Apartments.com. Monthly rental rates for studio apartments begin at $1,378. Amenities at the property include a clubhouse-integrated fitness center, resort-style swimming pool with grilling stations and an onsite dog park and grooming station, as well as proximity to the Gourd Island Conservation Area, a 3.7 dog-friendly trail system. Additionally, the community is within walking distance to Jacksonville’s St. Johns Town Center, a super-regional open-air mall that features more than 175 stores.

Fairfield Delivers Two Multifamily Developments in Fort Lauderdale Totaling 537 Units

by John Nelson

FORT LAUDERDALE, FLA. — Fairfield, a multifamily developer and owner based in San Diego, has completed construction of Coasterra Apartments in downtown Fort Lauderdale. The mid-rise community has 242 studio, one-, and two-bedroom apartments. Located at 150 SE 3rd Ave. in the Las Olas district, the community is adjacent to the One Financial Plaza office building. Fairfield also recently completed construction of Treo Apartments at 6500 N. Andrews Ave. in Fort Lauderdale. Treo has 295 studio, one- and two-bedroom units.