ROYAL PALM BEACH, FLA. — CBRE has arranged a 42,143-square-foot industrial lease within Royal Palm Logistics Center, an industrial property located at 1131 N. State Road 7 in Royal Palm Beach, a city in South Florida’s Palm Beach County. The tenant, Bush Brothers Provision Co., is a family-owned meat packing and distribution company based in nearby West Palm Beach. Set to open its new space in August, the move represents the first relocation for Bush Brothers since 1925, according to CBRE. The tenant plans to create 25 new positions in addition to its existing 65-person workforce. Kirk Nelson, Robert Smith and Jeff Kelly of CBRE represented the tenant in the lease negotiations. The developer is McCraney Property Co. Royal Palm Logistics Center features 32-foot clear heights, an ESFR sprinkler system and dock-high and grade-level loading.

Florida

Kennedy Funding Provides $7.5M Acquisition Loan for Townhome Development Site in Santa Rosa Beach, Florida

by John Nelson

SANTA ROSA BEACH, FLA. — Kennedy Funding has provided a $7.5 million acquisition loan for a land site in Santa Rosa Beach, a city in Florida’s Panhandle. The parcel currently houses a nine-bedroom home that fronts the Gulf of Mexico. The borrower, an entity doing business as 4228 Dana Beach LLC, plans to develop a luxury townhome development on the site. The construction timeline was not disclosed. Based in Englewood, N.J., Kennedy Funding is a direct lender that provides short-term bridge loans ranging from $1 million to $50 million for land purchases, working capital and developments.

MIAMI — JLL has brokered the $38.5 million sale of Milpa & Wesley Center, an industrial portfolio located at 6801-7500 N.W. 77th Ave. in Miami. The property, which was 91 percent occupied at the time of sale, comprises 182,575 square feet across six buildings. Cofe Properties LLC sold the portfolio to Miami Palmetto Property LLC, an entity co-sponsored by East Capital Partners and ABR Capital Partners’ GP Investment Program. Luis Castillo, Cody Brais, Wells Waller, Taylor Osborne and Aaliyah St. Louis of JLL represented the seller in the transaction. The property features 17- to 19-foot clear heights, 12 dock-high and 101 grade-level doors and 275 parking spaces.

BEB Provides $9.7M Acquisition Financing for Industrial Property in Lake Worth, Florida

by John Nelson

LAKE WORTH, FLA. — BEB Lending has provided a $9.7 million loan for the acquisition of an industrial property located at 1800 Hypoluxo Road in Lake Worth, a city in South Florida’s Palm Beach County. The 77,657-square-foot property is leased to a mix of small-bay and self-storage industrial tenants. Sean Silverbrook of BEB originated the 24-month bridge loan. Juda Hersh represented the borrower, Hersh Equity Group (HEG), on an in-house basis.

PCCP, Midwest Industrial Funds to Develop 337,000 SF Industrial Building in Jacksonville

by John Nelson

JACKSONVILLE, FLA. — A joint venture between PCCP LLC and Midwest Industrial Funds is underway on the development of a 337,000-square-foot speculative industrial building within Westlake Industrial Park in Jacksonville. Situated on 33 acres on Pritchard Road, the property will feature 36-foot clear heights, a 190-foot truck court, 72 dock-high doors, 245 car parking spaces and 97 trailer parking spots. Construction has begun on the project, and completion is scheduled for this December.

Rendina Healthcare, Artemis Acquire 48,000 SF Medical Office Building in Wellington, Florida

by John Nelson

WELLINGTON, FLA. — Rendina Healthcare Real Estate and joint venture partner Artemis Real Estate Partners have purchased Wellington Medical Arts Pavilion III, a 48,000-square-foot medical office building in Palm Beach County. The four-story property is situated on the Wellington Regional Medical Center campus, a Universal Health Services (UHS) hospital. The undisclosed seller sold the asset for $18.3 million. The property was 91 percent leased at the time of sale to tenants including UHS, Sanitas Medical Center, Gastro Associates of Florida, Conviva Care Centers and Physician Partners of America. Rendina Healthcare was the original developer of Wellington Medical Arts Pavilion III in 2006.

CREI Holdings Receives $41M Refinancing for Affordable Seniors Housing Community in Sweetwater, Florida

by John Nelson

SWEETWATER, FLA. — Development firm CREI Holdings has received a $41 million loan for the refinancing of Li’l Abner II apartments in Sweetwater, a South Florida city just west of Miami. Marc Suarez led the Lument team that provided the funds. The project was completed in April 2023. Designed by Burgos Lanza Architects and Planners, an architectural firm based in Coral Gables, Fla., the eight-story building is situated adjacent to its 87-unit sibling, Li’l Abner I. Li’l Abner II consists of 244 one- and two-bedroom units dedicated to affordable and workforce housing. Among these, 40 percent cater to low-income seniors, while the remainder is allocated to residents earning up to 120 percent of the area’s median income (AMI). The building is near full occupancy, according to CREI Holdings.

DORAL, FLA. — CBRE has arranged the sale of The Offices at Doral Square, a 141,246-square-foot office building located at 8600 N.W. 36th St. in Doral, a suburb of Miami. The Class A property is the office component of Doral Square, a mixed-use development that also features 150,000 square feet of shops and restaurants. A partnership comprising “several Miami families” purchased the asset from the undisclosed seller. The sales price was also not disclosed. Christian Lee, Sean Kelly, Amy Julian, Andrew Chilgren, Marcos Minaya, Tom Rappa, James Carr and Matthew Lee of CBRE represented the seller in the transaction.

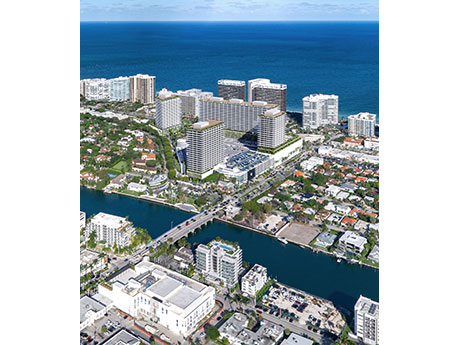

MIAMI — Whitman Family Development has submitted plans for a mixed-use project at its Bal Harbour Shops in Miami’s Bal Harbour village. Plans call for 600 apartment units, 40 percent of which are earmarked for workforce housing and 60 percent of which will be luxury housing. There will also be a 70-room, 20-story hotel and an additional 45,700 square feet of retail space. Bal Harbour Shops comprises more than 100 shops, restaurants and entertainment options. The open-air, luxury retail center, which is home to brands such as Chanel, Gucci, Tiffany & Co. and Valentino, is currently undergoing a $550 million retail expansion that will add about 250,000 square feet, nearly doubling the center’s current retail space. The expansion will accommodate the addition of 35 new upscale stores and restaurants. The new housing development is made possible by Florida’s Live Local Act, a bipartisan bill passed by the Florida legislature last year in response to the critical need for affordable and attainable housing statewide. The legislation enables developers to build at higher density and building heights, so long as they commit to including attainable housing units. The law requires that local municipalities approve mixed-use residential projects in any area zoned commercial …

TAMPA, FLA. — Cushman & Wakefield has brokered the $55.6 million sale of Tampa Airport Logistics, a newly constructed industrial park in Tampa’s Airport submarket spanning nearly 300,000 square feet. The two-building property is located at 5450 Johns Road and 5416 W. Sligh Ave., about six miles north of Tampa International Airport. Tampa Airport Logistics was fully leased at the time of sale and features 32- to 36-foot clear heights, 52- by 50-foot column spacing, ESFR fire protection and a 192-foot shared truck court. Clarion Partners purchased the property on behalf of a separate client from PCCP LLC. Rick Brugge, Mike Davis, Rick Colon, Dominic Montazemi, Ryan Jenkins and Chloe Strada of Cushman & Wakefield represented the seller in the transaction.