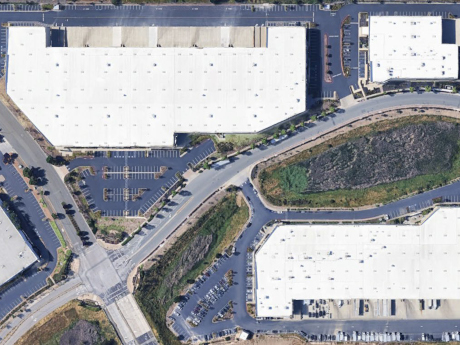

RICHMOND, CALIF. — PCCP has provided an $85 million loan to an affiliate of WPT Capital Advisors for the acquisition of a three-building industrial park at 6000, 6015 and 6025 Giant Road in Richmond. Built in 2015 and 2016, the 517,894-square-foot asset is 57 percent leased to two tenants. The Class A logistics asset features 30- to 32-foot clear heights, LED lighting and ESFR sprinklers. The property is located within Pinole Point Business Park, a 100-acre master-planned industrial park offering 2.2 million square feet of Class A space.

Industrial

Equity Oak Ventures Receives $12.2M in Financing for Four-Building Flex Portfolio in San Diego County

by Amy Works

RANCHO BERNARDO AND CARLSBAD, CALIF. — Equity Oak Ventures has received $12.2 million in portfolio financing for a four-building flex industrial, research-and-development (R&D) and office portfolio in San Diego County. Alex Witt, Chris Collins and Daniel Pinkus of JLL Debt Advisory’s team represented Equity Oak Ventures in securing a fixed-rate, three-year loan. The fully leased portfolio includes a 42,865-square-foot, three-building flex industrial and office campus in Rancho Bernardo and a 44,757-square-foot R&D and cGMP (Current Good Manufacturing Practice) facility within Carlsbad Research Center, repositioned post-acquisition with long-term leases. The Rancho Bernardo asset, located at 11225, 11235 and 11245 W. Bernardo Court, consists of three buildings totaling 42,865 square feet, including a single-tenant, 29,000-square-foot flex industrial building. Located at 1900 Aston Ave. in Carlsbad, the property occupies a corner lot and features dock-level doors, multiple roll-up doors, temperature-controlled industrial space and high-quality office improvements. The newest tenant has signed a long-term lease and is making an investment in a large-scale cGMP facility.

PLAINFIELD, ILL. — Trammell Crow Co. (TCC) has broken ground on a 788,000-square-foot speculative warehouse in Plainfield, about 40 miles southwest of downtown Chicago. The building marks the first speculative warehouse in Plainfield Business Center and is slated for completion in fall 2025. The facility will feature a clear height of 40 feet, 80 dock doors and 211 trailer stalls. The 52-acre site offers proximity to I-55 and I-80. Upon full build-out, Plainfield Business Center will total more than 8 million square feet. The project team includes Harris Architects, Krusinski Construction Co. and civil engineer Kimley-Horn and Associates. Matt Mulvihill and Phil DeBoer of CBRE represented TCC in acquiring the land and are marketing the property for lease.

JOLIET, ILL. — Saxum Real Estate, along with its partner Black Salmon, has begun development of a 294,840-square-foot cold storage project for Arcadia Cold in Joliet. Marc Duval, Ed Halaburt and Wells Waller of JLL represented the owner in securing joint venture equity. Bank OZK is providing debt financing. Clayco is the general contractor. The project will feature a clear height of 50 feet and convertible rooms. Completion is slated for the first quarter of 2026. Arcadia is the seventh-largest cold storage operator in the U.S., according to a release.

CARMEL, N.Y. — Diamond Point Development has broken ground on an 800-unit self-storage facility in Carmel, about 60 miles north of New York City in the Hudson Valley region. The multi-story facility will comprise 81,000 net rentable square feet of climate-controlled space. Diamond Point is developing the facility in partnership with Dallas-based Rosewood Property Co. Extra Space Storage will manage the property, which is expected to be complete in late 2025.

ALLENTOWN, PA. — Infinera (NASDAQ: INFN) has signed a nonbinding preliminary memorandum of terms to receive up to $93 million in funding under the CHIPS and Science Act, proceeds of which would be used to expand the California-based semiconductor manufacturer’s Lehigh Valley facility. Funding would also be allocated toward the expansion and modernization of the company’s Silicon Valley facility, and the projects could support the creation of as many as 1,700 manufacturing and construction jobs.

Despite healthy local market dynamics, the greater New Orleans industrial market did not perform as strongly as insiders expected it to perform over the past 12 months, which is indicative of wider economic factors suppressing a market with pent-up demand. The Port of New Orleans and its access to major shipping routes along the Mississippi River has long been the principal component for industrial real estate in the area. The recent 2024 regular session of the Louisiana Legislature committed $230.5 million to Port of New Orleans infrastructure projects, including allocations to the Louisiana International Terminal, a $1.8 billion project in Violet, La., scheduled to be operational in 2028, which will be the Gulf South’s premier container shipping gateway able to accommodate New Panamax- and Post New Panamax-sized vessels. A bit further up the Mississippi River but still in the greater New Orleans region, Canadian company Woodland Biofuels announced a $1.35 billion investment at the Port of South Louisiana in Reserve, La., to establish the largest renewable natural gas plant in the world. The facility will take waste wood and sugar cane and turn it into natural gas. The process will be carbon-negative, leaving less carbon in the atmosphere than before …

KISSIMMEE, FLA. — Cushman & Wakefield has brokered the $21 million sale of a flex office portfolio located in Kissimmee. Comprising two buildings — 3600 and 3700 Commerce Boulevard — the portfolio totals 193,571 square feet. Realife Real Estate Group acquired the properties from the Speer Foundation. Rick Colon, Rick Brugge, Mike Davis and Mark Stratman of Cushman & Wakefield represented the seller in the transaction. Built in 2001, the buildings were 93 percent leased at the time of sale. The properties, which include both office and warehouse space, feature 24- and 28-foot clear heights and a mix of dock-high and grade-level loading.

ATHENS, GA. — Cove Capital Investments, a Delaware Statutory Trust (DST) sponsor company, has completed the purchase of an industrial property located in Athens, roughly 70 miles northeast of Atlanta. Situated within the 35-acre General Time mixed-use development, the property totals 113,157 square feet. Originally built in 1990, the asset was redeveloped between 2018 and 2021. The property was acquired as part of Cove Capital’s growing portfolio of debt-free DST real estate assets for 1031 exchange and direct-cash investors, according to Dwight Kay, managing member and founding partner of Cove Capital Investments. The seller and sales price were not disclosed.

SELMA, TEXAS — Atlanta-based developer Ackerman & Co. has delivered Corporate Drive Industrial Complex, a 511,000-square-foot industrial property in Selma, located northeast of San Antonio. Building 1 at the property totals 274,000 square feet, and Building 2 totals 237,000 square feet. Building features include 32- to 36-foot clear heights, 60 dock doors, two drive-in bays and 647 parking spaces (expandable to 735). Ackerman developed the project in partnership with Baltisse US Inc. Partners Real Estate has been tapped as the leasing agent. Construction began in summer 2023.