SCOTTSDALE, ARIZ. — DXD Capital has broken ground on a self-storage facility totaling 66,750 rentable square feet in Scottsdale. Located at 8888 E. Desert Cove Ave., the four-story property will offer 706 individual storage units and two basement levels. Extra Space Storage will manage the facility, which is slated to open in fourth-quarter 2025. The project team includes TLW Construction as general contractor and Southwest Capital Bank as construction lender. DXD Capital acquired the site in July 2024. To date, DXD has invested in 19 self-storage developments and one seven-facility portfolio acquisition across the United States.

Industrial

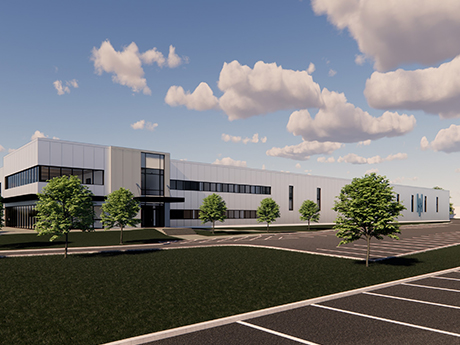

MILFORD, N.H. — Locally based design-build firm PROCON has broken ground on a 57,000-square-foot industrial flex project in Milford, located near the Massachusetts-New Hampshire border. The project is a build-to-suit for Hitchiner, a provider of casting-based components and assemblies for the aerospace and automotive industries, and will serve as a “shared services operations” center on the company’s existing campus. Completion is scheduled for fall 2025.

NEW HAVEN, CONN. — Pikalo Foods, a family-owned, wholesale provider of empanadas, has signed a 20,280-square-foot industrial lease in New Haven. According to LoopNet Inc., the building at 145 Hamilton St. was originally constructed in 1965. Mark Glassman of Arnold Peck’s Commercial World represented the tenant in the lease negotiations. Carl Russell and Chris Nolan of Pearce Real Estate represented the landlord, a New York-based entity doing business as 145 Hamilton LLC.

TUTTLE, OKLA. — Marcus & Millichap has brokered the sale of Premium Storage, a 375-unit self-storage facility in Tuttle, a southwestern suburb of Oklahoma City. The site spans seven acres, and the property features 107,330 net rentable square feet across 37 climate-controlled units, 334 non-climate-controlled units and four commercial spaces. Bryan Quaschnick, Danny Cunningham and Brandon Karr of Marcus & Millichap represented the Dallas-based seller in the deal and procured the buyer, an out-of-state, privately held investment group. Both parties requested anonymity.

LAS VEGAS AND HENDERSON, NEV. — Colliers has arranged the dual acquisitions of a two-parcel infill logistics portfolio in Henderson and Las Vegas by BKM Capital Partners and an Ares Management Real Estate fund. Michael Kendall, Gian Bruno, Dan Doherty, Paul Sweetland, Jerry Doty, Chris Lane, Brian Riffel and Tyler Jones of Colliers represented the seller, a private institutional investment firm, in the sales. BKM Capital Partners purchased a two-building, 153,368-square-foot property at 6620 Escondido St. in Las Vegas for an undisclosed price. BKM plans to implement a $4.4 million capital improvement program to execute structural and cosmetic improvements to the property, as well as speculative tenant improvements to turn the two large units into nine warehouses ranging in size from 7,000 square feet to 31,000 square feet each. The asset was constructed in 1995. An Ares Management Real Estate fund acquired Airparc Heights, a six-building, Class A business park at 3225-3255 Sunridge Parkway and 1065-1085 Alper Center Drive in Henderson. Ares acquired the park, which will be managed by the Ares Industrial Management team. Spanning 339,214 square feet, the project was delivered in 2022 and gained full occupancy within one month of delivery.

Marcus & Millichap Facilitates $19M Sale of Self-Storage Facility in Tacoma, Washington

by Amy Works

TACOMA, WASH. — Marcus & Millichap has negotiated the sale of 12th Street Storage, a self-storage facility in Tacoma. An undisclosed limited liability company sold the asset to a fund manager for $19 million. Located at 1018 E. Highland Ave., 12th Street Storage offers 91,546 square feet of self-storage space. The facility, which was developed in 2020 and 2021 by a local investment group, was acquired by an international real estate firm based in London and Los Angeles. Christopher Secreto of Marcus & Millichap’s Seattle office represented the seller and secured the buyer in the deal.

HUNTSVILLE, ALA. — TriOut Advisory Group plans to develop a 223,500-square-foot industrial project in Huntsville. The project will be situated near I-565 on an 18-acre site along Sparkman Drive within Cummings Research Park. The project team includes locally based civil engineer Johnson & Associates. NAI Chase Commercial Real Estate is handling the leasing assignment on behalf of TriOut.

Capital 360, Barings Sell 2,460-Unit Extra Space Storage Facility in Cerritos, California for $91M

by Amy Works

CERRITOS, CALIF. — A joint venture between Capital 360 and Charlotte-based Barings has completed the disposition of Extra Space Storage in Cerritos to Houston-based Hines for $91 million. Nick Walker and Trevor Roberts of CBRE’s Self Storage Advisory Group represented the seller in in the transaction. Capital 360 and Barings originally acquired the site in 2018. Situated on 4.9 acres at 17900 Crusader Ave., the three-story, 260,273-square-foot facility offers 2,460 storage units. Constructed in 2020, the facility was more than 88 percent occupied at the time of sale.

SAN DIEGO — Miramar Acquisitions has acquired 7191 Carroll Road, a 3.6-acre industrial outdoor storage (IOS) facility in San Diego’s Miramar submarket, from TFI International for $14.6 million. Evan McDonald, Kurtis Blanchard and Mark Lewkowitz of Colliers represented the buyer and seller in the deal. The low-coverage site features a 6,300-square-foot cross-dock facility with excess paved and secured yard space. The property’s zoning allows for an array of outdoor industrial uses, including equipment and material storage, vehicle equipment and supplies sales and rentals, and trucking and transportation facilities.

MILWAUKEE — Crow Holdings has expanded the scope of its South Cargo Logistics Hub project at the Milwaukee Mitchell International Airport in Wisconsin. The development is a public-private partnership whereby most of the $75 million in capital cost and resources necessary to complete the project will come from private sources. The developer signed a ground lease with the county. At the end of the term, the county will have the option for all improvements to become its property. Crow has expanded the size of the new facility by nearly 50,000 square feet for a total of 337,000 square feet, which is consistent with the 2022 Airport Master Plan prepared by Milwaukee County. Crow will also deliver a new garage for the Milwaukee County Highway department. The project scope has also grown to include large-scale repairs to the roughly 16 acres of public taxiway area directly adjacent to the project. This added work will enable modern wide-body cargo traffic to operate in this part of the airport on a consistent basis for the first time, according to a release. The increased size will facilitate the simultaneous parking of up to five Boeing 777-8F, or equivalent, plane parking positions along with a …