MONTEZUMA, IOWA — Stan Johnson Co. has brokered the $8.3 million sale of a 194,267-square-foot manufacturing facility in Montezuma, a city in Iowa located about midway between Des Moines and Iowa City. The single-tenant building is leased to Dieomatic Inc., a subsidiary of Magna International, which is a global automotive supplier. Rob Gemerchak of Stan Johnson represented the seller, a New York-based private investment firm. An individual investor based in Des Moines was the buyer.

Industrial

HOUSTON — Commercial finance and advisory firm Axiom Capital Corp. has arranged a permanent loan of an undisclosed amount for the acquisition of a 131,250-square-foot flex property in Houston. The property, which sits on a 12.1-acre site roughly four miles from William P. Hobby Airport, consists of two industrial buildings and one office building. The lender was an unspecified credit union, and the borrower was undisclosed.

GRAND PRAIRIE, TEXAS — A joint venture between two investment firms, Fort Worth-based PHP Capital and Southern California-based CapRock Partners, has purchased a 95,250-square-foot industrial property in the central metroplex city of Grand Prairie. The four-building complex sits on five acres and was roughly 90 percent leased at the time of sale. The seller and sales price were not disclosed. The new ownership plans to implement a value-add program.

Marcus & Millichap Negotiates Sale of 80,640 SF Priority Plastics Manufacturing Facility in Arvada, Colorado

by Amy Works

ARVADA, COLO. — Marcus & Millichap has arranged the sale of a single-tenant industrial facility at 5861 Tennyson St. in Arvada. The property traded for an undisclosed price. Priority Plastics occupies the 80,640-square-foot industrial manufacturing facility, which was built in 2000 on 5.3 acres. Alyssa Tomback of Marcus & Millichap’s Denver office represented the private investor seller in the deal. The name of the buyer was not released.

Levy Realty Advisors Arranges $50M Sale of Pelican Bays Warehouse Complex in South Florida

by John Nelson

DAVIE, FLA. — Levy Realty Advisors has arranged the $50 million sale of Pelican Bays, an eight-building warehouse complex located on SW 52nd Street in Davie, a city in South Florida’s Broward County. Situated near I-595 and the Florida Turnpike, the property spans 197,000 square feet of flex industrial and office space. The buyer, an entity doing business as Pelican Bays LLC, purchased the campus from the original developer, Charles Rowar. Alan Levy and Josh Levy of Levy Realty represented the buyer in the transaction. The firm will also oversee leasing and management at Pelican Bays, which currently houses about 120 tenants. Norman Matus of Red Rock Realty represented the seller.

LIBERTY, MO. — Contegra Construction Co. is nearing completion of a 1 million-square-foot distribution center at Liberty Commerce Center in Liberty, a northeast suburb of Kansas City. Dubbed Project Luna, the facility will feature a clear height of 40 feet, 112 dock doors, two drive-through doors and 20,000 square feet of office space. Completion is slated for this fall. NorthPoint Development is the developer. Upon full buildout, Liberty Commerce Center will comprise 3.4 million square feet of industrial space.

SPANISH FORK, UTAH — Salt Lake City-based Vesta Realty Partners has purchased Western Distribution Center, located at 4000 E. Highway 6 in Spanish Fork. A pair of Knoxville, Tenn.-based investors sold the asset for an undisclosed price. Jarrod Hunt of Colliers International represented the seller and buyer in the deal. Initially built by Fingerhut Corp., the facility features 1.1 million square feet of warehouse and distribution space.

BEND, ORE., AND CLARKSVILLE, TENN. — Invesco Real Estate Income Trust (INREIT) has acquired two self-storage portfolios in Bend and Clarksville for a combined purchase price of $42 million. The two-story, single-story, drive-up self-storage properties in Bend total 62,805 square feet across 674 units. The portfolio includes a 49,523-square-foot, 550-unit property that is 98.7 percent occupied, at 20230 Powers Road, as well as 345 Cleveland Ave., a 13,282-square-foot, 124-unit facility that is 100 percent occupied. Located in Clarksville, the three single-story, drive-up self-storage properties total 204,425 square feet across 1,347 units. The portfolio includes 1280 Parkway Place, a 67,350-square-foot, 505-unit facility that is 95.6 percent occupied; 4351 Guthrie Highway, an 80,275-square-foot, 471-unit facility that is 96.6 percent occupied; and 117 Old Excell Road, a 56,800-square-foot, 371-unit facility that is 97.8 occupied. The names of the sellers were not released.

BOSTON AND NEW YORK CITY — American Tower Corp. (NYSE: AMT), a multitenant communications REIT, has agreed to sell a 29 percent stake in its data center platform to Stonepeak, an alternative asset management firm based in New York City. The deal, which comprises common and preferred equity from Stonepeak’s affiliated investment vehicles and debt commitments, is valued at $2.5 billion. The AMT data center portfolio consists of 27 data centers in 10 U.S. markets. AMT purchased Denver-based CoreSite Realty Corp. in a $10.1 billion deal that was announced last November. AMT will retain managerial and operational control, as well as day-to-day oversight of its U.S. data center business, and Stonepeak will obtain certain governance rights. The transaction is expected to close in third-quarter 2022, subject to customary closing conditions. “We are pleased to partner with Stonepeak in our U.S. data center business,” says Tom Bartlett, president and CEO of American Tower. “While this transaction supports the equity financing component for our previously completed CoreSite acquisition, it also creates a platform through which growth opportunities can be strategically evaluated and financed.” Andrew Thomas, managing director and co-head of communications at Stonepeak, says that AMT’s data center platform aligns with Stonepeak’s …

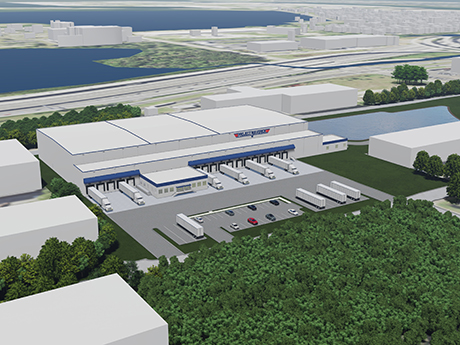

Sansone Group, Mandich to Develop 110,476 SF Spec Cold Storage Facility in Downtown Tampa

by John Nelson

TAMPA, FLA. — A partnership between St. Louis-based Sansone Group and Miami-based Mandich Group has purchased a 7.3-acre site in downtown Tampa’s Ybor City district. The developers plan to build a speculative cold storage facility at the site that will include 45-foot clear heights and span 110,476 square feet upon completion, which is set for 2024. The property, dubbed Tampa Cold Logistics, will be situated near I-4, Port Tampa and Tampa International Airport. Tippmann Group is the general contractor for the project, and Eric Swanson on Avison Young helped facilitate the deal, which is Sansone’s first partnership with Mandich Group.