PHOENIX — Sealy & Co. has purchased Sky Harbor Center, a Class A industrial building located at 801 S. 16th St. in Phoenix. An affiliate of Cohen Asset Management sold the asset for an undisclosed price. The 85,259-square-foot property is situated on 7.5 acres within the Sky Harbor Airport submarket and was fully leased to two tenants at the time of sale. Will Strong, Greer Oliver, Kirk Kuller and Connor Nebeker-Hay of Cushman & Wakefield represented the seller in the transaction. Cooper Fratt, John Werstler and Tanner Ferrandi of Cushman & Wakefield provide leasing advisory services for the property.

Industrial

BOISE, IDAHO — Cushman & Wakefield has arranged the sale of a newly renovated industrial facility situated on more than 3 acres in Boise. An undisclosed buyer acquired the asset from an entity doing business as Emerald Town LLC for $17.7 million. Located at 11193 Emerald St., the 77,962-square-foot property was fully leased to four tenants at the time of sale. The property features five roll doors, an insulated roof, upgraded office and restroom space, upgraded freezer/cooler space, resurfaced and restriped parking lot and revamped dock door systems. Jennifer McEntee, Bree Wells and D.J. Thompson of Cushman & Wakefield represented the seller in the deal.

SOUTH AMBOY, N.J. — A partnership between Woodmont Industrial Partners and Joseph Jingoli & Son Inc. has broken ground on a 152,100-square-foot warehouse in South Amboy, located in the eastern part of the Garden State. The site spans 22 acres. Building features will include a clear height of 36 feet, 22 dock doors, ample trailer and car parking and the capacity to add 22 knock-out doors if desired by a tenant. Completion is slated for summer 2023.

INVER GROVE HEIGHTS, MINN. — A joint venture between PCCP and United Properties has broken ground on InverPoint 2, a 96,000-square-foot speculative industrial building in the Twin Cities suburb of Inver Grove Heights. The property will be situated at 8450 Courthouse Blvd. within the InverPoint Business Park. Completion is slated for late 2022. InverPoint 2 will feature a clear height of 28 feet, 12 dock doors, four drive-in doors, 108 surface parking stalls and five entrances. The facility will be able to accommodate tenants ranging in size from 16,000 to 96,000 square feet. InverPoint Business Park will include five buildings spanning 475,000 square feet upon full buildout.

CINCINNATI — SRS Real Estate Partners has brokered the sale of a 93,000-square-foot industrial facility occupied by Frisch’s Commissary Kitchen in Cincinnati for $10.3 million. Located at 3011 Stanton Ave., the property also includes an onsite research and development department that is utilized for the restaurant chain’s brand innovation. There are more than 13 years remaining on the triple net lease. Matthew Mousavi and Patrick Luther of SRS represented the seller, a Southeast-based family partnership. Jeff Bracco of The Kase Group represented the buyer, a partnership based in the San Francisco Bay area. Frisch’s operates more than 177 restaurants.

Content PartnerFeaturesHealthcareIndustrialLoansMidwestMultifamilyNAINortheastOfficeSoutheastTexasWestern

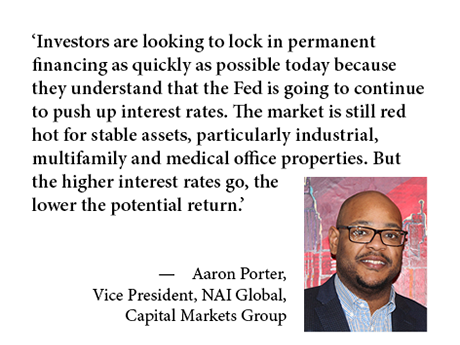

Rising Interest Rates and Inflation to Fuel Change in Property Markets

Beginning in the fourth quarter of 2020, commercial real estate buyers and sellers moved off the sidelines and began fueling an impressive investment sales rebound as many pandemic-related lockdowns and restrictions eased or ended. The rush to purchase hard assets hit its apex a year later when commercial property sales surged to a record $362 billion in the fourth quarter of 2021 alone, according to Real Capital Analytics, a part of MSCI Real Assets that tracks property transactions of $2.5 million or more. The strong market is continuing this year: Deals of $170.8 billion closed in the first quarter, a year-over-year increase of 56 percent, Real Capital reports. Buyers in the first quarter also pushed up prices 17.4 percent over the prior year, according to Real Capital’s Commercial Property Price Indices (CPPI). But given rising interest rates and other recent headwinds, will investors continue to drive robust investment activity and bid up prices? The 10-Year Treasury yield has spiked some 150 basis points to around 3 percent since the beginning of 2022, and fixed 10-year mortgage rates of between 3 percent and 4 percent are up about 100 basis points. For short-term variable loans, the benchmark secured overnight financing rate …

HOUSTON — North Texas-based Jackson-Shaw will develop Post Oak Logistics Park, a 536,992-square-foot industrial project that will be located in southwest Houston. Post Oak Logistics Park will comprise a 168,893-square-foot front-load building and a 368,099-square-foot cross-dock building. The typical bay is 56 feet by 50 feet, with 130- to 185-foot truck courts and ample trailer storage. An affiliate of Greystar is Jackson-Shaw’s equity partner on the project. Rosenberger Construction is the general contractor, with Powers Brown serving as the architect and WGA as the civil engineering firm. BancFirst provided construction financing. Cushman & Wakefield is the leasing agent. Completion is slated for the second quarter of 2023.

EL PASO, TEXAS — CBRE has preleased a 169,011-square-foot industrial building located in El Paso’s Far East submarket to an undisclosed logistics user. Mississippi-based EastGroup Properties is developing the speculative property, which sits on 12.6 acres, with completion slated for July. Building features include 32-foot clear heights, 135-foot truck court depths and parking for 163 cars and 50 trailers. Bill Caparis and Andre Rocha of CBRE represented EastGroup Properties in the lease negotiations.

HUMBLE, TEXAS — Colliers has brokered the sale of a 48,000-square-foot industrial facility in northeastern Houston suburb of Humble. The property comprises four buildings on a 3.3-acre site. Tom Condon Jr. of Colliers represented the seller, R.B. Machine Works, in the transaction. Patrick Swint of Knightsbridge Ventures represented the buyer, an entity doing business as 2407 Wilson LLC.

STERLING HEIGHTS, MICH. — Alliant Credit Union has provided a five-year, $16 million loan for the refinancing of a 370,656-square-foot industrial building in Sterling Heights, about 20 miles north of downtown Detroit. The property includes 47,856 square feet of office space. The borrower was a private investor group that closed an original loan with Alliant in December 2017.