PITTSBURGH — CIT, a division of First Citizens Bank, has provided a $37.2 million acquisition loan for a 510,000-square-foot distribution center in Pittsburgh that is fully leased to Amazon and e-commerce consulting firm Nogin. The property serves as one of Amazon’s two sortation facilities in the Pittsburgh area. The borrower is Aminim Group, an investment firm with offices in Houston and Jerusalem. Specific loan terms were not disclosed.

Industrial

STOCKTON, CALIF. — Colliers has arranged the sale of Hammer Lane Self Storage, a self-storage property located at 6220 Sampson Road in Stockton. Northwest Building LLC acquired the asset from Hammer Lane LLC for $25 million, or $227 per rentable square foot and $39,960 per unit. The property features 109,800 square feet in 526 fixed storage units and an additional 49,064 square feet of parking in 99 units. Tom de Jong and Dana Chobor of Colliers’ Self Storage Group represented the buyer and seller in the transaction.

CARROLLTON, TEXAS — Lee & Associates has negotiated an 85,000-square-foot industrial lease at 1700 Columbian Club Drive in the northern Dallas metro of Carrollton. According to LoopNet Inc., the property was built in 1996 and renovated in 2001. Ken Wesson of Lee & Associates represented the undisclosed landlord in the lease negotiations. Wilson Brown of CBRE represented the tenant, Lily of the Desert, a provider of organic gels and juices.

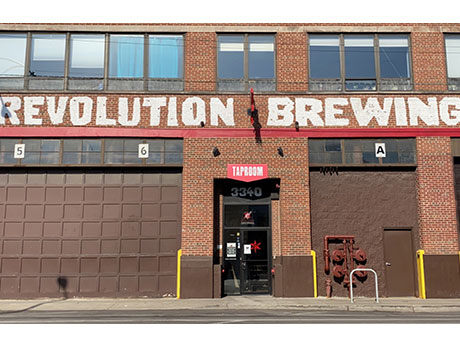

CHICAGO — Revolution Brewing, the largest independently owned brewery in Illinois, has purchased a 128,422-square-foot industrial property located on North Kedzie Avenue in Chicago. The purchase price was undisclosed. The building features clear heights ranging from 18 to 24 feet, 14 docks and one drive-in door. Mike Senner and Alex Kritt of Colliers represented the seller, a private investment group.

YUMA, ARIZ. — Arlington, Va.-based FD Stonewater has acquired Alside Distribution Center in Yuma from Phoenix-based Merit Properties for an undisclosed price. Located at 7550 E. 30th St., Alside Distribution Center features 222,554 square feet of manufacturing and distribution space with 25-foot clear heights, 22 dock-high doors and trailer storage. Alside, a division of Associated Materials, has occupied the single-tenant building since it was originally developed in 2005. The 21.1-arce site, which provides additional expansion opportunities, is under a ground lease owned by the tenant, with 74 years remaining. The tenant is a manufacturer and distributor of vinyl windows, siding and doors. Barry Gabel, Chris Marchildon and Dan Calihan of CBRE represented the seller in the deal.

By Elizabeth Capati, Associate, Colliers Greater Los Angeles A new trend has emerged across Greater Los Angeles’ industrial market that has developers waiting for under-construction projects to capture the highest possible rent near the final development stages or closer to their target completion dates. With rents increasing at historical rates, a certain hesitancy exists, and companies are less likely to sign a lease during earlier development stages. In some instances, landlords ask listing agents to place certain buildings or projects on the market months in advance to build momentum and pique interest. Still, those landlords elect not to review offers until a month or two before their target completion date. Los Angeles is a land-constrained market where all new developments come from knocking down older, functionally obsolete buildings or conversions from other property types. The more contemporary, state-of-the-art facilities with the tallest warehouses and functional loading set the high water mark for new lease rates. With a 0.6 percent vacancy across an 862-million-square-foot market, tenants will continue to aggressively bid for any new big box space that comes to market. The South Bay and San Gabriel Valley markets are the only areas with more than 1 million square feet of development activity. Activity and Incentives …

AlabamaConference CoverageFeaturesGeorgiaIndustrialNorth CarolinaSouth CarolinaSoutheastSoutheast Feature ArchiveVirginia

I-85 Corridor Markets See Explosion of Industrial Development, But InterFace Panelists Wonder if Housing Will Follow

by John Nelson

CHARLOTTE, N.C. — During the closing panel at France Media’s InterFace I-85 Industrial Corridor conference, brokers from the major markets along the 666-mile interstate gave updates about developments and opportunities in their territories. Brockton Hall, vice president of Colliers’ Upstate South Carolina office, said that the Greenville-Spartanburg industrial market in South Carolina had 16 million square feet of industrial space under construction, which represents an inventory growth of approximately 7.4 percent. Graham Stoneburner, senior vice president of Cushman & Wakefield, said that the Richmond, Va., market currently had 11 million square feet underway, which represents an inventory growth of 11 percent. Similarly Robbie Perkins, shareholder and market president at NAI Piedmont Triad, said North Carolina’s Triad region had 8.7 million square feet in the development pipeline, a nearly 11 percent growth rate compared to the market’s 80 million-square-foot inventory. During nearly every panel throughout the conference, which was held on Wednesday, April 13 at the Hilton Uptown Charlotte, brokers, investors and developers described the industrial growth along the I-85 Industrial Corridor as “unprecedented.” “There’s a real lack of supply at the moment, but we have a lot coming,” said John Montgomery, managing director of Colliers’ Upstate South Carolina office, during …

NASHVILLE, TENN. — JLL has arranged the $10.2 million sale of a single-tenant, 51,528-square-foot industrial building in Nashville. Mitchell Townsend, Anthony Walters, Perry Wolcott, Matt Wirth and Robin Stolberg of JLL represented the seller, an affiliate of Next Realty LLC, in the transaction. Bridge Net Lease acquired the property for $10.2 million. The industrial building is triple net-leased to Fiserv, a provider of payments and financial technology solutions. Fiserv has been a tenant at the property since 2005 and uses the building to manufacture credit and payment cards. Next Realty recently executed a new long-term lease extension with Fiserv. The property offers a side-load configuration, clear heights ranging from 20 to 22 feet, three dock-high doors, one drive-in door, office space and a half-acre of land for expansion or outdoor storage. Located on 4.3 acres at 575 Brick Church Park Drive, the building is approximately five miles from downtown Nashville and 10.5 miles from Nashville International Airport.

BAYTOWN, TEXAS — A joint venture between Stream Realty Partners and Principal Real Estate Investors will develop Portside Logistics Center, a 1 million-square-foot speculative industrial facility that will be located near Port Houston. The Baytown project will offer proximity to the Grand Parkway, Interstate 10 and Highway 225 while also providing access to Port Houston’s two container terminals: Barbour’s Cut and Bayport. Portside Logistics Center will consist of a 760,000-square-foot cross-dock building and a 260,000-square-foot front-load building with 40- and 36-foot clear heights. Both buildings will deliver with spec office space, LED warehouse lights and fully fenced and secured truck courts. Construction is set to begin in the third quarter and to be complete in late 2023. Stream will also handle leasing of the facility.

SAN ANTONIO — Atlanta-based developer Oakmont Industrial Group has broken ground on Oakmont 410, a 639,595-square-foot speculative industrial project in San Antonio. The site fronts the Interstate 410 Access Road on the city’s northeast side. The cross-dock facility will feature 40-foot clear heights, 146 dock-high doors, an ESFR sprinkler system and parking for up to 334 trailers and 406 cars. Oakmont has tapped NAI Partners as the leasing agent. Completion is slated for December.