BAYTOWN, TEXAS — TGS Cedar Port Partners LP, the owner of the 15,000-acre Cedar Port Industrial Park near Port Houston, will develop a 507,000-square-foot warehouse for online furniture retailer Article. John Simons and Gray Gilbert of NAI Partners represented TGS Cedar Port in the lease negotiations for the build-to-suit project. Andrew Lord and Walker Barnett of Colliers represented Article. Other tenants at the rail- and barge-served park include The Home Depot, Floor & Décor, IKEA, Walmart, Vinmar and Ravago. Site work will begin before the end of the current quarter, and the project is expected to be complete before the end of the year.

Industrial

WEBSTER, TEXAS — Fort Worth-based investment firm Fort Capital has purchased Hercules Business Center, a 145,619-square-foot industrial property in the southeastern Houston suburb of Webster. The seven-building development was 68 percent leased at the time of sale. The tenant roster includes 29 users in the engineering, automation, electronics and medical sectors. The seller and sales price were not disclosed.

FLOWER MOUND, TEXAS — Locally based developer TIG Real Estate Services is underway on construction of a 127,810-square-foot industrial project in the Fort Worth suburb of Flower Mound. Designed by Meinhardt & Associates, the project is a build-to-suit for Niagara, a manufacturer of water and energy conservation products. The facility, which will serve as Niagara’s new headquarters, will feature 49-foot clear heights, 19 overhead dock doors and one drive-up ramp. Cadence McShane is the general contractor for the development, which is slated for a fourth-quarter completion.

DETROIT — Innovo has broken ground on a 425,000-square-foot speculative industrial project at Gateway Industrial Center in Detroit. The new building will offer 62 docks, 317 vehicle parking spaces, 100 trailer parking spaces and a clear height of 36 feet. Innovo is also completing improvements to the existing buildings within the 1 million-square-foot business park, which is fully occupied. Sean Cavanaugh and Colin McCausland of JLL will market the new building for lease.

PROSPECT HEIGHTS, ILL. — Conor Commercial Real Estate has completed the lease-up of the 151,000-square-foot Executive Commerce Center in Prospect Heights, a northwest suburb of Chicago. Syncreon, a third-party logistics provider for Samsung, leased half of the building while Plitek, a manufacturer of precision die cut components, leased the other half. Completed in 2020, the development features a clear height of 32 feet, 35 truck docks and two drive-in doors. McShane Construction Co. was the general contractor and Ware Malcomb provided design services. Mike Sedjo and Ben Dickey of CBRE represented Conor in the lease transactions.

BOYLSTON, MASS. — Massachusetts-based developer NorthBridge Partners has broken ground on a 396,375-square-foot industrial project that will be situated on a 55.5-acre site at 80 Pine Hill Drive in Boylston, located northeast of Worcester. Slated for a fourth-quarter delivery, the building will feature a clear height of 36 feet, 92 dock-high doors, 45 trailer parking stalls and 492 car parking spaces. Jeff Black, Sean Burke and Bryan Koop of Colliers arranged $38.7 million in construction financing for the project through Cambridge Savings Bank on behalf of NorthBridge Partners. Colliers has also been retained to lease the property.

GOFFSTOWN, N.H. — Marcus & Millichap has brokered the sale of Goffstown Back Road Self Storage, a 451-unit facility located on the western outskirts of Manchester. The property spans 65,700 net rentable square feet of space across 380 non-climate-controlled units and 71 climate-controlled units. Nathan Coe, Brett Hatcher and Gabriel Coe of Marcus & Millichap represented the undisclosed seller in the transaction. Thomas Shihadeh of Marcus & Millichap assisted in closing the deal as the broker of record. Additional terms of sale were not disclosed.

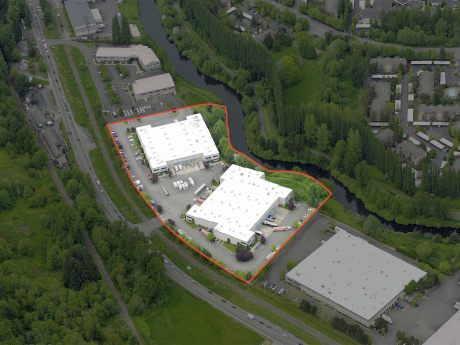

Kidder Mathews Brokers $33.5M Sale of Two Buildings at Woodinville West Business Park in Washington

by Amy Works

WOODINVILLE, WASH. — Kidder Mathews has arranged the sale of Buildings C and D of Woodinville West Business Park, located at 16650 and 16750 Woodinville Redmond Road NE in Woodinville. A private investor acquired the assets from Woodinville West CD for $33.5 million. Buildings C and D are high-quality, concrete and steel-framed buildings totaling 122,750 square feet of industrial space. Zach Vall-Spinosa of Kidder Mathews represented the seller in the deal.

NEW YORK CITY — New York City-based investment management firm Clarion Partners has provided a $415 million mezzanine loan for the refinancing of a national portfolio of 110 industrial buildings totaling 15.7 million square feet. The portfolio consists of properties in 15 markets, including Dallas-Fort Worth, Phoenix, Baltimore and Atlanta. At the time of the loan closing, the portfolio was approximately 93 percent leased to a roster of 300-plus tenants. The borrower was Blackstone.

BONDURANT, IOWA — Avison Young’s capital markets group has brokered the sale of a 2.7 million-square-foot fulfillment center occupied by Amazon in Bondurant, a city northeast of Des Moines, for more than $325 million. The newly constructed, four-story property sits across the street from a 270,000-square-foot Amazon sortation facility. Jonathan Hipp, James Hanson and Richard Murphy of Avison Young represented the seller, Mesirow Realty Sale-Leaseback Inc. Earl Webb of 9th Green Advisors also advised Mesirow on the sale. Virginia-based Capital Square was the buyer.