WOODRIDGE, ILL. — Eaton, a provider of power management technologies and services, has preleased a 370,973-square-foot industrial development in Woodridge, a southwest suburb of Chicago. The developer, Duke Realty Corp., began construction of the speculative project in August. Completion is slated for this July. The 21-acre site at 10000 Woodward Ave. was previously home to a vacant movie theater. The project will feature a clear height of 36 feet, 37 dock doors, four drive-in doors, 44 trailer spaces and 343 parking spaces. Jason Lev of CBRE represented Eaton, while Jason West and Sean Henrick of Cushman & Wakefield represented Duke.

Industrial

MIRAMAR, FLA. — Conshohocken, Penn.-based Seagis Property Group LP has purchased a 60,831-square-foot warehouse and distribution facility in Miramar. Tommy Gil of Vivo Real Estate Group Inc. represented the buyer in the transaction, while the seller, Megacenter US LLC, was self-represented by Bryan Demello. The sales price was $13.3 million. The property, which is being rebranded as Seagis @ Riviera Boulevard, is immediately available for lease and was vacant at the time of sale. Completed in 2021, Seagis @ Riviera Boulevard features 32-foot clear heights, six dock-high doors, five drive-in doors, a 1.4 per 1,000 parking ratio and the flexibility to accommodate tenants from 25,000 to 60,831 square feet. Located at 7481 Riviera Blvd., the property is situated along the Florida Turnpike. Seagis plans to make renovations on the interior of the property including an addition to office space to complement the distribution facility.

PISCATAWAY, N.J. — Indianapolis-based Duke Realty (NYSE: DRE) has acquired a 469,600-square-foot warehouse in the Northern New Jersey community of Piscataway. Constructed on 65 acres in 2019, the property serves as a storage and distribution center for Kiss Nail Products Inc. Building features include a clear height of 40 feet, 100 dock doors and 130-foot truck court depths. Thomas Kirczow of NAI DiLeo-Bram represented the undisclosed seller in the transaction. The sales price was also not disclosed.

EASTON, PA. — J.G. Petrucci Co. Inc. has purchased a 107,310-square-foot industrial building located at 3 Danforth Drive in the Lehigh Valley city of Easton. The building sits on 10.6 acres and includes 34 loading dock positions and just under an acre of outdoor storage space. J.G. Petrucci is currently renovating the building, which will be available for leasing in July. Kevin Hagenberg of SSH Real Estate brokered the deal. The seller and sales price were not disclosed.

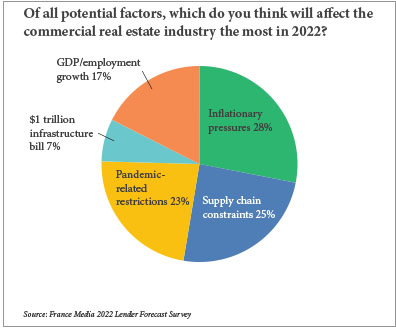

By Matt Valley An overwhelming percentage of direct lenders and financial intermediaries believe the multifamily and industrial sectors provide the most attractive financing opportunities for the lending community today, according to France Media’s 11th annual reader forecast survey. Conversely, the hotel and office sectors offer the least attractive financing opportunities, say survey participants. More specifically, 83 percent of participants in the email survey conducted between Nov. 19 and Dec. 13 indicate that the multifamily sector provides the most attractive financing opportunities, followed by industrial (75 percent), mixed-use (25 percent), retail (17 percent), hotel (14 percent) and office (7 percent). Multiple answers were permitted for this question. On the flip side, 62 percent of respondents believe that the hotel sector provides the least attractive financing opportunities, followed by office (58 percent), retail (27 percent), multifamily (7 percent), industrial (3 percent) and mixed-use (0 percent). Despite the persistence of the COVID-19 pandemic — which as of early January had claimed the lives of more than 830,000 Americans and has hobbled the hotel, office and retail sectors for nearly two years — the real estate fundamentals of the apartment and industrial sectors have remained rock solid. Fueled by strong tenant demand, the national …

VANCE, ALA. — Holmdel, N.J.-based Monmouth Real Estate Investment Corp. has acquired a 530,000-square-foot distribution center in Vance for $51.7 million. The seller was not disclosed. The distribution center is net-leased for 10 years to automobile giant Mercedes-Benz U.S. International Inc. The building will serve Mercedes-Benz’s new electric vehicle assembly line. Located at 11146 Will Walker Road on approximately 53.5 acres, the property is situated 37.3 miles from Birmingham and 21.3 miles from Tuscaloosa. Monmouth specializes in single tenant, net-leased industrial properties. The firm’s portfolio includes 124 properties with a total of approximately 25.7 million rentable square feet and an occupancy rate of 99.7 percent.

INDIANAPOLIS — Stos Partners and Cardinal Industrial have acquired a 1.1 million-square-foot light industrial portfolio in metro Indianapolis for an undisclosed price. The 34-property portfolio is 95 percent occupied by a variety of tenants. The California-based buyers plan to make improvements such as roof and parking lot upgrades and adding amenities. Alex Cantu and Alex Davenport of Colliers represented the seller, Indianapolis-based Mann Properties. Colliers will assume leasing and property management services for the portfolio. Jeremy Thornton, Andrew Gibson and Nicole Sayers of Colliers arranged $67.5 million in acquisition financing through Wells Fargo Bank.

JLL Negotiates $78M Sale of Four-Building Britannia Business Center in Pleasanton, California

by Amy Works

PLEASANTON, CALIF. — JLL Capital Markets has arranged the sale of Britannia Business Center, a four-building R&D and office campus at 4125, 4155, 4255 and 4385 Hopyard Road in the Bay Area city of Pleasanton. A Virtua Partners-managed company sold the asset to an undisclosed buyer for $78 million. Situated on 19.3 acres, Britannia Business Center features 292,000 square feet of R&D and office space. Originally built between 1997 and 1998, the property features 13-foot to 20-foot clear heights, eight roll-up doors, one dock-high door and 1,600 to 3,000 amps available. At the time of sale, the asset was 68.6 percent leased with nearly half of the tenancy being credit tenants. Erik Hanson, David Dokko and Nick Deaver of JLL Capital Markets represented the seller in the deal.

NORTH LAS VEGAS, NEV. — Newport Beach, Calif.-based CapRock Partners has completed the disposition of CapRock Interchange Industrial Center, a Class A industrial campus located at 5345-5445 E. Centennial Parkway in North Las Vegas. Terms of the transaction were not released. Developed in 2020 and 2021, CapRock Interchange Industrial Center features 684,000 square feet of Class A industrial space spread across two warehouses. The 174,000-square-foot Building 1 features 32-foot clear heights, 39 dock-high doors, two grade-level doors and 105 parking spaces. The 510,000-square-foot Building 2 features a cross-dock design, 36-foot clear heights, 89 dock-high doors, four grade-level doors, 115 trailer parking stalls and 249 parking spaces. At the time of sale, the property was 100 percent leased to BarkBox, Boxabl and Evanesce Packaging Solutions. Andrew Briner and Brett Hardy of Newmark represented CapRock in the transaction, while Rob Lujan, Xavier Wasiak and Jason Simon of JLL represented CapRock as local market experts.

TULSA, OKLA. — CBRE has negotiated the sale of a 622,814-square-foot industrial building in Tulsa that is fully occupied by Port City Metals Services. Built on 50 acres in 1950, the property features 35-foot clear heights, 70-plus parking spaces and 32,838 square feet of office space. Dwayne Flynn and Ryan Shaffer of CBRE represented the seller, an entity doing business as 1315 LLC, in the transaction. Radix Equity LLC purchased the asset for $13 million.