SAN ANTONIO — Marcus & Millichap has brokered the sale of Noah’s Ark Self Storage, a 477-unit facility located in the Stone Oak neighborhood of San Antonio. The facility was built on 1.2 acres in 2013 and spans 57,219 net rentable square feet. Dave Knobler and Charles LeClaire of Marcus & Millichap represented the seller, a locally based limited liability company, in the transaction. The duo also procured the buyer, a publicly traded REIT. Both parties requested anonymity.

Self-Storage

BEEVILLE, TEXAS — Marcus & Millichap has brokered the sale of Security Mini Storage, a 604-unit self-storage facility in Beeville, about 100 miles south of San Antonio. The facility, which consists of 21 buildings on a 5.9-acre site, spans 74,800 net rentable square feet. Dave Knobler and Charles LeClaire of Marcus & Millichap represented the Nevada-based seller in the transaction. The duo also procured the buyer, a Colorado-based limited liability company that closed on the asset via a 1031 exchange. Both parties requested anonymity. Security Mini Storage was 95 percent occupied at the time of sale.

SHEBOYGAN, WIS. — Marcus & Millichap has brokered the sale of the Champion Storage portfolio in Sheboygan, about 55 miles north of Milwaukee. The sales price was undisclosed. The portfolio totals five properties and 1,167 units. At the time of sale, the portfolio was 95 percent occupied. The facilities feature both climate-controlled and non-climate-controlled units as well as outdoor parking spaces and portable container units. Sean Delaney of Marcus & Millichap represented the seller, JGSS LLC, and the buyer, Rogers Equity Group IV LLC.

AZLE, TEXAS — Marcus & Millichap has brokered the sale of Azco Center Point Storage, an 276-unit facility in Azle, located northwest of Fort Worth. The facility spans 37,228 net rentable square feet. Danny Cunningham and Brandon Karr of Marcus & Millichap represented the seller, a local investment group, and procured the buyer, a private partnership, in the transaction.

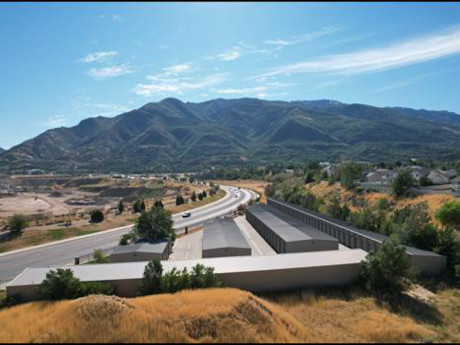

OGDEN, UTAH — Marcus & Millichap has brokered the sale of South Weber Storage, a self-storage facility in Ogden. Terms of the transaction were not released. Jordan Farrer and Adam Schlosser of Marcus & Millichap’s LeClaire-Schlosser Group represented the seller, a local partnership, and procured the undisclosed buyer. Totaling 26,060 square feet, South Weber Storage consists of five single-story buildings offering a total of 136 non-climate-controlled drive-up units. The facility features brick front dividers with all metal interior walls, slightly pitched standing seam metal roofs, roll-up doors and asphalt driveways.

LAYTON, UTAH — A local investment and development group has completed the disposition of Storage General – Layton, an 86,105-square-foot self-storage facility located on Antelope Drive in Layton. A REIT acquired the asset for an undisclosed price. Jordan Farrer and Adam Schlosser of Marcus & Millichap represented the seller and procured the buyer in the transaction. Storage General – Layton features 11 single-story buildings offering interior, drive-up, climate-controlled and traditional self-storage units with roll-up doors. The property has cinderblock front dividers with all metal interior walls, slightly pitched standing seam metal roofs, roll-up doors and driveways.

CEDAR HILL, COLLEYVILLE AND DENTON, TEXAS — JLL has negotiated the sale of a portfolio of three self-storage facilities totaling 1,743 units that are located in the North Texas cities of Cedar Hill, Colleyville and Denton. The portfolio totals 201,850 net rentable square feet. Brian Somoza, Steve Mellon, Matthew Wheeler, Adam Roossien and Jake Kinnear of JLL represented the seller, a joint venture between Chicago-based investment firm Harrison Street and Advantage Self Storage, in the transaction. The team also procured the buyer, Texas-based investment firm HPI.

HOUSTON — Marcus & Millichap has arranged the sale of Easy Self Storage, a 236-unit facility located along State Highway 249 in northwest Houston. The five-building property was built in 1984 and spans 29,716 net rentable square feet across 172 non-climate-controlled units and 64 climate-controlled units. Dave Knobler of Marcus & Millichap represented the seller, a private investor, and procured the buyer, a limited liability company, in the transaction. Both parties requested anonymity.

SAN ANTONIO — Marcus & Millichap has arranged the sales of three self-storage facilities in San Antonio totaling 89,815 net rentable square feet across 650 units. The properties include Comal Ridge Self Storage, located at 23995 Bat Cave Road; Garden Ridge Self Storage, located at 22480 FM 3009; and Palo Alto Self Storage, located at 9018 Poteet Jourdanton Freeway Access Road. Jon Danklefs of Marcus & Millichap represented the three limited liability companies that sold the assets in the transactions. Each facility was purchased by a different buyer, with all parties requesting anonymity.

SOUTH ELGIN, ILL. — Marcus & Millichap has brokered the $11.6 million sale of an AAA Storage property in South Elgin. Constructed in 1995 and located at 300 Sundown Road, the facility consists of 388 units within eight non-climate-controlled buildings, 13,000 square feet of flex industrial space and 28 outdoor parking spaces. At the time of sale, 96 percent of the units were occupied. Sean Delaney of Marcus & Millichap represented the seller, Shanahan Enterprises LLC, and procured the buyer, Trojan Storage. The transaction also includes an adjacent two-acre parcel where the new owner plans to build a three-story, climate-controlled building.