HOUSTON — Houston Methodist has signed a 75,800-square-foot lease at Texas Medical Center in Houston. The provider will occupy two floors at the Dynamic One building at TMC Helix Park for various biomedical research initiatives. The building was completed last fall and offers a fitness center, outdoor terrace and a multi-purpose lounge. Scott Carter of CBRE represented Houston Methodist in the lease negotiations. Eric Johnson, Lisa Bovermann and Kaitlyn Harp of Transwestern represented the landlord, Beacon Capital Partners, which developed the building in partnership with Zoë Life Sciences.

Leasing Activity

MONTGOMERY, ILL. — NAI Hiffman has negotiated a 330,694-square-foot industrial lease on behalf of NORKOL Converting Corp. at CenterPoint 88 Industrial Center in Montgomery, a western suburb of Chicago. NORKOL, a family-owned paper and packaging provider, signed a long-term lease agreement and will relocate from its Northlake headquarters this spring. Originally built in 1960 and renovated in 2000, the property is served by the BNSF Railway and is located less than five miles from I-88. NORKOL plans to make significant upgrades to the facility, including improvements to the truck courts, sprinkler system, power capacity and lighting. Dan Leahy of NAI Hiffman represented the tenant and provided site selection services. Rick Daly and George Cibula of DarwinPW Realty/CORFAC International represented the landlord, CenterPoint Properties.

KANSAS CITY, MO. — Banksia is opening a 5,300-square-foot restaurant at 1111 Main, the largest office building in Kansas City, according to owner Copaken Brooks. The Australian-inspired café and bistro is relocating from its existing downtown location at 105 W. 9th St. The new restaurant is slated to open this spring. Copaken Brooks is performing the owner’s representative services for Banksia’s build-out. Banksia will offer patio seating, a full bar, coffee, breakfast, lunch and dinner service as well as private event spaces. Tiffany Ruzicka of AREA Real Estate Advisors represented the tenant, while Erin Johnston of Copaken Brooks represented ownership.

BEVERLY, MASS. — Axcelis Technologies, which supplies manufacturing equipment for the semiconductor business, has signed a 95,800-square-foot industrial lease in Beverly, a northern suburb of Boston. Axcelis will use the entirety of the building at 105 Sam Fonzo Drive for order fulfillment and distribution purposes. Richard Ruggiero, Matt Adams, Torin Taylor and Rory Walsh of Newmark represented the tenant in the lease negotiations. The representative of the landlord, a Massachusetts-based limited liability company, was not disclosed.

BETHLEHEM, PA. — Regional brokerage firm Zimmel Associates has negotiated a 70,000-square-foot industrial lease in the Lehigh Valley city of Bethlehem. The 120,000-square-foot building at 2500 Emrick Blvd. was constructed in 2017 and features a clear height of 32 feet and 3,500 square feet of office space. David Zimmel of Zimmel Associates represented the tenant, Romeo & Layla Warehousing, in the negotiations for the seven-year lease. Locally based developer J.G. Petrucci Co. owns the building.

AUSTIN, TEXAS — Harmony Public Schools has signed a 7,211-square-foot office lease extension in northwest Austin. The academic administrator will continue to occupy space at Building G at Amber Oaks, a 10-building park located along I-45. Patrick Ley and Jason Steinberg of Equitable Commercial Realty represented the undisclosed landlord in the lease negotiations. Nick Boyd of Nick Boyd Real Estate represented the tenant.

NEW YORK CITY — Investment banking advisory firm Evercore has signed a 95,000-square-foot office lease expansion at Park Avenue Plaza, a 45-story, 1.2 million-square-foot building in Midtown Manhattan. Evercore’s additional space is located across floors 39 through 41, and the company now occupies about 500,000 square feet total at Park Avenue Plaza. Alan Desino of Colliers represented Evercore in the lease negotiations. Marc Packman, Charles Laginestra, Clark Briffel and Josh Fisher represented the landlord, Fisher Brothers, on an internal basis.

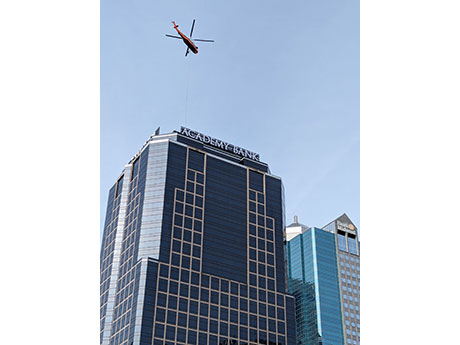

KANSAS CITY, MO. — Academy Bank, a full-service community bank and family-owned subsidiary of Dickinson Financial Corp., has opened a new retail branch within the lobby of 1201 Walnut, a 29-story office tower owned by Copaken Brooks in downtown Kansas City. The bank also moved its corporate headquarters to three contiguous floors of the building totaling roughly 50,000 square feet. Additionally, the property now features Academy Bank signage. Of Academy Bank’s 71 branches, 23 are located throughout metro Kansas City. Sister bank Armed Forces Bank will maintain its headquarters in Fort Leavenworth, Kan.

Prologis Signs Seaboard Marine to 308,000 SF Lease Renewal at Industrial Park in Medley, Florida

by John Nelson

MEDLEY, FLA. — Prologis has signed Seaboard Marine Ltd. to two lease renewals at Prologis Palmetto Tradeport, an 880,000-square-foot industrial park in Medley, a city in Miami-Dade County. The two leases, for facilities located at 7800-7890 N.W. 80th St. and 8001 N.W. 79th Ave., total 308,000 square feet. Brian Smith of JLL represented Prologis in the lease transactions. Jonathan Kingsley of Colliers represented the tenant. Situated near Miami International Airport and PortMiami, Prologis Palmetto Tradeport is located adjacent to the Medley Metrorail Station and features three acres of outside storage. Seaboard Marine is a global ocean carrier offering shipping services between the Caribbean, North, Central and South America. The company, which is the largest cargo operator at PortMiami, has a 25-vessel fleet and more than 60,000 shipping containers.

HOUSTON — Coworking and flexible workspace provider The Cannon will open a 21,960-square-foot space in Houston’s 265-acre Memorial City District. The space will span a full floor within Two Memorial City Plaza, which is part MetroNational’s three-building complex that recently received $30 million in capital improvements. Slated to open this spring, the space will feature 38 private offices and will be able to support more than 60 members.