Perhaps the most salient information within Lee & Associates’ 2024 Q3 North America Market Report pertains to the office market. The third quarter of 2024 ended nine continuous quarters of negative net absorption in the office sector. However, additional occupancy losses may be on the horizon for the office market, even as supply pressures ease for this property type. Positive retail news has led to positive industrial news, as rising demand for retail goods has bolstered tenant demand for industrial space just as additional industrial inventory is coming on line. Steady economic growth and continuing impediments to home ownership have created strong absorption in the multifamily sector. Rent growth and vacancy rates have largely plateaued. Lee & Associates has made their complete third-quarter report available here (with more detailed information broken down according to property type). Below is an overview of the strengths and challenges in the industrial, office, retail and multifamily sectors. Industrial Overview: U.S. Demand Spikes Industrial demand across the United States dramatically improved in the third quarter. There were 52.8 million square feet of positive net absorption in the country in the third quarter, a 76 percent jump from the same period a year ago and more than double the …

Lee & Associates

Content PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

AURORA, ILL. — Lee & Associates has brokered the sale of a nearly four-acre industrial development site at 2290 White Oak Circle in Aurora. The sales price was undisclosed. The site features convenient access to the I-88 tollway via Eola Road to the east and Farnsworth Avenue to the west. Nick Eboli and Andrew Block of Lee & Associates represented the seller. George Cibula of DarwinPW Realty/CORFAC International represented the buyer, which plans to build a 50,000- to 60,000-square-foot speculative cold storage or warehouse.

LYNDHURST, N.J. — Nemo Tile has signed a 30,046-square-foot industrial lease in the Northern New Jersey community of Lyndhurst. The lease term is 65 months. The building at 2 Terminal Road was recently renovated and features a clear height of 18 feet, seven truck parking spaces and 1,800 square feet of office space. Michael Schaible and Troy Wisse of Lee & Associates represented the landlord, Woodmont Industrial Properties, in the lease negotiations. Daniel Reider of Newmark represented the tenant.

ELK GROVE VILLAGE, ILL. — Transportation company Midwest Express has signed a 40,320-square-foot, full-building industrial lease at 1850 Arthur Ave. in the Chicago suburb of Elk Grove Village. The property features 24 exterior docks and 29 trailer spots. Chris Nelson of Lee & Associates represented the owner, RREEF America. Calvin Gunn of Lee & Associates represented the tenant, which is relocating from Mount Prospect.

ITASCA, ILL. — Lee & Associates of Illinois has brokered the $6.2 million sale of a 59,778-square-foot industrial building in Itasca. The property is located at 700 District Drive. Jeffrey Janda of Lee & Associates represented the seller, Levi Holdings. The buyer, Venture One Real Estate, purchased the building pre-leased to Premistar, an HVAC contractor. Cal Payne of CBRE represented Premistar, and Michael Clewlow represented Venture One on an internal basis.

WEST SACRAMENTO, CALIF. — Lee & Associates has arranged the sale of a heavy industrial-zoned property at 3961 Channel Drive in West Sacramento. Yara North America sold the asset Greencycle Properties, an affiliate of Teichert Inc., for $17.9 million. Alex Weiss and Greg Pieratt of Lee & Associates represented the seller in the transaction. The site, which was formerly used by Yara International as a fertilizer supply port, was decommissioned a year ago. Situated on 23.4 acres, the asset includes one existing building, rail spurs, 5.5 acres of undeveloped industrial land and direct access to the Sacramento Deep Water Ship Channel.

FLOWER MOUND, TEXAS — A partnership between Hopewell Development and MBK Industrial Properties has broken ground on Lakeside Business Center, a 123,910-square-foot building in Flower Mound, a city located in the northern-central part of the metroplex. Lakeside Business Center will consist of two buildings with 32-foot clear heights, a 200-foot shared truck court, ESFR sprinkler systems and a total 16 dock doors and two ramped doors. Lee & Associates is marketing the development for lease and/or sale. Completion is scheduled for summer 2025.

HOUSTON — Alterra IOS has acquired two industrial outdoor storage sites totaling 7.2 acres in the eastern Houston suburb of Baytown. The sites at 8121 and 8223 Parkside Ave. are located within Bay 10 Business Park and house a combined 50,000 square feet of warehouse space. Lee & Associates brokered the sale. The seller and sales price were not disclosed. Alterra IOS plans to make capital improvements into the sites, including adding speculative office space and a reinforced concrete yard at 8121 Parkside.

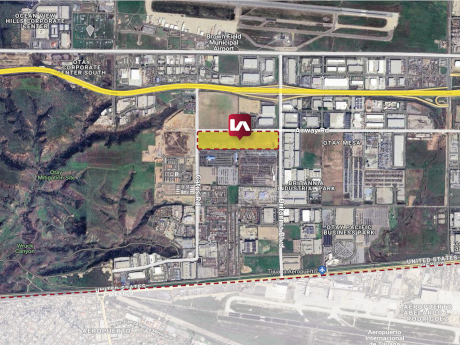

Lee & Associates Negotiates $58M Purchase of Industrial Land in San Diego’s Otay Mesa District

by Amy Works

SAN DIEGO — Lee & Associates has arranged the acquisition of 37.9 acres of industrial land at 5761 Airway Road in San Diego’s Otay Mesa neighborhood. Hyundai Translead purchased the asset for $58 million in an off-market transaction. The site will support Hyundai Translead’s operations in San Diego, which will allow the company to continue to utilize the location of Otay Mesa as a thoroughfare for its cross-border operations. Rusty Williams, Chris Roth, Jake Rubendall and Andrew Kenny of Lee & Associates – NSDC, as well as Eugene Kim of Lee & Associates LA North/Ventura, represented the buyer in the transaction.

NEW YORK CITY — Lee & Associates has brokered the $6.8 million sale of a 37-unit apartment building in the Brooklyn Heights neighborhood. The six-story, rent-stabilized building at 75 Pierrepont St. consists of 25 one-bedroom apartments and 12 studios that were fully occupied at the time of sale. Thomas Gammino and Patrick Donahue of Lee & Associates represented the buyer and seller, both of which requested anonymity, in the transaction. The deal traded at a cap rate of 6.2 percent. The deal traded at a cap rate of 6.2 percent.