WINDHAM, N.Y. — CooperWynn Capital, a Utah-based firm that provides capital advisory services for the hospitality industry, has arranged a $19.5 million loan for the refinancing of Wylder Windham Resort, a 110-room hotel located about 50 miles southwest of Albany. Built in the 1880s and most recently renovated in 2022, the hotel offers various lodge-style accommodations and amenities such as a heated outdoor pool, fitness center, pickleball courts, onsite food-and-beverage options and both indoor and outdoor meeting/event spaces. CooperWynn Capital arranged the nonrecourse, floating-rate loan through Formida Capital on behalf of the owner, Wilder Hotels.

Loans

PASSAIC, N.J. — Valley Bank has provided an $18.6 million loan for the refinancing of a 124,000-square-foot industrial building in the Northern New Jersey community of Passaic. The building at 101 Seventh St. is currently operated as a recycling facility and offers proximity to several major nearby thoroughfares. Jason Gaccione, Shawn Rosenthal and Jake Salkovitz of CBRE arranged the loan on behalf of the owner, an entity doing business as 101 Seventh Street Urban Renewal LLC.

FARMINGTON HILLS, MICH. — Bernard Financial Group (BFG) has arranged a $2.8 million loan for the refinancing of Botsford Place Terrace Apartments in the Detroit suburb of Farmington Hills. The multifamily property features 98 units. David Ruff of BFG arranged the loan with Genisys Credit Union on behalf of the borrower, Botsford Place Terrace Apartments LLC.

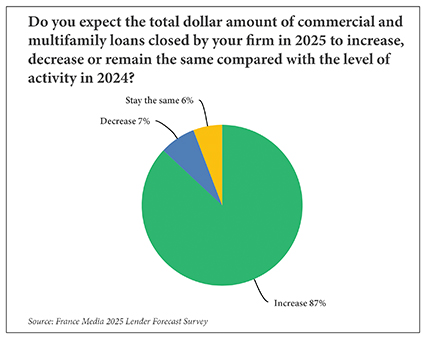

Lenders and financial intermediaries are much more confident about the prospect for business growth in 2025 than they were heading into 2024, according to France Media’s 14th annual forecast survey conducted nationally. A massive 87 percent of debt providers and arrangers of capital expect the total dollar amount of commercial and multifamily loans closed by their firm in 2025 to be higher than in 2024, versus 7 percent who expect a decrease, according to the survey findings. Another 6 percent anticipate no change (see above chart). The sentiment is much more bullish than it was heading into 2024 when 58 percent of survey respondents projected an increase in deal volume, 24 percent predicted a decrease and 18 percent said deal volume would remain the same. Among those who expect a rise in annual deal volume in 2025, 43 percent predicted the increase will be by more than 20 percent. Another 17 percent of survey participants expect the increase in deal volume to range between 16 and 20 percent, and 15 percent of survey respondents expect an increase of 11 to 15 percent. Slightly more than half of respondents (52 percent) said that refinancing activity will make up the bulk of …

HOBOKEN, N.J. — Locally based developer LCOR has broken ground on a 386-unit multifamily project in Hoboken. The 27-story building will be known as Charlie and will be located within the $900 million Hoboken Connect mixed-use development. Units will come in studio, one-, two- and three-bedroom floor plans, with 20 percent of the residences to be reserved as affordable housing, although specific income restrictions were not disclosed. Amenities will include a resident lounge with package room, concierge and pet spa, as well as a second floor and rooftop amenity space with a fitness center, entertainment kitchen, coworking spaces, dining areas and an outdoor pool. Consigli Construction Co. is the general contractor for Charlie, a tentative completion date for which was not disclosed. Jon Mikula, Jim Cadranell and Michael Lachs of JLL arranged a $155 million construction loan through insurance accounts managed by KKR for the project. The loan carried a five-year term and a floating interest rate.

PORTLAND, CONN. — Kriss Capital, a New York-based private equity firm and bridge lender, has provided a $33.5 million construction loan for a 130-unit multifamily project in Portland, a southern suburb of Hartford. The four-story building will be part of a larger development known as Brainerd Place and will include 11,000 square feet of commercial space. John Harrington of HKS Real Estate Advisors arranged the loan on behalf of the developers, Bright Ravens Development and DiMarco Group. Completion is slated for spring 2026.

SOMERSET, N.J. — NewPoint Real Estate Capital has provided $17.7 million in bridge-to-HUD financing for the acquisition of Brentwood Park, a 77-unit multifamily property located in the Northern New Jersey community of Somerset. Built in 2023, Brentwood Park consists of two four-story buildings that house studio, one- and two-bedroom units, as well as 3,125 square feet of commercial space. Matthew Meskill of NewPoint originated the financing, which was structured with a floating interest rate and a two-year initial term, on behalf of the undisclosed buyer. Adam Zweibel of Hudson Atlantic brokered the sale.

DERBY, VT. AND WALLINGFORD, CONN. — New Jersey-based financial intermediary Cronheim Mortgage has arranged the $9 million refinancing of two New England shopping centers. The first property is Shaw’s Plaza, an 80,193-square-foot, grocery-anchored center in Derby, Vt., that was originally built in 1968. The second property is Kohl’s Plaza, a 159,600-square-foot shopping center in Wallingford, Conn., that is also home to Aldi, Harbor Freight and Sally Beauty. Brandon Szwalbenst, Dev Morris and Andrew Stewart of Cronheim arranged the debt on behalf of the owner, National Realty & Development Corp. The direct lender was not disclosed.

VANCOUVER, WASH. — Gantry has secured a $23 million permanent loan to refinance the Mission Hills Apartments located at 11900 NE 18th St. in Vancouver. Situated on 33 acres, the property includes 556 one-, two- and three-bedroom apartments in multiple buildings. Community amenities include a club house, pool, spa and other Class A amenities. Blake Hering and Abi Hunter of Gantry represented the borrower, a private real estate family. The 10-year, fixed-rate loan was secured through one of Gantry’s correspondent life company lenders and features nonrecourse terms and a 30-year amortization schedule. The loan retires two maturing loans placed on different phases of the property.

NEW YORK CITY — NuVerse Advisors LLC has received a $99 million construction loan to convert The Emmet Building, a 17-story office building at 95 Madison Ave. in New York City, for residential use. The vacant property was originally constructed between 1911 and 1912 as a loft office building with grade-level retail space. The building will be converted into 65 residential condominiums across 108,000 square feet, along with 17,000 square feet of retail space and 3,400 square feet of office space. Internal demolition is currently in progress. However, an expected delivery date was not disclosed. The conversion is sponsored by NuVerse Advisors’ S3 Multi Strategy Global Fund, with Sunlight Development as a strategic partner and general contractor. BHI — the U.S. branch of Tel Aviv, Israel-based Bank Hapoalim BM — is the senior lender in the financing. Under the terms of the loan, BHI will provide $40 million of debt. The company has worked with several financial partners to arrange the remainder of the financing. “BHI was a trusted partner in financing the acquisition of this property this past summer and we’re thrilled to work together again now as we redevelop this property for residential use,” said Dov Schlein, managing …