DALLAS — Dallas-based Westdale Real Estate Investment & Management has received a $115 million loan for the refinancing of a portfolio of three commercial properties in Texas. The portfolio comprises Epic I, a 282,873-square-foot office building located in the Deep Ellum district of Dallas; Colonnade, a 168,255-square-foot office building located on the north side of San Antonio; and Woodmeade, a 304-unit multifamily property in Irving. The five-year loan carried a fixed interest rate of 7.11 percent and a 70 percent loan-to-value ratio. Giryes Capital Group, an intermediary that connects American borrowers and Israeli lenders, sourced the debt through Pando Cos., a Dallas-based company that is also owned and managed by Giryes founder and CEO Amir Giryes.

Loans

LAREDO, TEXAS — JLL has arranged an undisclosed amount of acquisition financing for a 250,000-square-foot warehouse located on an 18-acre site in the Rio Grande Valley city of Laredo. Completed in late 2023, the property was fully leased at the time of the loan closing. Building features include 30-foot clear heights, 48 docks, 3,000 square feet of office space and parking for 272 cars and 233 trailers. Peter Rotchford, David Sitt, Jarrod McCabe, Foster Huggins and Jordan Buck of JLL arranged the floating-rate loan through Connecticut-based Shelter Growth Capital Partners. The borrower is New York City-based Thor Equities.

NEW YORK CITY — Newmark and Greystone have jointly arranged $560 million in floating-rate debt for the refinancing of 3ELEVEN, a 60-story, 938-unit apartment tower in Manhattan. The site at the corner of 11th Avenue and West 29th Street lies at the intersection of the borough’s Hudson Yards and West Chelsea neighborhoods. Units come in studio, one-, two- and three-bedroom floor plans. Amenities include a pool with cabanas, fitness center with a yoga studio, theater, coworking spaces with conference rooms, music practice rooms and multiple outdoor gathering areas, including a 42nd-floor terrace and dedicated dog runs. Jordan Roeschlaub, Nick Scribani and Jonathan Firestone of Newmark collaborated with Drew Fletcher, Paul Fried and Bryan Grover of Greystone to originate the debt, which retires a senior construction loan provided by HSBC. The borrower, a partnership between Ares Corp. and Douglaston Development, originally announced the project in summer 2019 and completed construction in summer 2023. At the time of the loan closing, 3ELEVEN was 99 percent occupied.

NEW YORK CITY — Ariel Property Advisors has arranged an $8.7 million loan for the refinancing of a retail and hospitality portfolio in Manhattan’s Theater District. The fully occupied portfolio consists of two properties, both of which feature bars/restaurants that are owned and operated by the undisclosed borrower. In addition, the second property has a boutique hotel occupying floors three through six that is leased to a third-party operator. The direct lender and addresses of the property were also not disclosed. Ben Schlegel, Matt Swerdlow, Christoffer Brodhead and Rhea Vivek of Ariel originated the three-year loan.

Tolles Development Receives $114M in Financing for 890,000 SF Airway Commerce Center in Reno, Nevada

by Amy Works

RENO, NEV. — CBRE has arranged $114 million in financing for Airway Commerce Center in Reno on behalf of Tolles Development Co. Mike Walker and Brad Zampa of CBRE’s debt and structured finance team secured the three-year, nonrecourse loan from Barings, a Massachusetts-based global investment management firm. Eric Bennett of CBRE is handling leasing, while CBRE’s Brett Hartzell facilitated the sale. Located at 3000-3030 Airway Drive, Airway Commerce Center features four buildings offering a total of 890,000 square feet of Class A industrial space. The buildings feature high clear heights, ample car and trailer parking, 152 dock-high doors, 28 drive-in doors and multiple points of ingress/egress. Airway Commerce Center is adjacent to the Reno-Tahoe International Airport and is within five miles of the regional and national freeways, including interstates 580 and 80, McCarren Boulevard, downtown Reno and the California-Nevada border.

Keystone Mortgage Arranges $25.7M Bridge Loan for Neighborhood Retail Center in Upland, California

by Amy Works

UPLAND, CALIF. — Keystone Mortgage Corp. has arranged a $25.7 million fixed-rate bridge loan to fund the repositioning of a 140,000-square-foot neighborhood retail center in Upland, approximately 35 miles east of Los Angeles. Amazon Fresh, Ross Dress for Less and Burlington are tenants at the property, which is situated on 12.3 acres. Tim Winton of Keystone’s Orange County office arranged the financing on behalf of the borrower, a private real estate investor. One of Keystone’s correspondent life company lenders provided the 36-month, high-leverage, nonrecourse loan.

NEW YORK CITY — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged a $50 million loan for a 12-story, 144,000-square-foot office and retail property in Manhattan’s SoHo neighborhood. The newly renovated building spans a full city block from Broadway to Crosby Street in between Houston and Prince streets. Matthew Polci, Steven Buchwald and Rachael Krawiecki of IPA originated the loan through a partnership between Maxim Capital Group, Sabal Investment Holdings and GDS Brightstar. The borrower was a partnership between London-based Chelsfield Group and RAM Holdings.

KeyBank Funds $45.4M Financing for Camas Flats Affordable Housing Project in Oak Harbor, Washington

by Amy Works

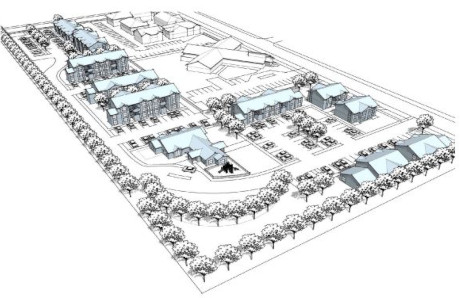

OAK HARBOR, WASH. — KeyBank Community Development Lending and Investment (CDLI) has provided $17.9 million in federal Low Income Housing Tax Credit equity and a $19.3 million construction loan for the construction of Camas Flats, an affordable residential property in Oak Harbor, located on an island north of Seattle. KeyBank Commercial Mortgage Group also arranged an $8.2 million Fannie Mae MTEB permanent loan for the project. Shelter Resources Inc., a Bellevue-based affordable housing developer, is the borrower. Additionally, Opportunity Council (OC) will service as the nonprofit general partner for the project, providing supportive services and case management to tenants on site. Camas Flats will consist of 10 garden-style, walk-up apartment buildings offering a mix of one-, two- and three-bedroom units, as well as one manager’s unit. Community amenities will include a playground, park and community building. The community will provide 81 affordable housing units for residents earning between 30 percent and 80 percent of area median income. Camas Flats will also include eight units that are specifically Permanent Supportive Housing (PSH) for those experiencing homelessness and two units for veterans. For the PSH units, OC will offer full-time case management services that are focused on wellness, medical health and behavioral health …

Lument Provides $38.8M Freddie Mac Refinancing for Carlton Senior Living Portfolio in California

by Amy Works

FREMONT AND SAN JOSE, CALIF. — Lument has provided $38.8 million in Freddie Mac refinancing loans for Carlton Senior Living, one of Northern California’s largest senior living providers with 11 independent living, assisted living, and memory care communities in operation. The loans are spread across two separate properties — $13.5 million to refinance a 123-unit senior living property in Fremont and $25.3 million to refinance a 126-unit senior living property in San Jose. Both loans feature a fixed interest rate, 10-year term and 30-year amortization. One loan also provides funds for renovations to improve the San Jose property. Lument’s Nick Hamilton and Casey Moore, both based in San Diego, led the transaction.

KANSAS CITY, MO. — Bayview PACE has provided a $20.5 million C-PACE loan for the construction of a $72 million headquarters facility for Master’s Transportation in Kansas City. Bayview says the C-PACE financing provided a complementary role in the capital stack of the development, which is now under construction and slated to open in 2025. Other financing includes a $31 million construction loan and $20 million in sponsor equity. Master’s is a bus and transportation fleet operator serving 26 states. The 324,000-square-foot facility will consolidate eight other area locations. C-PACE financing offers favorable and cost-effective terms for qualified improvements in energy, lighting, water systems, building envelope and other resiliency components. It can be applied to new construction or renovations. In this transaction, PACE financing was used in place of a participant bank. Kansas City-based Miller Stauch Construction Co. is the general contractor, and Eskie & Associates is the owner’s representative. Kansas City-based Finkle + Williams Architecture is the project architect.