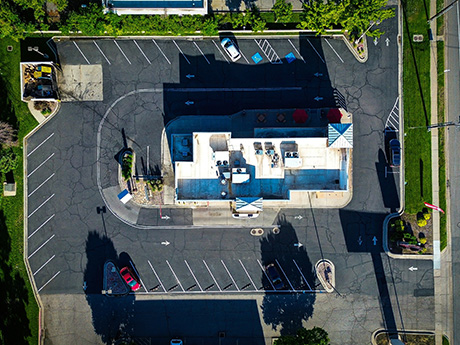

SCHILLER PARK, ILL. — Associated Bank has provided a $2.2 million loan for the refinancing of an industrial outdoor storage facility near O’Hare International Airport in Schiller Park. O’Hare Blue Sky Parking leases the property and operates it as an offsite parking facility servicing O’Hare. The asset includes a 16,562-square-foot building. Daniel Barrins of Associated Bank originated the loan on behalf of the borrower, The Missner Group, which acquired the property in February 2023.

Loans

AcquisitionsContent PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates Second Quarter Report: Industrial, Office Market See Continued Challenges While Retail, Multifamily Trends Follow Region-Specific Patterns

In the first half of 2024, high interest rates led to decreased demand, higher vacancy rates, reduced construction starts and lower property sales in industrial and office, according to Lee & Associates’ 2024 Q2 North America Market Report. Meanwhile, retail saw minimal development and continued low vacancies. Retail rent growth was particularly strong in the South and Southwest. Finally, high demand for multifamily, coupled with a sudden influx of supply in the second quarter of the year, has created a market where outcomes are highly tied to region. Midwest and Northeast multifamily markets have remained stronger than their counterparts in the South and Southwest, while Western markets saw mixed growth. Lee & Associates has made their full market report available here (with complete breakdowns of cap rates by city, market rents, vacancy rates, square footage information and more). The summaries for the industrial, office, retail and multifamily sectors below provide detailed insight into the trends and trajectories likely through the end of 2024. Industrial Overview: Activity, Growth Checked by High Interest Rates Industrial market performance across North America continued to downshift in the first half of this year. Although net absorption remains positive, demand for industrial space has fallen to the lowest levels …

OKO Group, Cain International Obtain $565M Loan for 830 Brickell Office Tower in Miami

by John Nelson

MIAMI — Co-developers OKO Group and Cain International have obtained $565 million in financing for 830 Brickell, a 57-story office tower underway in Miami’s Brickell district. TYKO Capital, a joint venture between Adi Chugh and a Florida-based hedge fund that was established last year, provided the loan that pays off an existing construction loan that MSD Partners provided in 2019. Beatriz Azcuy of Sidley Austin LLP assisted the developers in the loan arrangement. Set to open this fall, 830 Brickell is fully leased to several high-profile tenants, including Microsoft, Citadel, Kirkland & Ellis, Marsh Insurance, Sidley Austin, CI Financial (Corient), Thoma Bravo, Santander Bank and A-CAP. OKO Group and Cain International are receiving temporary certificates of occupancy (TCOs) in phases for tenants, many of which are already building out their interior spaces within 830 Brickell ahead of its completion. Designed by Adrian Smith + Gordon Gill with interiors by Iosa Ghini Associati, the office tower will feature a restaurant and bar/private club on the top floor, upscale health and wellness center, conference facilities, outdoor terrace, cafés and street-level retail space.

TAMPA, FLA. — BWE has arranged a $76.8 million loan for the refinancing of The Mav Channelside, a 324-unit midrise apartment community located at 601 N. 12th St. in Tampa’s Channelside District. Alan Tapie, Thomas Wiedeman, Brad Walker and Hanley Long of BWE secured the five-year, fixed-rate loan using Fannie Mae’s Near-Stabilization Execution on behalf of the borrower, a joint venture led by Birmingham, Ala.-based Daniel Corp. Built in 2022, The Mav Channelside features a mix of 108 studio, 163 one-bedroom and 53 two-bedroom apartments that were 90 percent occupied at the time of sale. Amenities include a fitness studio, indoor/outdoor coworking space with private conference rooms, a pool deck with a resort-style pool and a sky deck with views of downtown Tampa and Tampa Bay.

PHILADELPHIA — Walker & Dunlop (NYSE: WD) has arranged a $53.8 million construction loan for PhilaPort Logistics Center, a 282,250-square-foot industrial project in Philadelphia. The 15-acre site at 3060 S. 61st St. is located approximately three miles from Philadelphia International Airport and six miles from the Packer Avenue Marine Terminal. PhilaPort Logistics Center will feature a rear-load configuration, a clear height of 40 feet, 135-foot truck court depths, 50 exterior dock doors, two drive-in doors, 5,000 square feet of office space and parking for 187 cars and 72 trailers. Aaron Appel, Jonathan Schwartz, Keith Kurland, Adam Schwartz and Michael Ianno of Walker & Dunlop arranged the financing through ACORE Capital. The borrower was New York City-based DH Property Holdings. Construction is slated for a third-quarter 2025 completion.

MADISON, MIDDLETON AND FRANKLIN, WIS. — KeyBank Real Estate Capital (KBREC) has arranged $98 million in fixed-rate Freddie Mac loans for the refinancing of three multifamily properties in Wisconsin. Axiom Properties was the borrower. The Meadows in Madison is a 404-unit complex built in 1979 and renovated in 2008. The property consists of 16 residential buildings along with two pool buildings and two sheds. The $39.6 million loan features a 10-year term, 35-year amortization schedule and five years of interest-only payments. Springtree Apartments is a 272-unit, garden-style property in Middleton. Built in 1970, the community features one-, two- and three-bedroom units with 39 garage parking spaces and 338 surface parking spaces. The $29.4 million loan features a five-year term, 35-year amortization schedule and two years of interest-only payments. Mission Hills Apartments is a 271-unit, garden-style community in Franklin. Built in 1971 and renovated in 2015, the property features 10 buildings as well as a community pool and pool equipment building. The loan features a seven-year term, 35-year amortization schedule and two years of interest-only payments. Samantha Miller and Tom Reynolds of KBREC arranged the financing.

EL CAJON, CALIF. — Marcus & Millichap Capital Corp. (MMCC) has arranged a $5.6 million loan for the refinancing of a retail property located at 13578 Camino Canada in El Cajon, a suburb of San Diego. Tenants at the property include Wells Fargo, Subway, Panda Express, The UPS Store and H&R Block. Chad O’Connor of MMCC’s San Diego office secured the financing with a local credit union on behalf of a private client. Terms of the 10-year loan include a 6.5 percent fixed interest rate with 30-year amortization and a loan-to-value ratio of 65 percent.

HOUSTON — Marcus & Millichap Capital Corp. (MMCC) has arranged $5 million in acquisition financing for a 112,700-square-foot industrial building in East Houston. According to LoopNet Inc., the single-tenant facility at 14830 Talcott St. was constructed on seven acres in 1970. Adam Pike of MMCC originated the financing, which carried an 8 percent fixed interest rate and a 20-year amortization schedule, through an undisclosed local bank. The borrower was also not disclosed.

Cronheim Hotel Capital Arranges $42.3M Acquisition Loan for Cambria Hotel in Downtown DC

by John Nelson

WASHINGTON, D.C. — Cronheim Hotel Capital has arranged a $42.3 million acquisition loan for Cambria Hotel Washington, D.C. Convention Center, a 182-room hotel located at 899 O St. NW in downtown D.C. Built in 2014 by Concord Hospitality, the hotel is situated with a half-mile of the Walter E. Washington Convention Center and features a rooftop gathering area. The borrower, locally based Frontier Development & Hospitality Group, plans to overhaul the hotel and rebrand it to the Hyatt House flag. Other details of the renovation and loan underwriting were not disclosed.

NEW YORK CITY — Eastern Union has arranged a $12 million loan for the refinancing of a 35,210-square-foot industrial building in the Williamsburg area of Brooklyn. The single-story building was originally constructed in 1931 and includes warehouse and office space as well as onsite parking. David Brody of Eastern Union arranged the loan, which was structured with a five-year term, a 65 percent loan-to-value ratio and a fixed interest rate of 6.54 percent. The borrower and direct lender were not disclosed.