YONKERS, N.Y. — Affinius Capital has provided a $112.7 million loan for the refinancing of Alexander Crossing, a 440-unit apartment building located north of New York City in Yonkers. The newly built waterfront property offers 119 studios, 218 one-bedroom units, 90 two-bedroom residences and 13 three-bedroom apartments. Units are furnished with stainless steel appliances, quartz countertops and individual washers and dryers. Amenities include an outdoor heated pool, terraces with grills and outdoor games, a fitness center, resident lounge, coworking space, multi-sport simulator and a game room. Jonathan Schwartz, Aaron Appel, Sean Reimer, Keith Kurland, Adam Schwartz and Sean Bastian of Walker & Dunlop arranged the financing on behalf of the borrower, a joint venture between Rose Associates and Battery Global Advisors.

Loans

BOSTON — Colliers has arranged a $62 million loan for the refinancing of Addison, a 230-unit apartment community in East Boston that was completed in late 2021. The property offers one- and two-bedroom units and amenities such as a pool, fitness center, basketball court, outdoor grilling and dining stations, coworking lounge, industrial kitchen and a maker space equipped with 3D printers, a laser cutter for digital sewing/embroidery machines and art supplies. Jeffrey Black, Bryan Koop, Sean Burke, Kevin Phelan and Matthew Lombardi of Colliers arranged the loan through CrossHarbor Capital Partners. The borrower was a joint venture between Redgate Capital Partners, North River Co. and ELV Associates.

Walker & Dunlop Arranges $148M Refinancing for The Victoria Mixed-Use Tower in Harlem

by Katie Sloan

NEW YORK CITY — Walker & Dunlop (NYSE: WD) has arranged the $148 million refinancing for The Victoria, a mixed-use property in the Harlem neighborhood of Upper Manhattan. At 30 stories, the property is the tallest building in Harlem. The Victoria is built around the neighborhood’s historic Victoria Theater and offers 191 luxury apartments, a 211-room Marriott-branded hotel and 23,000 square feet of retail space. The project was completed in the third quarter of 2023 and also features 52 below-grade parking spaces. Aaron Appel, Keith Kurland, Jonathan Schwartz, Adam Schwartz, Ari Hirt and William Herring of Walker & Dunlop’s New York capital markets team acted as exclusive advisors to the borrowers, Lam Group and Exact Capital. Aareal Capital provided the financing, which will support ongoing operations and future enhancements to the project. “This transaction underscores the project’s significance as a transformative development in Upper Manhattan, combining luxury living, hospitality excellence and cultural preservation,” says Appel. Bethesda, Md.-based Walker & Dunlop is one of the largest commercial real estate finance and advisory firms in the United States. — Katie Sloan

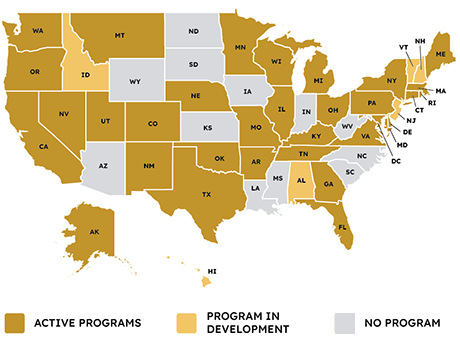

It may have taken more than a decade, but after starting out as a niche financing vehicle to create more energy-efficient and resilient buildings, the commercial property assessed clean energy (C-PACE) program has arguably achieved mainstream acceptance. Roughly 40 states and Washington, D.C., now either offer or are developing C-PACE programs. Over the last year alone, Georgia, Hawaii, New Mexico, Minnesota and Idaho passed legislation enabling or substantially improving the financing tool, points out Rafi Golberstein, CEO of PACE Loan Group, a direct lender of C-PACE headquartered in Minneapolis, Minn. What’s more, he adds, New Jersey and North Carolina are among states that in the coming months are expected to advance bills authorizing the use of C-PACE, or PACE for short. Given the current partisanship within the country, one of the most revealing characteristics of PACE’s growing appeal has been its ability to cross the political aisle, Golberstein observed. PACE’s popularity in particular has ascended over the last several months as developers have sought fresh capital to enhance their financial flexibility in a rising interest rate environment. “PACE is really turning out to be a bipartisan issue, as many state lawmakers are realizing that it is a great financing tool …

DARIEN, CONN. — JLL has arranged $165 million in construction financing for Phase II of The Corbin District, a six-acre mixed-use project located in the southern coastal Connecticut city of Darien. The project is part of a larger initiative to redevelop the downtown area. Upon completion, the development will feature 11 new buildings with 78,810 square feet of retail space, 105,968 square feet of office space and 112 apartments. The financing consists of a $102 million construction loan from Barings and $63 million in C-PACE financing from Counterpointe SRE. Michael Gigliotti, Evan Pariser and Robert Tonnessen of JLL arranged the debt on behalf of the sponsor, locally based developer Baywater Properties.

KANSAS CITY AND ST. LOUIS — Pearlmark has provided a $15.5 million mezzanine debt investment for the refinancing of a 10-property industrial portfolio in metro Kansas City and St. Louis. The warehouse and light industrial assets total 1.9 million square feet and are fully leased. Five properties are located in metro Kansas City and five are in metro St. Louis. The assets were constructed between 1994 and 2021. Pearlmark made the investment on behalf of Pearlmark Mezzanine Realty Partners V LP. An entity managed by Argentic Investment Management LLC provided the senior loan. SparrowHawk owns the portfolio. Brian Walsh of JLL arranged the financing on behalf of SparrowHawk. Mark Witt led the transaction on an internal basis for Pearlmark.

PACE Loan Group Originates $7.1M C-PACE Loan for Construction of Senior Living Facility in Minnesota

ST. FRANCIS, MINN. — PACE Loan Group has provided a $7.1 million C-PACE loan for the construction of Vista Prairie at Eagle Pointe, a 134-unit senior living community in St. Francis, a northern suburb of Minneapolis. The 20-year loan complements a $30 million qualified tax-exempt loan on the project using Series 2023A Bonds with Sunrise Bank as the senior lender. Located at 23440 Ambassador Blvd., the property will feature 49 independent living units, 43 assisted living units, 24 memory care units and eight care suites. Completion is slated for 2025. Total project costs are estimated at $47.6 million. The PACE proceeds will be used to finance energy conservation and renewable energy measures, including the building envelope, Energy Star windows, HVAC, high-efficiency plumbing and lighting systems and controls. The renewable and energy conservation measures are expected to save $368,613 annually with payback in 20 years. Vista Prairie Communities is both the property manager and services provider for the project. Additional project partners include Pope Architects and Bauer Design Build.

CORAL GABLES, FLA. — Locally based CMC Group has obtained a $69.9 million loan for the refinancing for 4000 Ponce, a mixed-use development located in Coral Gables, a western suburb of Miami. City National Bank of Florida provided the loan to CMC, whose affiliate Ugo Colombo developed the nine-story project in 2002. Paul Stasaitis, Paul Adams and Nicole Barba of JLL arranged the five-year, floating-rate loan on behalf of CMC Group. Situated at the intersection of Ponce de Leon Boulevard and Bird Road, 4000 Ponce features The Collection, a luxury car dealership whose brands include Ferrari, Aston Martin, Porsche, Maserati, Alfa Romeo, McLaren and Audi. The property also includes 150,000 square feet of office space and 32,000 square feet of retail space. 4000 Ponce was 90 percent leased at the time of sale to tenants including Steinway & Sons, Coldwell Banker, Hemisphere Media Group, Korn Ferry, Evensky & Katz, Pure Barre and Jetset Pilates.

PORTLAND, ORE. — PCCP has provided a $45 million senior loan to a joint venture between Alamo Manhattan and MetLife Investment Management for the refinancing of The Dylan, an apartment property in Portland. Located at 3883 S. Moody Ave., The Dylan offers 232 apartments and 6,154 square feet of ground-floor retail space. Built in 2022, The Dylan features 19 studios, 185 one-bedroom and 28 two-bedroom units, with an average size of 724 square feet. The units feature nine-foot ceilings, stainless steel appliances, quartz countertops with designer backsplashes, plank flooring and washers/dryers. Select units include a kitchen island, separate shower, walk-in closet and private balcony. Community amenities include communal workspaces, a fitness center, top-floor resident lounge, dog wash station, private courtyard with fireplaces and barbecues, and a rooftop terrace with views of downtown Portland, as well as one floor of subterranean parking. Charles Halladay and Charlie Watson of JLL Capital Markets Debt Advisory arranged the non-recourse loan.

JLL Arranges $11.9M in Acquisition Financing for Eastglen Apartments in Longmont, Colorado

by Amy Works

LONGMONT, COLO. — JLL Capital Markets has arranged $11.9 million in acquisition financing for Eastglen Apartments in Longmont, a suburb north of Denver. The borrower is a joint venture between Two Arrows Group and LEM Capital. Tony Nargi and Brock Yaffe of JLL Capital Markets Debt Advisory arranged the five-year, fixed-rate loan through its Freddie Mac Targeted Affordable Housing team. Jones Lang LaSalle Multifamily, a Freddie Mac Optigo lender, will service the loan. Located at 630 Lashley St., Eastglen Apartments features 102 apartments, laundry facilities, a community swimming pool, courtyard, on-site surface parking lot and access to parks and trails.