LENEXA, KAN. — Walker & Dunlop Inc. has arranged $29.6 million in federal Low-Income Housing Tax Credit (LIHTC) equity for the financing of Canyon Creek East, an affordable housing project in Lenexa. The development will include 212 units across five buildings. Jennifer Erixon led the Walker & Dunlop team that arranged the LIHTC equity, which will finance approximately 40 percent of the total development costs, on behalf of MRE Capital. Canyon Creek East is part of the larger Cedar Canyon West development plan, which encompasses a mix of residential, commercial and recreational facilities. MRE’s development will provide units for households earning between 30 and 80 percent of the area median income.

Loans

SEATTLE — Washington Federal Bank, the wholly owned subsidiary of WaFd Inc. (NASDAQ: WAFD), has consummated the sale of approximately $2.8 billion of multifamily commercial real estate loans to Bank of America, which in turn is selling the loans to funds managed by Pacific Investment Management Co. The sale of the multifamily loans was executed at no loss to WaFd and provides immediate liquidity, according to the seller. The packaged loans all came from WaFd’s acquisition of Luther Burbank Savings in March. The sale of the CRE loans was not a condition of the merger.

MERIDEN, CONN. — KeyBank has provided $51.5 million in financing for a multifamily conversion project in Meriden, located roughly midway between New Haven and Hartford. The sponsor, Trinity Financial, will redevelop the former manufacturing facility of musical instrument maker Aeolian Co. into an 82-unit mixed-income housing complex. The historic building is located at 85 Tremont St. and was originally constructed in 1887. Units will be subject to a range of income restrictions, with 11 residences to be rented at market rates. Amenities will include a fitness center, community room and a children’s play area. KeyBank provided a $24.5 million construction loan as the primary debt component of the financing package, and Trinity secured another $27 million in equity financing from a multitude of different sources. A tentative completion date was not disclosed.

TOTOWA, N.J. — Cushman & Wakefield has negotiated the sale of a 506,723-square-foot industrial park in the Northern New Jersey community of Totowa. Totowa Commerce Center consists of 12 industrial buildings, one office building and a 5.8-acre development site. Building features include clear heights of 21 to 23 feet, 92 loading positions and aggregate parking for more than 1,400 cars. Gary Gabriel, Kyle Schmidt, Ryan Larkin and Seth Zuidema of Cushman & Wakefield represented the seller, New Jersey-based Heritage Capital Group, in the transaction. The team also procured the buyer, Boston-based Longpoint Partners. The park was leased to more than 50 tenants at the time of sale. PGIM Real Estate provided a $63.5 million fixed-rate acquisition loan for the deal.

ELIZABETH, N.J. — Locally based financial intermediary G.S. Wilcox & Co. has arranged an $11 million loan for the refinancing of a 223,000-square-foot shopping center located at 750 Dowd Ave. in the Northern New Jersey community of Elizabeth. Wesley Wilcox and Albert Raymond of G.S. Wilcox arranged the loan, which carries a 10-year term and a 25-year amortization schedule, through a correspondent life insurance company. The borrower was locally based firm Elberon Development Group.

MINNEAPOLIS — Minneapolis-based Värde Partners has provided a $185 million loan for the refinancing of a multi-state self-storage portfolio. The borrower was a joint venture between Metro Storage and Fremont Realty Capital. The portfolio comprises 20 Class A properties in markets across Illinois, New Jersey, Pennsylvania, Minnesota, New York and Wisconsin. With 14,214 units in total, the assets include more than 1.5 million net rentable square feet. Kim Bishop, Eric Snyder, Tom Sherlock, Mason Brusseau and Lauren Maehler of Talonvest Capital arranged the floating-rate bridge loan with a three-year initial term and two one-year extension options.

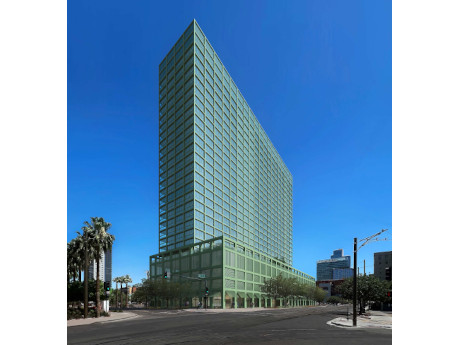

PHOENIX — JLL Capital Markets has arranged $120 million in construction financing for the development of Ray Phoenix, a 26-story residential building in downtown Phoenix. Michael Gigliotti, Brad Miner and Frank Choumas of JLL Capital Markets Debt Advisory secured the financing for the borrower, VeLa Development Partners and Ray, through an affiliate of RXR Realty Investments LLC. Located at 777 N. Central Ave., Ray Phoenix will offer 401 studio, one- and two-bedroom apartments, including duplex and penthouse units with floor-to-ceiling windows, custom cabinetry and luxury flooring and bathroom tiles. The property will feature 20,000 square feet of amenity space, including a large fitness center, yoga studio, resort-style pool, communal kitchen, fireplace lounge, sunken lounge with theater experience, dog wash stations, indoor and outdoor gardens, and workspaces. Situated within an Opportunity Zone, Ray Phoenix will be located on the Phoenix light-rail line and less than a mile north of the Footprint Center and Chase Field.

ARMONK, N.Y. — Basis Industrial has received $39.6 million in financing for 100 Business Park Drive, a mixed-use property in Armonk, located north of New York City in Westchester County. Proceeds will be used to refinance existing debt on a 60,000-square-foot warehouse building on the site and to fund construction of a 117,000-square-foot mixed-use building. The new building will house an 82,400-square-foot Extra Space Storage facility, a 26,550-square-foot Sportime pickleball complex and an additional 8,000 square foot of industrial space for Jan-Tile, the primary tenant at the existing warehouse. Basis originally purchased the site in spring 2023. Construction of the new building is slated to begin in July and to be complete in the third quarter of 2025. Ackman-Ziff Real Estate Group arranged the debt through Beach Point Capital Management.

NEW YORK CITY — S3 Capital Partners, a locally based private lender, has provided a $32 million construction loan for the ground-up development of a mixed-use project that will be located in Brooklyn’s Flatbush neighborhood. The project at 2700 Church Ave. will consist of 69 residential rental units, 9,796 square feet of retail space and 13,446 square feet of community facility space. Pinchas Vogel and Leah Paskus of Landstone Capital Group arranged the debt through S3 Capital Partners on behalf of the sponsor, Triple C Builders.

BRENTWOOD, CALIF. — Gortikov Capital has arranged $49.5 million in refinancing for Lux Villas, a Class A multifamily building in the East Bay city of Brentwood. Bryan Gortikov of Gortikov Capital led the capital markets team representing the undisclosed borrower. Developed in 2005 and fully renovated in 2023, Luxe Villas features 60 apartments, a fitness center, clubhouse, sunlit central courtyard and a rooftop lounge with expansive city views. Units offer expansive glass windows, high ceilings, top-of-the-line appliances and in-unit washers/dryers.