ELMONT, N.Y. — The Feil Organization has refinanced Home Depot Shopping Center, a 269,490-square-foot property located at 600 Hempstead Turnpike in the Long Island community of Elmont. Feil has owned the property since 1992. At the time of the loan closing, the center was fully leased, with Marshalls and Target serving as the other anchor tenants. Estreich & Co. arranged the $23.5 million loan for the refinancing through Principal Asset Management on behalf of Feil.

Loans

Ariel Property Advisors Arranges $5.5M Refinancing for Guadalupe Plaza Retail Center in Albuquerque

by Amy Works

ALBUQUERQUE, N.M. — Ariel Property Advisors has arranged a $5.5 million cash-out refinancing for Guadalupe Plaza, a shopping center in Albuquerque. The grocery-anchored plaza features 87,000 square feet of retail space. Matt Swerdlow, Matthew Dzbanek and Rhea Vivek of Ariel Property’s Capital Services Group secured the financing for the borrower, a New Jersey-based investor. The 15-year loan includes one year of interest-only payments and a 30-year amortization schedule at a 75 percent loan-to-value ratio with no prepayment penalty.

OSAGE BEACH, MO. — Driftwood Capital has received a $60.5 million loan for the refinancing of the Margaritaville Lake Resort, Lake of the Ozarks. The 520-room resort is located in Osage Beach, a central Missouri city situated along the Lake of the Ozarks. Located at 494 Tan Tar A Drive, the property includes a full-service marina, championship golf course, indoor water park, spa and seven restaurants and bars. Driftwood acquired the asset in 2017 and rebranded it from the Tan-Tar-A Resort into a Margaritaville hotel. Michael Weinberg and Scott Wadler of Driftwood worked with Alec Fox of Berkadia to secure the loan through Goldman Sachs Bank USA and Starwood Mortgage Capital. The five-year loan features interest-only payments for the full term.

Gantry Arranges $128M in Construction Financing for Legado at the Met Apartments in Santa Ana, California

by Jeff Shaw

SANTA ANA, CALIF. — Gantry Inc. has negotiated $128 million in construction-to-permanent financing from three separate lenders for the development of Legado at the Met in Santa Ana, less than 10 miles southeast of Anaheim. The borrower was Legado Cos. Legado at the Met will comprise 258 market-rate apartments. The Class A development will be situated at 200 E. First American Way, across from First American Title’s headquarters. While a construction timeline for the project was not officially disclosed, Apartments.com states that the property will open in 2025. According to the City of Santa Ana’s government website, the community will rise six stories. Units will come in studio, one-, two- and three-bedroom layouts ranging from 612 to 1,783 square feet in size. The property will also include a 617-space parking garage. George Mitsanas and Amit Tyagi of Gantry’s Los Angeles production office arranged the financing on behalf of the borrower. Gantry’s production team underwrote the complex financing in three tranches with three of the firm’s correspondent life company lenders. Gantry will service all three loans. — Channing Hamilton

Greystone Provides $18.6M Agency Loan for Keystone Apartments in Fayetteville, North Carolina

by John Nelson

FAYETTEVILLE, N.C. — Greystone has provided an $18.6 million Freddie Mac loan for the refinancing of Keystone Apartments, a 202-unit multifamily property in Fayetteville, about 64 miles south of Raleigh. Justin Hechler of Greystone originated the nonrecourse, fixed-rate loan on behalf of the borrowers, Magma Equities and Prudent Growth Partners. The financing was underwritten with a five-year term, two years of interest-only payments and a 30-year amortization schedule. Built in 1974, Keystone Apartments features one- and two-bedroom units, as well as a clubhouse, fitness center, swimming pool and a dog park.

DALLAS — BWE, the commercial lender formerly known as Bellwether Enterprise Real Estate Capital, has provided $16.8 million in Freddie Mac permanent financing for Estates at Ferguson, a 164-unit affordable seniors housing project in Dallas. The property will offer 99 one-bedroom units and 65 two-bedroom units, with the majority of residences (148) reserved for renters earning 60 percent or less of the area median income. John Killough and John Roberts of BWE originated the loan, which carries a 15-year term and a fixed interest rate. The City of Dallas HFC also issued tax-exempt bonds as part of the project’s capital stack, and The Texas Department of Housing & Community Affairs provided Low-Income Housing Tax Credit (LIHTC) equity. Construction is underway and expected to last about 15 months. The sponsor was not disclosed.

DUNELLEN, N.J. — Locally based developer Prism Capital Partners has received $53.9 million in financing for The Nell, a 252-unit multifamily property in the Central New Jersey community of Dunellen. Designed by Spiezle Architectural Group, the transit-oriented, newly built property offers one- and two-bedroom units and includes 3,700 square feet of retail space. The amenity package comprises a pool, fitness center, resident lounge, community kitchen, meeting rooms, an outdoor bar with TVs and grilling and dining areas. Rodney Sherman and Greg Halvorson of KeyBank Real Estate Capital arranged the seven-year loan, which provides fixed-rate takeout financing, through New York Life Real Estate Investors on behalf of Prism Capital Partners.

KANSAS CITY, KAN. — VICI Properties Inc. has entered into a construction loan agreement with affiliates of Homefield Kansas City to provide up to $105 million in financing for the development of a Margaritaville Resort in Kansas City. The construction loan has an initial term of three years with three 12-month extension options. The Margaritaville Resort, set to open in summer 2025, will serve as the anchor to the Homefield Development, an ongoing project in Kansas City that will house Homefield’s new youth sports training facility and baseball center that are currently under development within the Homefield Resort campus. Both the training facility and baseball center are slated to open this spring. Homefield is an operator of youth sports facilities. Simultaneous with entering the loan agreement, VICI entered into a call right agreement that provides VICI with a call option on the Margaritaville Resort, the Homefield youth sports training facility, the Homefield baseball center and the existing Homefield youth sports complex in Olathe. VICI also received a right of first refusal to acquire the real estate of any future Homefield property in a sale-leaseback transaction, should Homefield elect to monetize such assets. If the call right is exercised, all of …

AcquisitionsContent PartnerFeaturesLoansMidwestMultifamilyNAINortheastOfficeRetailSoutheastTexasWestern

Previous Year’s Challenges Shape 2024 Outlook for Cap Rates, Investment Activity, Distressed Properties

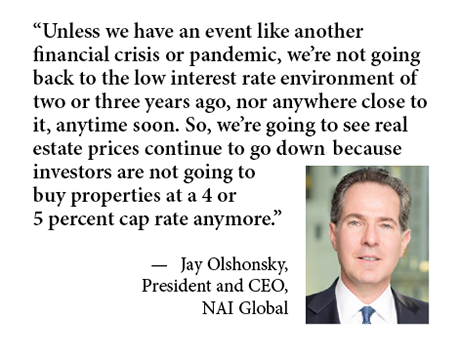

If NAI Global president and CEO Jay Olshonsky had to use one word to sum up the 2023 commercial real estate market, it would be “inactive.” The interest rate-fueled bid-ask spread stifled investment sales of all property types, and in the office sector especially, tenants avoided making any space decisions if they didn’t have to. One month into 2024, not much has changed. From an investment sales perspective, Olshonsky still sees properties offered at capitalization rates between 4 and 5 percent while interest rates are 6 percent or higher, which is prolonging the disconnect between buyers and sellers. Meanwhile, robust job creation well beyond today’s levels is needed to create the leasing demand that will reverse the office sector’s troubles in the new era of hybrid work. But that’s not likely to happen in 2024 as the tech sector, in particular, continues to lay off workers. “I’ve been in the real estate business a long time, and this is a cycle unlike most others,” says Olshonsky. “The biggest problem we have right now is mainly record-high office vacancy just about everywhere — certainly in the large cities — which we’ve never really seen before. On the investment side, lenders cannot …

SAN DIEGO — JLL has secured a $149 million loan for the refinancing of a three-property multifamily portfolio in the Southeastern United States. Aldon Cole, Tim Wright and Bharat Madan of JLL’s San Diego office arranged the three-year, fixed-rate loan through a life insurance company on behalf of the borrower, Sunroad Enterprises. The properties in the portfolio include the 313-unit Verde Vista in Asheville, N.C.; the 288-unit Avenues at Verdier Point in Charleston, S.C.; and the 256-unit Adara at Godley Station in Savannah, Ga. San Diego-based Sunroad Enterprises acquired the three properties in 2021 and has since completed 100 percent of its planned exterior and common area renovations and 50 percent of interior renovations.