NEW YORK CITY — Derby Copeland Capital, a locally based lending and investment firm, has provided two acquisition loans totaling $20.8 million for a pair of Manhattan apartment buildings with a combined 51 units. In the first transaction, Derby Capital provided $17 million for a 31-unit building in the East Village that includes ground-floor retail space that is leased to Lucy’s Bar and Top Beauty Salon. In the second deal, the firm funded a $3.8 million loan for a 20-unit building in Rose Hill neighborhood. The undisclosed borrower(s) plans to use portions of the proceeds to fund capital improvements.

Loans

DALLAS — Marcus & Millichap Capital Corp. (MMCC) has arranged a $23 million acquisition loan for Maravilla, a 310-unit apartment community in northwest Dallas. According to Apartments.com, the property was built in 1967 and offers studio, one-, two- and three-bedroom units that range in size from 450 to 1,350 square feet. Amenities include multiple pools, a clubhouse, pet park, playground, soccer field and outdoor grilling and dining stations. Ralph Rader of MMCC arranged the 10-year, fixed-rate loan on behalf of the buyer, a partnership led by Granite Towers Equity Group. Maravilla was 99 percent occupied at the time of sale.

WEST NEW YORK, N.J. — JLL has arranged a $150 million construction loan for RB3, a 426-unit multifamily project that will be located across the Hudson River from Manhattan in West New York, N.J. The 11-story waterfront property, which will be located within the 200-acre Port Imperial master-planned development, will offer studio, one- and two-bedroom units. Residences will be furnished with stainless steel appliances, quartz countertops, individual washers and dryers and private balconies/patios. Amenities will include a pool, fitness center, clubhouse, private offices and coworking spaces, a virtual reality room, golf simulator, children’s playroom, sky lounge, grilling stations and a pickleball court. Jon Mikula, Jim Cadranell, Steven Klein and Ryan Carroll of JLL arranged the five-year, fixed-rate loan through Northwestern Mutual on behalf of the locally based borrower, Canoe Brook Development.

SEATTLE — JLL Capital Markets has arranged $11.8 million in refinancing for J.G. Whittier, a mid-rise apartment community in Seattle’s Ballard neighborhood. Seth Heikkila and Steve Petrie of JLL secured the five-year, fixed-rate loan for the borrower, FFV Crown Hill LLC, through National Life Group. Completed in 2023, J.G. Whittier features 54 studio, one- and two-bedroom apartments with stainless steel appliances and full-size washers/dryers. Community amenities include a rooftop pet play area with washing station; a rooftop deck with green space; walking paths and multiple seating areas; a fireplace lobby and lounge; media room; electric vehicle charging stations; sundeck; and business center. Additionally, the asset features 2,819 square feet of ground-floor retail space. J.G. Whittier is located at 7759 15th Ave. NW.

PLEASANTON, CALIF. — Gantry has arranged an $8.6 million permanent loan to refinance Oak Hills Shopping Center, located at 5410-5480 Sunol Blvd. in the Bay Area city of Pleasanton. Raley’s grocery, BMO Bank, Mountain Mike’s Pizza, Jim’s Country Restaurant, Gymboree and Brick Fitness are tenants at the 120,000-square-foot retail center. Mitch Zeemont, Tony Kaufmann and Alex Poulos of Gantry arranged the financing for the borrower, a private real estate entity. One of Gantry’s correspondent life company lenders provided the 12-year, fixed-rate loan with a 20-year amortization.

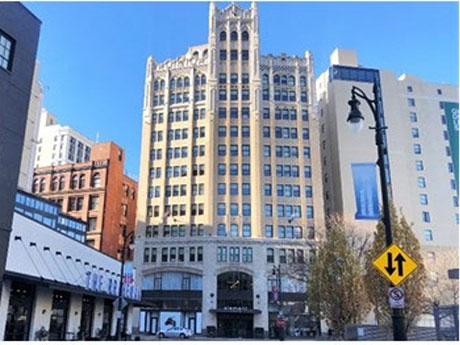

DETROIT — Bernard Financial Group (BFG) has arranged a $24.3 million CMBS loan for the refinancing of the Element Hotel at the Metropolitan in downtown Detroit. Located at 33 John R St., the hotel features 110 rooms. Dennis Bernard, Joshua Bernard and Dan Duggan of BFG arranged the loan on behalf of the borrower, Metropolitan Building SPE LLC.

Calmwater Capital Funds $32.2M Construction Loan for Multifamily Project in San Gabriel, California

by Amy Works

SAN GABRIEL, CALIF. — Calmwater Capital has provided Alhambra-based GE Development with a $32.2 million construction loan for the completion of The One, a multifamily community in San Gabriel, a suburb of Los Angeles. The transaction also included an additional $3.7 million in subordinate financing from a Los Angeles-based alternative lender in order to reduce the borrower’s equity commitment. The financing will be used to take out the original construction loan with a portion of the proceeds to be used to fund hard and soft costs needed to bring the project to 100 percent completion. The property was 86 percent completed at loan closing. Located at 101 E. Valley Blvd., The One will feature 81 market-rate studio, one- and two-bedroom apartments in a multi-level, four-story building. Additionally, the property will offer 13,000 square feet of street-level retail space, a three-level subterranean parking garage, interior retail plaza and pedestrian promenade, resident sundeck and a rooftop garden. Completion is slated for second-quarter 2024. Zalmi Klyne and Karl Weidell of Northmarq’s Los Angeles office arranged the financing. Larry Grantham, Zach Novatt and DaJuan Bennett of Calmwater originated the loan.

BELLFLOWER, CALIF. — The Colliers Structured Finance Group (SFG) has arranged a $27.8 million Fannie Mae loan for the refinancing of Edgeway, a 91-unit multifamily property in Bellflower, a suburb south of Los Angeles. The loan features a 5.5 percent interest rate for five years. Jonathan Lee, Bill Hyatt, and Shahin Yazdi of SFG arranged the loan for the borrower, Serrano Development Group. Colliers SFG closed the Fannie Mae loan prior to property stabilization. Built in 2023, the Edgeway luxury apartment community offers one-, two- and three-bedroom units with open floor plans. Unit features include quartz countertops, stainless steel appliances, in-unit washer and dryer, private balconies, modern technology features and ample storage. Community amenities include a resort style pool, spa and cabana lounge; business center and co-working lounge; dog run and pet wash; fitness center with spin studio; and multiple outdoor lounges with BBQs. Located near the intersection of highways 91 and 605, Edgeway is centrally located with ready access to Los Angeles, Long Beach and Orange County.

DURANGO, COLO. — Bayview PACE has provided $6 million in C-PACE financing for key improvements for the 124-unit Mesa Verde senior living community in Durango, a small city in the southwest corner of the state. The C-PACE financing helped fund primary building systems including HVAC, electrical, plumbing and roofing. The 105,000 square-foot Mesa Verde will offer 92 assisted/transitional living units spread across studio, one-bedroom and one-bedroom configurations, as well as 32 memory care studio units. Mesa Verde is directly adjacent to Centura Mercy Hospital, the only major hospital in the area. Mesa Verde is a project of Mission Senior Living, a developer, operator and owner of senior living communities across Arizona, New Mexico, Nevada and Montana. The Durango market is underserved with currently only one existing assisted living facility and no memory care units within city limits, according to Mission Senior Living.

SUMMERVILLE, S.C. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged a $23 million construction loan for the development of a 39-acre industrial park in the Charleston suburb of Summerville. Todd McNeill and Sunny Sajnani of IPA’s Dallas office arranged the three-year construction loan through Southern States Bank on behalf of the borrower, Atlanta-based Capital Development Partners. The loan was underwritten at a 65 percent loan-to-cost ratio. Boasso Global, a provider of cleaning, maintenance, storage and transportation services for the tank trailer and container industry, will occupy the park, which is located near I-26 and I-526 and a short drive to Port of Charleston’s North Charleston Terminal. The construction timeline was not disclosed.