BOSTON — Madison Realty Capital has provided a $177.5 million loan to Scape, a London-based multifamily developer that opened its U.S. headquarters in Boston in 2018. The loan will refinance the $165 million construction loan for SCAPE Boylston, a 415-unit apartment development that opened earlier this month in Boston’s Fenway neighborhood. The 226,700-square-foot property offers a mix of furnished studios, one- and two-bedroom apartments with Class A retail space on the ground floor. The apartments are already 95 percent occupied, and the retail space is 80 percent leased. Retail tenants include a global bank; Immersive Gamebox; Carbon Health; Dave’s Hot Chicken; Halal Guys; and a 10,000-square-foot, 156-seat, LGBTQ-focused black box theater. Tenant amenities include a landscaped terrace, fitness center, yoga room, co-working space, lounge library and study. The site is located near prominent academic and medical institutions including Boston University and Northeastern University, as well as Fenway’s rapidly growing biotech and life sciences industries. The lights of Fenway Park, home of Major League Baseball’s Boston Red Sox, are visible from the community, which is a block away from a Red Line MBTA train station. “Fenway is a premier academic and employment hub within Boston with substantial demand for efficiently designed, …

Loans

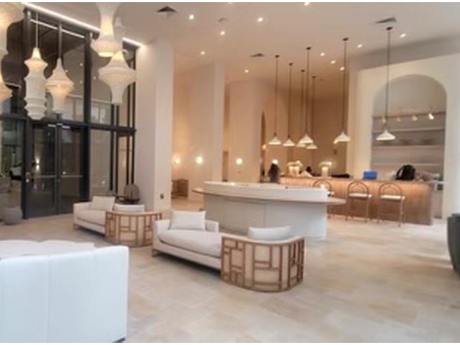

MIAMI — JLL has arranged a $115 million loan for the refinancing of Metro Edgewater, a new 32-story apartment tower in Miami’s Edgewater neighborhood. Jesse Wright, Elliott Throne, Kenny Cutler, Joshua Odessky and J.J. Hovenden of JLL arranged the financing through MF1 Capital on behalf of the borrower, a consortium between Lujeni Corp., Camino Capital Management and Building Block Realty. MF1’s team working on the deal included Michael Squires, Phil Pesant and Connor Pensabene. The 279-unit property comprises one-, two- and three-bedroom units averaging 955 square feet in size. Amenities include a hotel-style pool with cabanas and day beds, fitness center, live-work club room, sky lounge, private dining room and a coffee bar.

LOGAN TOWNSHIP, N.J. — JLL has arranged a $23 million acquisition loan for a 209,437-square-foot industrial property in the Southern New Jersey community of Logan Township. The warehouse and distribution center was built in 2018 on a site that spans 88 acres, 17 of which can support future development. Building features include clear heights of 36 to 40 feet, 12 dock-high loading doors, two drive-in doors, 10,500 square feet of office space and parking for 336 cars and 22 trailers. Michael Klein, Max Custer and Michael Lachs of JLL arranged the fixed-rate loan through an undisclosed life insurance company on behalf of the borrower, foodstuffs provider Chelten House Products.

WEST PALM BEACH, FLA. AND LAGRANGE, GA. — BWE has secured two loans totaling $16 million for a pair of shopping centers in Florida and Georgia. The deals include a $6 million loan for the refinancing of Palm Beach Commons, a 70,000-square-foot, Family Dollar-anchored retail center in West Palm Beach, and a $10 million acquisition loan for Publix at Merganser Commons, a newly built, Publix-anchored shopping center spanning 46,791 square feet in LaGrange. Both loans are underwritten with full-term, interest-only payments. The borrowers and direct lenders for both loans were not disclosed.

CHARLOTTE, N.C. — Berkadia has arranged a $10 million CMBS loan for the refinancing of WoodSpring Suites Charlotte – University Research Park, a 122-room, extended-stay hotel located at 7007 MacFarlane Blvd. in Charlotte. Michael Weinberg and Alec Fox of Berkadia’s Hotels & Hospitality team arranged the five-year, fixed-rate loan through KeyBank on behalf of the borrower, Orlando-based Liberty Investment Properties. The sponsor has developed more than 35 WoodSpring Suites-branded hotels since 2007. Built in 2021, WoodSpring Suites Charlotte – University Research Park is situated adjacent to a Topgolf off I-85 and is within three miles of the University of North Carolina at Charlotte campus.

NEW YORK CITY — Wells Fargo has provided $293 million in Fannie Mae financing for Lyra, a 590-unit apartment building in Manhattan’s Hudson Yards neighborhood. The property was completed in 2022 and features Class A amenities, a full-time doorman and ground-floor retail space. Additionally, 30 percent of the units are designated as affordable housing. The five-year loan retires a $225 million construction loan that Wells Fargo provided in 2019. Matthew Wiener and Preyaa Strzalkowski of Wells Fargo originated the financing on behalf of the borrower, an affiliate of Rockrose Development.

NEW YORK CITY — A partnership between two locally based firms, EJS Group and New Hope Capital, has received $108.1 million in construction financing for a 240-unit multifamily project in Brooklyn’s Bedford-Stuyvesant neighborhood. The development at 12 Halsey St. will consist of three buildings, with 30 percent of the units to be reserved as affordable housing. Amenities will include a pool, fitness center, tenant lounge and rooftop garden, as well as ground-floor retail space. Completion is slated for fall 2025. The financing package consists of an $83.1 million senior mortgage loan from Bank OZK and $25 million in mezzanine financing from CanAm Enterprises. Aaron Appel of Walker & Dunlop arranged the debt on behalf of the developers.

Pinnacle Obtains $41.2M Construction Financing for Affordable Seniors Housing Development in South Florida

by John Nelson

MIRAMAR, FLA. — Pinnacle has obtained $41.2 million in construction financing for Pinnacle at La Cabana, a 110-unit affordable seniors housing development in Miramar, a city in South Florida’s Broward County. The financing included debt or LIHTC equity from Bank of America, Neighborhood Lending Partners, Florida Housing Finance Corp., City of Miramar and United Way of Broward County. Located at 8911 Miramar Parkway, the development is a public-private partnership between Pinnacle and the City of Miramar, which is the landowner. Pinnacle at La Cabana will feature one- and two-bedroom apartments, with 11 units reserved for seniors earning 28 percent of the area median income (AMI) and the remaining affordable to seniors earning 60 percent of AMI. Amenities will include indoor and outdoor multi-purpose facilities. Completion of the project is estimated for mid-2025.

WEST WINDSOR, N.J. — JLL has arranged an undisclosed amount of permanent financing for Woodmont Way at West Windsor, a 443-unit apartment community located about 12 miles northeast of Trenton. Completed in 2022, the garden-style property features 13 buildings that house one-, two- and three-bedroom units. Amenities include a clubhouse, pool with a sundeck, resident lounge, golf simulator, fitness center, game den, dog park, pet spa and outdoor courtyards with pickleball courts. Thomas Didio, Thomas Didio Jr., Salvatore Buzzerio and Benjamin Morgenthal of JLL arranged the five-year, fixed-rate loan through Northwestern Mutual. The borrower was New Jersey-based Woodmont Properties.

CBRE Arranges $13.5M Construction Loan for Last-Mile Industrial Facility in Billings, Montana

by Amy Works

BILLINGS, MONT. — CBRE has secured a $13.5 million participating construction loan for the development of a last-mile industrial facility in Billings. Situated on 9.77 acres, the 39,600-square-foot building will feature 32-foot clear heights. Upon completion, a single tenant will occupy the facility on a long-term basis. Bob Ybarra, Bruce Francis, Shaun Moothart, Doug Birrell, Nick Santangelo and Jim Korineck of CBRE Capital Markets Debt and Structured Finance negotiated the loan at a fixed interest rate on behalf of the undisclosed client.