KEY WEST, FLA. — KeyBank Real Estate Capital has secured a $77.5 million Fannie Mae non-recourse loan for the refinancing of Ocean Walk, an apartment community located in Key West. Built in 1991 and renovated in 2016, the property comprises 297 units across two buildings situated on 17 acres. Amenities at the community include a clubhouse, swimming pool, tennis courts and a basketball court. Caleb Marten and Chris Neil of KeyBank arranged the financing on behalf of the borrower, Passco Cos., which acquired the community in 2017 for $101.5 million. The 10-year loan features a seven-year interest-only period and will amortize on a 30-year schedule.

Loans

DENVER — KeyBank Real Estate Capital has arranged a $16.7 million Fannie Mae fixed-rate loan to refinance existing debt secured by Edge DTC, an apartment community in Denver. Brian Caudel and Allison Loftsgordon of KeyBank Real Estate Capital structured the five-year loan featuring full-term interest-only payments through Fannie Mae for the borrower, Grand Peaks Properties. Built in 1986, Edge DTC features 204 apartments spread across eight two-story residential buildings. Community amenities include a swimming pool, fitness center, business center, dog park and picnic area.

ARCADIA, RENSSELAER AND FOWLER, IND. — BWE has arranged $19.7 million in financing for the acquisition and rehabilitation of three affordable housing properties in rural Indiana. Lundat Kassa and Bob Morton of BWE arranged the financing on behalf of Vita Investment Holdings LLC, an Indiana-based developer of affordable and seniors housing communities. Vita acquired the properties to preserve their long-term affordability for residents. The financing consisted of two loans, including a construction loan from Fifth Third Bank. BWE also secured a $17.1 million loan through the USDA 538 Forward Permanent Loan program. The nonrecourse loan features a 40-year amortization schedule. Vita also utilized 4 percent Low-Income Housing Tax Credits to finance the project. The three properties include: Hamilton Place, which totals 54 units in Arcadia; Madison Cottage of Rensselaer, which includes 71 units in Rensselaer; and Madison Cottage of Benton County, a 51-unit building in Fowler. The developments will be preserved as affordable to residents who earn up to 60 percent of the area median income. All three properties will receive improvements to mechanical systems and the unit interiors will be enhanced. Community amenities will also be upgraded.

BROOKLYN CENTER, MINN. — Colliers Mortgage has provided a $3.2 million HUD 223(f) loan for the refinancing of Ewing Square Townhomes in the Minneapolis suburb of Brooklyn Center. The 23-unit affordable housing community features three- and four-bedroom units, all of which are covered by a Section 8 HAP contract. Amenities include a playground and a clubhouse with a business center. Frank Hogan of Colliers Mortgage originated the 35-year loan, which features a 35-year amortization schedule. The borrower was Ewing Square Acquisition Partners LP, an affiliate of Vitus Group LLC.

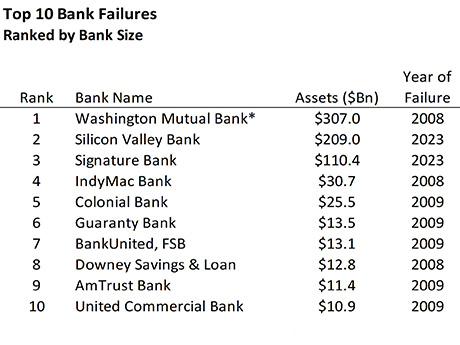

Blackstone Acquires 20 Percent Stake in $16.8B FDIC-Run Signature Bridge Bank Portfolio

by Jeff Shaw

WASHINGTON, D.C. — The Federal Deposit Insurance Corp. (FDIC), as receiver of Signature Bridge Bank, has sold 20 percent of its equity stake in the defunct bank. The agency received the loan portfolio after the failure of Signature Bank in March. Hancock JV Bidco L.L.C. (Hancock), an entity indirectly controlled by Blackstone Inc. and other investors, paid $1.2 billion for a 20 percent equity interest. The portfolio consists of approximately $16.8 billion in commercial real estate loans collateralized by office, retail and market-rate multifamily assets. FDIC will retain an 80 percent equity interest in the venture. Hancock will be responsible for the management, servicing and liquidation of the venture’s assets. The entity will also be required to manage the portfolio in accordance with the terms of the transaction, subject to monitoring and oversight by FDIC. The New York State Department of Financial Services (DFS) took possession of Signature Bank on March 12. The bank failed after depositors withdrew substantial amounts of money in the wake of the collapse of Silicon Valley Bank on March 10. DFS named FDIC as receiver, and FDIC in turn transferred all deposits of Signature Bank to a new entity called Signature Bridge Bank. The bridge bank …

SAN ANTONIO — Artemis Real Estate Partners has purchased Franklin Park Alamo Heights, a 221-unit seniors housing community in San Antonio. Artemis is taking over as equity partner for Chicago-based Harrison Street while retaining Franklin Park as part owner in the joint venture. Franklin Park Alamo Heights features 117 independent living units, 64 assisted living units and 40 memory care units. Richard Swartz, Jay Wagner, Jim Dooley and Jack Griffin of JLL arranged the recapitalization of the property. Allison Holland, also with JLL, arranged a Freddie Mac loan for the new ownership entity. Neither the price nor the amount of the financing were disclosed.

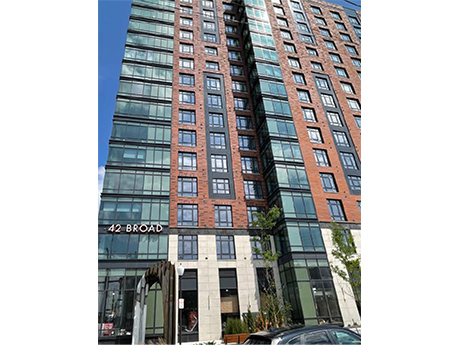

MOUNT VERNON, N.Y. — Canadian institutional investment firm Otera Capital has provided a $93 million loan for the refinancing of a 249-unit multifamily property in Mount Vernon, about 20 miles north of Manhattan. The 16-story building at 42 W. Broad St. houses studio, one-, two- and three-bedroom units. Amenities include a pool, fitness center, game room, entertainment kitchen, outdoor dining areas, coworking spaces, library and a courtyard garden. Kellogg Gaines and Geoff Goldstein of JLL arranged the financing. The borrower is a joint venture between two New York City-based firms, Alexander Development Group and The Bluestone Organization, and institutional investors advised by JP Morgan Asset Management.

ITHACA, N.Y. — Largo Capital, a financial intermediary based in the Buffalo area, has arranged a $40.5 million loan for the refinancing of a 64,500-square-foot medical office building in downtown Ithaca. The newly developed building is located on the Cayuga Park healthcare campus and houses a walk-in clinic, specialized care for complex illnesses, diagnostic imaging facility, outpatient clinic and a comprehensive women’s health center. Ned Perlman of Largo Capital arranged the debt. The borrower and direct lender were not disclosed.

The spike in interest rates and the consequent disruption throughout real estate capital markets over the last 18 months is generating newfound interest in commercial property assessed clean energy (C-PACE) financing. The program, which emerged more than a decade ago, pays for building upgrades to improve energy and water efficiency as well as seismic resilience in new construction and rehabs. In cases where cost overruns, stabilization delays and declining values threaten the ability to refinance construction loans, developers are tapping C-PACE retroactively for a much-needed slug of so-called “rescue capital,” says Rafi Golberstein, CEO of the PACE Loan Group, a direct lender of C-PACE based in Minneapolis, Minn. Typically, developers are using the proceeds to pay down debt and fund reserves to secure loan extensions or modifications. “We are seeing a ton of opportunities right now in deals that were built over the past three years, and C-PACE can provide a liquidity infusion to get many folks through a maturity logjam,” he declares. “When confronted with other options, they’re going to prefer C-PACE all day long.” Cost-Effective Debt Indeed, the cost of those other options, such as mezzanine financing or preferred equity, can be upwards of 500 basis points higher …

FORT WORTH, TEXAS — Marcus & Millichap Capital Corp. (MMCC) has arranged an $8.6 million acquisition loan for Renaissance Square, a shopping center in Fort Worth that totals 105,065 square feet, according to LoopNet Inc. The center was built in 2013 and was fully leased at the time of the loan closing to tenants such as Marshall’s, Ross Dress for Less and Dollar Tree. The borrower and direct lender were not disclosed. The loan carried an interest rate of 6.75 percent and a 30-year amortization schedule. Marcus & Millichap also represented the undisclosed seller in the disposition of the property.