NEW YORK CITY — Merchants Capital has provided $225 million in Freddie Mac financing for seven affordable housing properties in The Bronx. The properties comprise 18 buildings and 983 units that carry a range of income restrictions. The borrower is a joint venture between The Arker Cos., SBV RE Investments LLC and Dabar Development Partners. Proceeds will be used to refinance existing debt, rehabilitate units with building-wide improvement plans and preserve affordability. The scope of work includes kitchen upgrades, plumbing improvements and common area maintenance. Completion is slated for September 2025.

Loans

TEANECK, N.J. — Eastern Union has secured a $74.2 million construction loan for a 256-unit, six-story multifamily project that is currently under development at 329 Alfred Ave. in the Northern New Jersey community of Teaneck. The loan carries a 36-month term, 75-percent loan-to-cost ratio and a fixed interest rate of 7.8 percent with interest-only payments for the full term. Gabriel Sasson of Eastern Union originated the financing, a portion of which will be used to retire existing debt. The borrower and direct lender were not disclosed.

LOVES PARK, ILL. — American Street Capital (ASC) has arranged a $4.2 million CMBS loan for the refinancing of an apartment complex in Loves Park, about five miles north of Rockford. Built in 1969, the complex consists of 60 units across eight buildings. Units come in one-, two- and three-bedroom layouts. Igor Zhizhin of ASC arranged the 10-year loan, which features a fixed interest rate and two years of interest-only payments. The borrower was a seasoned owner-operator in the market.

LAS VEGAS, NEV. — NewPoint Real Estate Capital has provided $17.5 million in Fannie Mae DUS conventional multifamily financing for the purchase of Intrigue Apartments in Las Vegas. The borrower was a private family trust. David Bleiweiss of NewPoint originated the loan, which features a seven-year term with four years of interest-only payments followed by 30-year amortization schedule. The loan was made through Fannie Mae’s Sponsored-Dedicated Workforce Program, which is designed to support conventional multifamily properties. Borrowers receive lower interest rates and streamlined underwriting by agreeing to keep a minimum of 20 percent of units affordable at 80 percent of area median income (AMI) or 100 to 120 percent of AMI in specific cost-burdened markets. Formerly known as Andiamo Apartments, the community features 193 apartments, a pool, fitness center, dog park, playground and barbecue areas. Built in 1986, the garden-style property is located in the Twin Lakes neighborhood roughly seven miles north of the Las Vegas Strip.

EL SEGUNDO, CALIF. — PSRS has arranged $11.7 million in refinancing for an industrial building on Allied Way in the Los Angeles suburb of El Segundo. The freestanding, single-tenant building features 35,890 square feet of industrial space on 1.7 acres of land. The property includes 11,000 square feet of office space on the first and second floors, equating to one third of the overall net rentable area. Michael Thorp and Ari Zeen of PSRS secured the loan, which features a 10-year term and 25-year amortization with a “significant amount” of cash-out proceeds for the undisclosed borrower. A life insurance company provided the financing.

BWE Secures Financing for 362,710 SF Adaptive Reuse Industrial Facility in Fort Pierce, Florida

by John Nelson

FORT PIERCE, FLA. — BWE has secured an undisclosed amount of permanent financing for a converted industrial facility in Fort Pierce, a city midway between Orlando and Miami. Situated near I-95 and the Florida Turnpike, the 362,710-square-foot flex property was formerly Orange Blossom Mall. Now known as Renaissance Business Park, the property features loading docks, drive-in loading, private restrooms, HVAC, 18-foot clear ceilings, a fiber optic cable feed and a suite of interior and exterior security cameras and fire safety measures. The borrower and owner, Fort Lauderdale-based Prime Rock Real Estate Capital, recently made exterior improvements to the property, including a new roof, façade, irrigation system, sewer line, signage, overhead doors for tenant spaces, driveways for tenant entrances, outdoor lighting, overhauled landscaping and modern flood protection. Kevin Hicks and Michael Powell of BWE originated the loan through an unnamed life insurance company on behalf of Prime Rock.

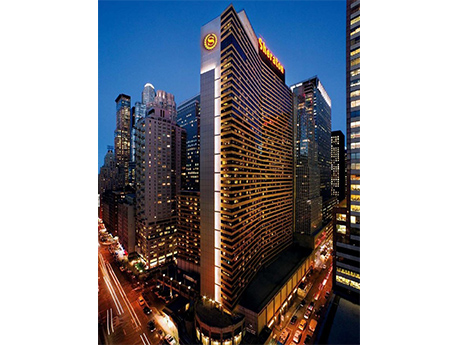

NEW YORK CITY — JLL has arranged a $260 million loan for the refinancing of the 1,780-room Sheraton New York Times Square hotel, which is located at 811 Seventh Ave. in Midtown Manhattan. The 50-story hotel features a fitness center, business center, 61,800 square feet of meeting and event space and multiple onsite food and beverage options. Kevin Davis, Mark Fisher and Russell Freed of JLL arranged the four-year, floating-rate loan through funds managed by affiliates of Fortress Investment Group. The borrower, a partnership between hospitality owner-operator MCR Hotels and global investment firm Island Capital Group, acquired the hotel in April 2022.

LITTLE CANADA, MINN. — Colliers Mortgage has provided a $26.7 million Fannie Mae loan for the refinancing of Montreal Courts Apartments in Little Canada, a northern suburb of St. Paul. The 444-unit multifamily property features a pool, fitness center, community room, playground and laundry facilities. Tony Carlson and Ben Fazendin of Colliers Mortgage originated the 10-year loan on behalf of the undisclosed borrower.

Following the financial markets crash 15 years ago, banks and other lenders began working with commercial real estate (CRE) borrowers who had run into trouble. Solutions included loan extensions, loan sales, recapitalizations and foreclosures. Today lenders are pulling out the playbook again. “We have seen a huge number of loan workout deals come across our desk,” says Jeff Salladin, a managing director with Dallas-based private debt fund Revere Capital. “Any lender that holds loans on their books is seeing the same thing.” Back in 2008, dodgy and highly leveraged residential and CRE loans — along with the emergence of exceedingly risky debt derivatives created by Wall Street — eventually crashed, causing the credit market to collapse. Today credit is still available, but the cost of it has spiked over the last 18 months. Consequently, many commercial properties owners have seen values plummet, making it difficult to find refinancing. The Federal Deposit Insurance Corp.’s (FDIC) imminent auction of Signature Bank’s $33 billion in commercial property loans and other assets is expected to attract bids as much as 40 percent below face value, according to The Wall Street Journal. That’s just the latest gloomy bellwether regarding CRE values and underscores the predicament …

Axiom Arranges $2.1M Acquisition Financing for Industrial Property on Florida’s Space Coast

by John Nelson

MELBOURNE, FLA. — Axiom Capital has arranged a $2.1 million loan for the acquisition of an industrial property located 1.5 miles from I-95 in Melbourne, a city on Florida’s Space Coast. Constructed on a 4.2-acre site in 1998, the 30,000-square-foot property features 18- to 20-foot ceiling heights, two dock doors, three drive-in doors and 101 car parking spaces. The borrower was not disclosed.