SAN MARCOS, TEXAS — BWE has arranged undisclosed amounts of construction debt and preferred equity for Riley’s Pointe, a 360-unit multifamily project in the Central Texas city of San Marcos. Specific information about floor plans and amenities was not disclosed, but the residences will have an average size of 914 square feet. Adam Bieber and Alec Jenkins of BWE arranged the debt through an undisclosed regional bank and the equity contribution from an unnamed partner. The sponsor is South Carolina-based Woodfield Development. The first units are expected to be available for occupancy by the third quarter of next year.

Loans

PACE Loan Group Funds $11.2M Construction Loan for Reset Hotel in Twentynine Palms, California

by Amy Works

TWENTYNINE PALMS, CALIF. — PACE Loan Group has provided a $11.2 million C-PACE loan for the construction of Reset Hotel. The site is near the north entrance of Joshua Tree National Park in Twentynine Palms, a desert city approximately 150 miles east of Los Angeles. Qualifying C-PACE improvements include plumbing, HVAC, electrical, lighting, building envelope and seismic measures. The 30-year loan is combined with a $7.5 million first mortgage. Located at 7000 Split Rock Ave., the independent hotel will use modular construction to reduce construction time by nearly half with delivery slated for early 2025. Offering views of Joshua Tree National Park, the hotel will offer 65 guest rooms with private outdoor patios, an outdoor swimming pool overlooking the park, gift shop, poolside cocktail bar serving small bites, conference room and 65 surface parking spots. Built on 5.8 acres of 11.1 acres of land acquired in 2021, the asset is the only hotel in the area that is removed from the highway and completed adjacent to the national park. The developers own 170 acres of the surrounding land up to the park boundary and are currently leaving the area undeveloped to maintain views and privacy for guests. Sightline Hospitality will manage …

Marcus & Millichap Arranges $2.7M Refinancing for North of Market Mixed-Use Building in San Diego

by Amy Works

SAN DIEGO — Marcus & Millichap Capital Corp. (MMCC) has arranged a $2.7 million refinancing for North of Market, a mixed-use retail and multifamily property in San Diego. Located at 701-721 8th Ave., the property comprises a restaurant, salon, clothing store and 10 apartments. Chad O’Connor of MMCC’s San Diego office secured the three-year, fixed-rate, interest-only loan for the undisclosed borrower.

CARTERET, N.J. — Greystone has provided a $21.6 million Fannie Mae loan for the refinancing of Roosevelt Village Apartments, a 101-unit affordable housing complex in the Central New Jersey community of Carteret. Built in 1969, the complex consists of 10 buildings on a 5.2-acre site that house one-, two- and three-bedroom units. Specific income restrictions were not disclosed. The nonrecourse, fixed-rate loan was structured with a 10-year term, 35-year amortization schedule and seven years of interest-only payments. Ryan Harkins of Greystone originated the financing on behalf of the borrower, Tryko Partners.

CBRE Secures Construction Financing for Whole Foods-Anchored Development in Rogers, Arkansas

by John Nelson

ROGERS, ARK. — CBRE has secured an undisclosed amount of construction financing for the development of Pinnacle Springs, a planned mixed-use development located at 1800 S. Osage Springs Drive in Rogers. The project will comprise 362 apartments and 91,000 square feet of retail space, including a 37,000-square-foot Whole Foods Market grocery store. The borrower is SJC Ventures, a mixed-use development firm based in Atlanta. Richard Henry, Mike Ryan, Brian Linnihan and J.P. Cordeiro of CBRE Capital Markets’ Debt & Structured Finance team in Atlanta arranged the financing. Arvest Bank provided uncrossed construction loans for the project, while Dome Equities provided both common and preferred equity investments in the multifamily component. SJC Ventures plans to break ground on Pinnacle Springs by the end of the year, with an expected delivery date of 2025.

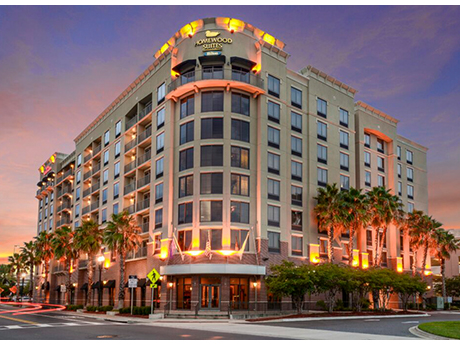

JACKSONVILLE, FLA. — Berkadia has arranged the $26 million refinancing of the leasehold interest in a 221-room dual-branded hotel in Jacksonville’s Southbank neighborhood. Built in 2009 along the St. Johns River, Hilton Garden Inn-Homewood Suites Jacksonville Downtown Southbank is an eight-story hotel located at 1201 Kings Ave. Amenities include an outdoor pool, fitness center, onsite restaurant, room service and meeting rooms. Michael Weinberg, Alec Fox and Lindsey deButts of Berkadia’s Hotels & Hospitality team secured the five-year loan through an undisclosed regional bank on behalf of the borrower, Excel Group.

Barings Real Estate Receives $115M Loan for The Ventana Luxury Apartments in West Los Angeles

by Amy Works

LOS ANGELES — Barings Real Estate has received $115 million in financing for The Ventana Luxury Apartments, a low-rise multifamily community within the master-planned community of Playa Vista in Los Angeles. The Ventana Luxury Apartments features 405 studio, one-, two- and three-bedroom units, with an average size of 1,049 square feet. The apartments offer in-unit washers/dryers, granite countertops and ceiling heights ranging from nine to 14 feet. Community amenities include two clubhouses, two swimming pools, a spa, business center and fitness center. Originally built in 2007 in two phases, the property is located at 7225 and 6565 Crescent Park. Chris Drew, Annie Rose, Brandon Smith and Gyasi Edmondson of JLL Capital Markets Debt Advisory secured the cash-neutral, five-year loan, which features full-term interest-only payments. The use of the funds was not disclosed.

MINNEAPOLIS — Mag Mile Capital has arranged $5.2 million of senior debt financing from a Minnesota-based bank and an additional $500,000 of Commercial Property Assessed Clean Energy (C-PACE) financing on behalf of CDT Realty Corp. The Minneapolis-based developer plans to complete an adaptive reuse project of two existing brick-and-timber loft buildings totaling 50,000 square feet in Northeast Minneapolis. The properties were originally constructed in 1910. The buildings will be connected with a new elevator lobby and fully renovated to create loft office space, retail shops and a variety of tenant amenities. The development will be named Burlap Lofts. Planned amenities include a clubroom with tenant lounge and full kitchen, large-screen TVs, private call booths, meeting spaces, a rooftop garden terrace, outdoor seating and an onsite Harmony Coffee location. The building is slated to open in spring 2024. The 81 percent loan-to-cost debt ratio combines floating-rate construction-period financing with fixed-rate permanent debt and 20-year, fixed-rate C-PACE financing. Cody Harper of Mag Mile Capital arranged the financing.

Greystone Provides $15.1M in Financing for University Village Apartment Property in Hayward, California

by Amy Works

HAYWARD, CALIF. — Greystone has provided a $15.1 million Fannie Mae Delegated Underwriting & Servicing (DUS) loan to refinance a multifamily community in the Bay Area city of Hayward. Tim Thompson of Greystone originated the financing for the borrower, WSB University Village LLC. Constructed in 1964, University Village features 68 one- and two-bedroom apartments, on-site parking, laundry facilities and a fitness center. The nonrecourse, fixed-rate loan features a 10-year term with five years of interest-only payments. In addition to refinancing, the loan proceeds will enable the borrower to continue with ongoing property maintenance.

SMITHTOWN, N.Y. — JLL has arranged $29 million in financing for Whisper Woods of Smithtown, a seniors housing property located on Long Island. Built in 2018, the property houses 136 beds across 101 units and offers assisted living and memory care services. The borrower is a partnership between Sculptor Real Estate and Benchmark Senior Living, and the direct lender was an undisclosed regional bank. Joel Mendes, Ted Flagg and Stephen Van Leer led the transaction for JLL.