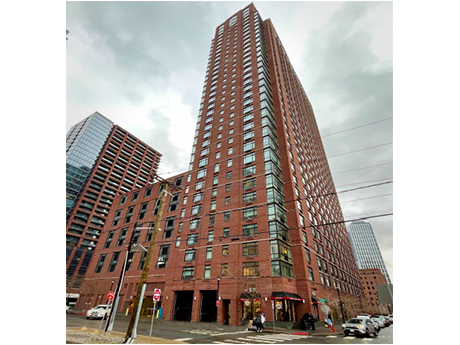

JERSEY CITY, N.J. — NewPoint Real Estate Capital has provided a $153.6 million Freddie Mac loan for the refinancing of The One, a 35-story apartment tower located in Jersey City’s waterfront district. Built in 2015, The One features 451 units in studio, one-, two- and three-bedroom formats, with 10 percent of the units reserved as affordable housing. Residences are furnished with stainless steel appliances, quartz countertops and individual washers and dryers. Amenities include a pool, fitness center, children’s playroom, theater room, golf simulator, game room and a dog park. Carol Shelby and Eric Schleif of Meridian Capital Group placed the loan, which carried a seven-year term and a 35-year amortization schedule, with NewPoint on behalf of the borrower and developer, BLDG Management. The One was 98 percent occupied at the time of the loan closing.

Loans

DENVER — Essex Financial Group has secured $32 million in financing for the purchase of 2nd & Josephine, a 105,253-square-foot mixed-use property in Denver. Comprising four buildings, the development was fully leased at the time of sale. Bank of America anchors the property, which features retail and office space, as well as 260 parking spaces. Paul Donahue, Cooper Williams, Nate Schneider and Andrea Mehlem of Essex arranged the seven-year, fixed-rate loan through an undisclosed life insurance company on behalf of the buyer.

Cushman & Wakefield Arranges $8.6M Acquisition Loan for Former PGA of America Office Building in South Florida

by John Nelson

PALM BEACH, FLA. — Cushman & Wakefield has arranged an $8.6 million acquisition loan for the purchase of an office building located at 100 Ave. of Champions in Palm Beach. Totaling two stories and 42,090 square feet, the property served as PGA of America’s headquarters since its construction more than 50 years ago prior to the organization’s relocation to Frisco, Texas. Jason Hochman and Ron Granite of Cushman & Wakefield secured the financing through a local bank on behalf of the borrower, Blue Water Advisors LP, which plans to convert the property to a multi-tenant building.

SOUTHLAKE, TEXAS— Lument has provided a $15.7 million bridge loan for the refinancing of a 91-bed seniors housing property in Southlake, a northern suburb of Fort Worth. The facility offers assisted living and memory care services. Doug Harper, Chris Mauger and Casey Moore of Lument originated the financing, which carried a 36-month term and a one-year extension option, on behalf of the borrower, California-based owner-operator Silverado.

NEW YORK CITY — Northmarq has arranged a $26 million loan for the refinancing of an 11-story, 90-unit apartment complex in East Harlem. Chuck Cotsalas and Robert Delitsky of Northmarq arranged the financing though Nationwide Life Insurance Co. on behalf of the undisclosed borrower. The loan carried a 20-year term, 25-year amortization schedule and a fixed interest rate of 5.4 percent.

HOFFMAN ESTATES, ILL. — Red Oak Capital Holdings has provided an $8.3 million bridge loan for Prairie Stone Commons in the Chicago suburb of Hoffman Estates. The Class B office property consists of two buildings totaling 101,981 square feet. The funds will be used to refurbish, re-tenant and increase occupancy and rental rates at the property. Built in 1996 and 2000, the buildings are situated within Prairie Stone Business Park. The borrower, YP Trillium LLC, is managed by Zaya Younan, president and CEO of investment and brokerage firm Younan Properties Inc. The loan features a loan-to-value ratio of 92.2 percent based on the property’s current valuation as well as a 24-month term with two six-month renewal options. The borrower originally acquired the property in March 2005 for $16.3 million.

Walker & Dunlop Arranges Construction Financing for $146M College Point Logistics Center in Queens

by Jeff Shaw

NEW YORK CITY — Walker & Dunlop’s capital markets team has arranged $94 million in construction financing for the development of College Point Logistics Center in the College Point neighborhood of Queens, just across Flushing Bay from LaGuardia International Airport. A joint venture between Wildflower Ltd. and Drake Real Estate Partners is developing the project, with construction costs estimated at $146 million. College Point Logistics Center will be a ground-up warehouse and structured parking facility. The property will feature 81,000 square feet of rentable industrial space, as well as 160,000 square feet of enclosed parking across two floors and 68,000 square feet of surface-level parking. Wildflower designed the project with ground-floor warehouse space and multi-story parking to maximize the project’s efficiency and meet the needs of modern industrial and logistics tenants. College Point Logistics Center is located alongside the Whitestone Expressway, making it accessible to LaGuardia and John F. Kennedy International Airports, the New York and Atlantic Railways and the Red Hook Container Terminal. Development of the facility is scheduled for completion in the second quarter of 2024. Jonathan Schwartz, Aaron Appel, Mo Beler, Ari Hirt and Triston Stegall led the Walker & Dunlop team in securing the floating-rate loan on behalf of …

HOUSTON — Ziegler has arranged $76 million in bond financing for Brazos Presbyterian Homes (BPH), a nonprofit seniors housing owner-operator based in Houston. The tax-exempt, draw-down bonds are supported by a three-bank syndicate comprised of Amegy Bank, Hancock Whitney and Trustmark. BPH owns and operates three continuing care retirement communities in Texas: Brazos Towers at Bayou Manor, The Hallmark and Longhorn Village. The bonds will fund an expansion project at Longhorn Village, refinance bonds from 2013 and pay the costs of issuance. The expansion project will add 48 independent living apartments to the community, as well as underground parking. Greenbrier Development is assisting with the development.

HOUSTON — Lument has provided a $21.1 million bridge loan for the refinancing of Hermann Park, an 80-bed seniors housing property in Houston. The facility offers assisted living and memory care services. Doug Harper, Chris Mauger and Casey Moore of Lument originated the financing, which carried a 36-month term and a one-year extension option, on behalf of the borrower, California-based owner-operator Silverado.

AUSTIN, TEXAS — Lument has provided an $18.6 million bridge loan for the acquisition of Barton Springs, a 56-bed seniors housing property in Austin. The facility offers assisted living and memory care services. Doug Harper, Chris Mauger and Casey Moore of Lument originated the financing, which carried a 36-month term and a one-year extension option, on behalf of the borrower, California-based owner-operator Silverado.