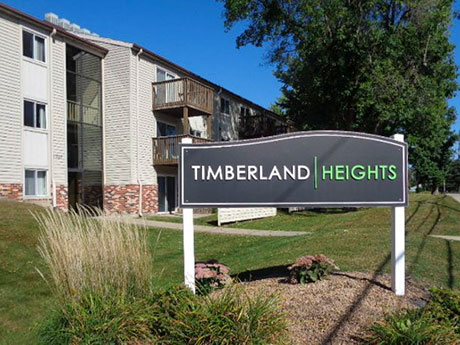

ROCHESTER, MINN. — Northmarq has provided a $12.5 million Freddie Mac loan for the acquisition of Timberland Heights in Rochester. The 147-unit multifamily property, built in 1975, is located at 1515 41st St. NW. Amenities include a fitness center, pool, clubhouse, playground and laundry facilities. Mike Padilla of Northmarq originated the 10-year loan, which features four years of interest-only payments and a 30-year amortization schedule. The borrower was not provided.

Loans

PARSIPPANY, N.J. — New York Life has provided a $146.6 million construction loan for The District at 15fifteen, a 498-unit multifamily project that will be located in the Northern New Jersey community of Parsippany. The three-building development will include 58,866 square feet of retail space and 1,062 parking spaces. The amenity package will comprise a pool, rooftop lounge, fitness center, conference center and sport simulator rooms. John Alascio, Chuck Kohaut, T.J. Sullivan and Meredith Donovan of Cushman & Wakefield arranged the floating-rate loan on behalf of the borrower, a joint venture between Claremont Development, Stanbery Development Group and PCCP.

OCOEE, FLA. — JLL has arranged a $45.1 million construction loan for Commerce 429, an eight-building industrial park located on a 40-acre site at 1290 Ocoee Apopka Road in the Orlando suburb of Ocoee. The borrower, locally based industrial developer McCraney Property Co., plans to develop Commerce 429 in two phases, the first of which will comprise six rear-load buildings with sizes ranging from 27,000 to 131,000 square feet. Phase II will feature two rear-load buildings spanning approximately 76,000 square feet and 95,000 square feet. Melissa Rose, Michael DiCosimo and Mateo Bolivar of JLL arranged the four-year loan through an undisclosed lender on behalf of McCraney.

OMAHA, NEB. — Northmarq has arranged a $5.3 million loan for the refinancing of Clocktower Village in Omaha. The retail strip center spans 44,000 square feet and is located at 605 N. 98th St. John Reed of Northmarq arranged the fixed-rate loan, which features a 10-year term and a 25-year amortization schedule. A local credit union provided the loan.

SAN ANTONIO — CBRE has arranged an undisclosed amount of acquisition financing for Network Crossing, a 143,831-square-foot office complex in northwest San Antonio. Network Crossing consists of five buildings that were 85 percent leased at the time of the loan closing. Brock Hudson and Beau Brehm of CBRE arranged the five-year, fixed-rate loan on behalf of the borrower, Houston-based investment firm Fuller Interests. The direct lender was not disclosed.

KeyBank Provides $100M Bridge Financing for Affordable Housing Community in Metro Baltimore

by John Nelson

GLEN BURNIE, MD. — KeyBank Community Development Lending and Investment (CDLI) has provided a $100 million bridge loan for Villages at Marley Station, a 757-unit mixed-income apartment community located in Glen Burnie, a suburb of Baltimore. The borrower, San Diego-based Fairfield, plans to renovate the property and convert 100 percent of the units to be affordable to households earning 60 percent of the area median income (AMI). Matt Haas and Greg Deeks of KeyBank structured the bridge financing, which will be re-syndicated later this year with 4 percent LIHTC equity, bonds and equity bridge loan funding for renovations that will take place over the next three years. Built in 1963 and renovated in 1997 and 2009, Villages at Marley Station consists of 26 elevator-serviced, low-rise buildings housing 35 studios, 428 one-bedroom, 281 two-bedroom and 12 three-bedroom apartments. Fairfield’s renovations to the interiors will include upgrades to HVAC, appliances, flooring, countertops, cabinets, bathtubs, plumbing and vanities. Common area improvements will be made to the property’s central laundry, clubhouse, pool equipment and furniture, fitness center, sport courts and playgrounds.

TAMPA, FLA. — Berkadia has arranged $92 million in debt and preferred equity financing for the construction of Tampa Heights Apartments, a new 321-unit, mixed-income multifamily project in the Tampa Heights neighborhood. U.S. Bank provided the senior debt, and Marble Capital provided the preferred equity. The borrowers, Tampa-based Loci Capital and Pennsylvania-based Maifly Development, plan to begin construction in February and complete the project in late 2024. Michael Weinberg, Rebecca Van Reken and Alec Fox of Berkadia arranged the financing. Humphreys & Partners Architects is serving as the architect for the project. As part of its negotiations with the City of Tampa, Tampa Heights Apartments will include 32 income-qualifying units for residents earning no more than 80 percent of the area’s median income (AMI). Located on a 2.5-acre site at the northeast corner of North Florida and East 7th avenues, Tampa Heights Apartments will feature one-, two- and three-bedroom units that range from 512 square feet to 1,393 square feet in size. Community amenities will include multiple outdoor lounging and park areas, a resort-style rooftop pool with cabanas, firepits and grilling stations, fitness center, coffee bar, meeting rooms, bike storage, dog park and secure package storage.

NORMAL, ILL. — Draper and Kramer’s Commercial Finance Group has arranged a $14.9 million refinance and construction loan for The Park at Constitution Trail Centre, a three-phase student housing development in Normal. The financing retired the existing debt on the first two phases of the project and provided funding on the remaining phase of construction. The off-campus community serves students at Illinois State University. The initial two phases, which were delivered between 2019 and 2022, include 204 fully leased beds. Phase III will offer an additional 76 beds upon completion, which is slated for August 2023. When complete, the development will contain a total of 280 beds across 13 buildings. The project is connected to The Constitution Trail, a paved 40-mile trail. Matthew Wurtzebach of Draper and Kramer arranged the loan on behalf of the borrower, 100 McKnight LLC.

FORT DODGE, IOWA — Colliers Mortgage has provided a $12.9 million HUD-insured loan for the refinancing of District 29 Apartments and Townhomes in Fort Dodge, about 90 miles north of Des Moines. The 118-unit property features studio, one- and two-bedroom apartment units as well as two- and three-bedroom townhome units. Amenities include a fitness center, community room, mail room and dog park. The loan features a 35-year term and a 35-year amortization schedule. Fritz Waldvogel of Colliers originated the loan on behalf of the borrower, District 29 Apartments LLC.

Dwight Capital Provides $45M HUD Refinancing for Villa Lucia Apartments in Fresno, California

by Amy Works

FRESNO, CALIF. — Dwight Capital has provided a $45 million HUD 223(f) loan for Villa Lucia Apartments, a multifamily community in Fresno. The financing features a 35-year term and fixed interest rate. Dwight previously provided a HUD 223(f) loan for Villa Lucia Apartments in 2016 and the subsequent cash-out refinance closed in December 2022. Ari Mandelbaum of Dwight Capital originated both transactions for the borrower, Latco Enterprises. The refinancing benefited from a Green Mortgage Insurance Premium Reduction set at 25 basis points because the property qualifies for National Green Building Standard Bronze Certification. Situated on 20 acres, the 272-unit community consists of 42 one- and two-story residential buildings, 19 garage buildings and a clubhouse. Community amenities include a courtyard, fitness center, playground, pool and spa.