KEY WEST, FLA. — Sonnenblick-Eichner Co. has arranged $82.4 million in financing for Ocean Key Resort & Spa, a 100-room waterfront hotel in Key West. The borrower, Kirkland, Wash.-based Noble House Hotels & Resorts, will use the five-year, fixed-rate loan to pay off an existing loan and fund a $10.5 million renovation of the property. An unnamed life insurance company provided the nonrecourse loan, which is interest-only for the entire term. Ocean Key’s amenities include a full-service restaurant, oceanfront pool with cabanas and a poolside bar and spa. The resort also includes Sunset Pier and the Sunset Pier Restaurant and Bar.

Loans

Parkview Financial Funds $35M Loan for CMNTY Culture Campus Development Project in Hollywood

by Amy Works

LOS ANGELES — Parkview Financial has provided a $35 million loan to CMNTY Culture for the acquisition of a land assemblage situated at the northeast corner of the intersection of Sunset Boulevard and Highland Avenue in Los Angeles’ Hollywood district. The site comprises four contiguous parcels totaling 1.88 acres at 1518-1836 N. Highland Ave. and 6751-6767 W. Sunset Blvd. One parcel at 6767 W. Sunset Blvd. was purchased in July 2021 for $9.1 million. Parkview provided the loan to facilitate the acquisition of the three remaining parcels, which were recently purchased for $44 million. Once fully rezoned and entitled, the ownership plans to construct CMNTY Culture Campus that will include two towers – one 13 stories and one 14 stories – totaling approximately 500,000 square feet of creative office and studio/production space with six subterranean parking levels. The four parcels consist of U-shaped land that currently features a strip retail center, live performance venue, plant nursery and two surface parking plots. The owner plans to demolish the buildings for the new development. HKS Architects is serving as project architect and Oakland-based Hood Design Studio is serving as landscape designer.

CIT Provides $50.8M Refinancing for Providence Family Wellness Center in Hillsboro, Oregon

by Amy Works

HILLSBORO, ORE. — CIT, a division of First Citizens Bank, has provided a $50.8 million loan to Seavest Healthcare Properties for the refinancing of Providence Family Wellness Center and Medical Office Building in Hillsboro. CIT’s healthcare finance unit provided the financing. Providence Family Wellness Center is a newly delivered, 118,000-square-foot medical office building and wellness center. Providence Health & Services – Oregon, a subsidiary of Providence St. Joseph, leases the building. The property offers clinical space for services, including primary care, pediatrics, behavioral health, sports medicine, women’s health, dermatology, cardiology, urgent care, diagnostics imaging, lab, rehabilitation and sports therapy. Additionally, the building features a comprehensive active wellness center complete with indoor warm water and outdoor lap pools.

DENTON, TEXAS — Lument has provided a $15.4 million bridge loan for the acquisition of Village on University, a 133-unit apartment complex located in the North Texas city of Denton. The 12-building property was built on 6.9 acres in 1968. John Sloot of Lument originated the financing, which was structured with interest-only payments throughout the entirety of the three-year term, as well as two 12-month extension options. The undisclosed borrower plans to use a portion of the proceeds to fund capital improvements.

NEW YORK CITY — JLL has arranged a $142 million construction loan for Majestic, a 255-unit multifamily project located within a Qualified Opportunity Zone in Brooklyn’s Gowanus neighborhood. Designed by Handel Architects, the 12-story building will include 18,000 square feet of commercial space, and 25 percent of the units will be reserved as affordable housing. Christopher Peck, Nicco Lupo, Jeff Julien, Rob Hinckley and Jonathan Faxon of JLL arranged the loan through U.S. Bank on behalf of the borrower, a partnership led by Domain Cos.

PASSAIC, N.J. — Seven Hills Realty Trust (NASDAQ: SEVN), an affiliate of The RMR Group, has provided a $47 million acquisition loan for a 330,000-square-foot industrial property located at 153 Linden St. in the Northern New Jersey community of Passaic. JLL arranged the financing on behalf of the borrower, Thor Equities, which will use a portion of the proceeds to fund capital improvements.

FREMONT, NEB. — Grandbridge Real Estate Capital has arranged a $6.9 million loan for the refinancing of a 72-unit multifamily property in Fremont, about 40 miles northwest of Omaha. Brett Olson and Jeff Witt of Grandbridge arranged the permanent, fixed-rate loan. The borrower and lender were not disclosed.

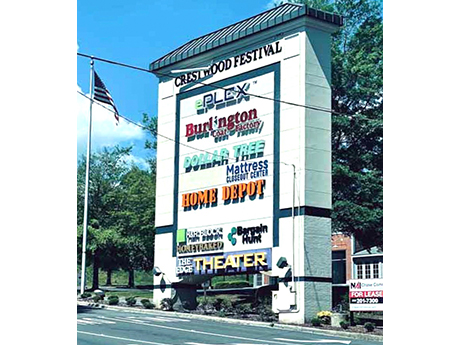

BIRMINGHAM, ALA. — Eastern Union has secured $7 million in acquisition financing for Crestwood Festival Centre in Birmingham. Marc Tropp of Eastern Union arranged the financing on behalf of the buyer, CityWide Properties, which intends to invest $1.5 million in capital improvements at the 299,707-square-foot shopping center. The five-year loan includes a fixed interest rate of 4.6 percent with one year of interest-only payments. The investor purchased the property, which is shadow-anchored by The Home Depot, for $9.4 million. Built in 1989 on 41 acres, Crestwood Festival Centre comprises 44 retail suites and nearly 1,000 parking spaces. Notable tenants include Phoenix Theatres The Edge 12 Birmingham, Burlington, Mattress Warehouse and Dollar Tree.

BURLINGTON, MASS. — Locally based mortgage banking firm Fantini & Gorga has arranged $12.5 million in financing for One Wheeler Road, a 22,000-square-foot retail property located on the northern outskirts of Boston in Burlington. The undisclosed borrower will use the proceeds to redevelop One Wheeler Road and rebrand the property as Gateway Burlington. Casimir Groblewski and Colin Monahan of Fantini & Gorga placed the debt through a direct lender that also requested anonymity. Construction is underway and expected to be complete before the end of the year.

FRIDLEY, MINN. — Northmarq has provided a $45 million Freddie Mac loan for the refinancing of Axle Apartments in the Minneapolis suburb of Fridley. The 262-unit apartment complex is located at 6530 University Ave. NE. Andy Finn and Dan Trebil of Northmarq arranged the 10-year, fixed-rate loan, which features seven years of interest-only payments followed by a 30-year amortization schedule. Roers Cos. was the borrower.