NEW YORK CITY — Newmark has arranged a $260 million loan for the refinancing of 75 Rockefeller Plaza, a 627,000-square-foot office building located within Midtown Manhattan’s Plaza District. Office users at 75 Rockefeller Plaza, which was originally constructed in 1947, include WeWork and Bank of America, and American Girl anchors the ground-floor retail space. Jordan Roeschlaub, Dustin Stolly and Nick Scribani of Newmark arranged the financing through Bank of America and Carlyle Group. The borrower, RXR Realty, originally acquired the leasehold interest in the asset in 2013 and has subsequently invested $150 million in capital improvements. RXR Realty also operates its New York City headquarters out of the building.

Loans

CHELSEA, MASS. — MassHousing has provided $10.4 million in construction financing for a project that will convert a former light industrial site in the northeastern Boston suburb of Chelsea into a 62-unit mixed-income complex. Units will come in one-, two- and three-bedroom formats and will be reserved for renters earning up to 30, 60 and 90 percent of the area median income (AMI). In addition, six units will be available for purchase by households that are first-time homebuyers earning up to 80 or 100 percent of AMI. The borrower is nonprofit organization The Neighborhood Developers. NEI General Contracting is constructing the project, and Utile Architecture & Planning is designing it. A tentative completion date was not disclosed. WinnCos. will manage the property.

CHICAGO — Logistics Property Co. (LPC) has received a $150 million loan for the construction of a multi-story warehouse at 1237 W. Division St. in Chicago. The project will span 1.2 million square feet of logistics space across two floors. Plans call for both rooftop parking and an adjacent five-story parking garage. The development will include direct loading on both the first and second floors, each with a 135-foot truck court. The first floor will feature a clear height of 36 feet, 28 dock doors and two drive-in doors. The second floor, which will be accessible by 53-foot tractor trailers via separate up and down ramps, will feature a clear height of 33 feet, 28 dock doors and two drive-in doors. The project marks the first multi-story warehouse in Chicago, according to LPC. A timeline for completion was not disclosed. Wells Fargo led the financing, along with Inland Bank and Trust and Associated Bank. Michael Svets and Jeff Goodman led the financing on behalf of Wells Fargo.

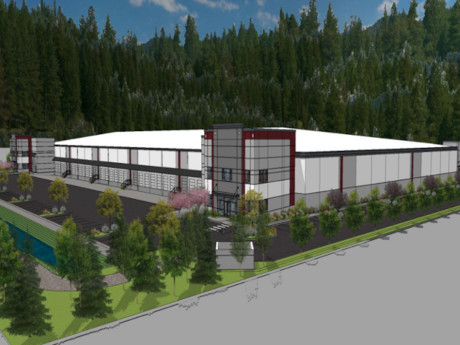

Gantry Arranges $18M Construction Loan for Spec Industrial Development in Pacific, Washington

by Amy Works

PACIFIC, WASH. — Gantry has secured a $18 million construction-to-permanent loan for the speculative development of an industrial property in Pacific. Situated on 12 acres, the property will feature 160,000 square feet of industrial space. Construction began in second-quarter 2022 and completion is slated for early 2023. Mike Wood and Alex Saunders of Gantry arranged the financing for the borrower, Davis Property Investment. A regional bank provided the seven-year loan with a fixed, sub-4.4 percent interest rate. The financing features an initial two-year interest-only payment period before moving to a 30-year amortization for the remaining term. The initial funding is for $15 million to complete construction, with an additional $3 million earn-out upon lease up and stabilization of the project.

Walton Street Capital Originates $69.8M Acquisition Loan for Metro Raleigh Apartment Community

by John Nelson

CARY, N.C. — An affiliate of Walton Street Capital LLC has originated a $69.8 million acquisition loan for Aventura Crossroads, a 344-unit apartment community located at 1010 Legacy Village Drive in Cary, a suburb of Raleigh. The borrower is a partnership between The Bainbridge Cos. and Virtus Real Estate Capital. Built in 2009, Aventura Crossroads was 98 percent occupied at the time of sale. The garden-style community features one-, two- and three-bedroom units averaging 1,154 square feet. Amenities include a recently renovated clubhouse, upgraded fitness center, pet spa and an outdoor pool. The seller and sales price were not disclosed.

Berkadia Arranges $57.5M Construction Loan for Multifamily Project in Miami’s Allapattah Neighborhood

by John Nelson

MIAMI — Berkadia has arranged a $57.5 million construction loan for Fourteen Residences Allapattah, a 237-unit apartment community located within an opportunity zone at 1470 N.W. 36th St. in downtown Miami’s Allapattah neighborhood. Charles Foschini, Chris Apone and Shannon Wilson of Berkadia’s Miami office secured the financing on behalf of the borrower, Neology Life Development Group, a residential and commercial real estate firm led by Lissette Calderon. Jeff Rosenfeld and Sean Robertson originated the 24-month loan, which features two extension options, internally for the lender, Churchill Real Estate. Upon completion in early 2024, Fourteen Allapattah Residences will consist of a 14-story building with 180 apartment units connected via a pool deck to a five-story building with 57 apartments. The property will be situated within walking distance from the Allapattah Miami Metrorail Station, Rubell Museum and SuperBlue, an immersive art museum. The community will offer studio, one- and two-bedroom units ranging from 450 to 900 square feet. Amenities will include original artwork, a multipurpose lobby, media lounges and living rooms, rooftop pool and clubhouse, poolside cabanas, coworking spaces, conference rooms, outdoor movie screen, an indoor and outdoor fitness and wellness center, dog park with dog wash area, bike storage, virtual concierge …

PRESCOTT VALLEY, ARIZ. — Bellwether Enterprise Real Estate Capital (BWE) has provided a $75 million HUD loan for the construction of Legado Apartments, a multifamily property in downtown Prescott Valley. Jim Swanson of BWE’s Phoenix office originated the loan through HUD’s 221(d)(4) mortgage insurance program on behalf of the developer, Fain Signature Group. The non-recourse, fully assumable loan features a 40-year, fully amortizing term. The HUD-insured financing provides a combined construction and permanent loan for market-rate multifamily projects. The mid-rise apartment property will feature 329 units in a mix of one-, two- and three-bedroom layouts. Units will offer Energy Star appliances, washers/dryers, patio/balcony storage and scenic views. Community-wide amenities include electric vehicle charging stations, elevators serving all apartment floors and a parking garage. Common area amenities will include a community room/clubhouse with free Wi-Fi, poolside cabanas and spa, fitness center, a picnic area with barbecue grills, and recreation area with a dog run and dog washing station. As part of the mixed-use residential and commercial development project in the Prescott Valley Entertainment District, the property will have a rooftop restaurant open to the public and a variety of other foodservice outlets, including cafés, plus retail space on first and sixth …

Trinitas Receives $67.3M Construction Financing for Student Housing Development Near UCF in Orlando

by John Nelson

ORLANDO, FLA. — Trinitas Ventures, a multifamily and mixed-use developer based in Lafayette, Ind., has received $67.3 million in construction financing for a 286-unit, 750-bed student housing development located near the University of Central Florida campus in Orlando. Citizens Financial Group’s commercial real estate finance team is acting as the sole lead arranger, book runner and administrative agent for the financing. Further details of the project were not disclosed. Citizens has also financed Trinitas student housing projects at Miami University in Ohio, Washington State University and University of Nebraska.

YONKERS, N.Y. — Los Angeles-based Parkview Financial has provided an $18.3 million construction loan for a self-storage conversion project in Yonkers, a northern suburb of New York City. The borrower, KCT Inc., plans to demolish a 9,820-square-foot industrial building at 1060 Nepperhan Ave. and to construct a facility that offers 77,000 square feet of net rentable space across 949 units. CubeSmart will operate the facility, completion of which is slated for late 2023. The general contractor for the project is JCT Development, and the architect of record is ELEVEN18 Architecture.

Dollinger Properties Receives $97M in Financing for Office Building in Sunnyvale, California

by Amy Works

SUNNYVALE, CALIF. — Gantry has arranged $97 million in permanent financing to retire construction debt for a four-story, LEED Gold-certified office building in Sunnyvale’s Perry Park office district. Located at 675 Almanor Ave., the property features 152,000 square feet of Class A office space. Tony Kaufmann of Gantry arranged the financing for the borrower, Dollinger Properties. The nonrecourse, balance-sheet loan is structured with two fundings. The permanent, interest-only loan was structured with flexible prepayment and term extension options. A life insurance company lender provided the capital and locked the borrower’s rate 90 days in advance of closing.