WASHINGTON, D.C. — Mesirow, a financial services firm based in Chicago, has provided the $275 million refinancing for the National Aeronautics and Space Administration (NASA) headquarters offices in Washington, D.C. Located at 300 E St. SW, the nine-story office building spans more than 600,000 square feet and was built in 1991, according to LoopNet Inc. The borrower is a partnership between Hana Alternative Asset Management and Ocean West Capital Partners. Proceeds from the financing provided the partnership with fixed-rate debt that is interest-only for the full term. The loan has a 2028 maturity date, which is coterminous with NASA’s lease. With the funds, the Hana and Ocean West partnership is recapitalizing its equity interest at the property, which is subject to the sixth-largest lease by the General Services Administration (GSA), the federal government’s independent agency that oversees certain operations like office and research space. (The GSA is the leaseholder for NASA.) Mesirow served as placement agent and administrative agent on the financing. Cushman & Wakefield arranged the financing on behalf of the borrower and negotiated terms between the borrower and Mesirow. Mesirow was founded in 1937 and offers credit tenant lease and structured debt products to borrowers. The company’s services …

Loans

Content PartnerFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

How to Maintain Multifamily Investment Momentum in the Face of Rising Interest Rates

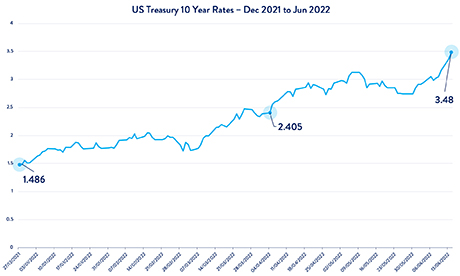

By Melissa Jahnke, associate director of operations, Walker & Dunlop The Federal Reserve raised interest rates by 75 basis points in June and then another 75 basis points in July, sending shockwaves across the commercial real estate industry. Fortunately, there are opportunities and solutions to bypass these potential roadblocks. Specifically, investors in a segment of multifamily housing known as small balance lending (SBL), encompassing five- to 150-unit properties, have several options to realize their aspirations for financing multifamily portfolios. View a higher resolution version of the timeline above here. During a recent webcast “Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans,” Walker & Dunlop’s market experts spoke about navigating today’s financing landscape. The expert panel included Allison Williams, senior vice president and chief production officer; Allison Herrera, senior director of SBL; and Tim Cotter, director of capital markets. These experienced professionals have found ways to make deals happen in a wide variety of financing environments and have shared their perspectives and guidance. If you are an owner of five- to 150-unit properties that require loans between $1 million to $15 million, the following will help you navigate today’s financial environment and build your momentum. Step 1: Consider the …

AUSTIN, TEXAS — Northmarq has arranged three bridge loans totaling $43.7 million for the acquisition of five multifamily properties in Austin. The properties include Mueller I and II, which feature a combined 110 units and are located in the Windsor Park area; Villas at Mueller, a 124-unit community; the 40-unit Spanish Trails Apartments; and the 51-unit Miller Square Apartments. Chase Johnson and Brian Fisher of Northmarq originated the financing on behalf of the borrower, Zion Capital. The direct lenders were not disclosed.

WOODLAND PARK, N.J. — City National Bank has provided a $60 million loan for the refinancing of a 205,000-square-foot industrial building located in the Northern New Jersey community of Woodland Park. The property at 1150 McBride Ave. features a clear height of 36 feet, two drive-in doors and ample trailer and employee parking. The borrower was a partnership between two New Jersey-based firms, The STRO Cos. and KRE Group.

BURLINGTON COUNTY, N.J. — JLL has arranged a $47 million construction loan for an undisclosed, 300-unit multifamily project that will be located in Southern New Jersey’s Burlington County. The community will offer one-, two- and three-bedroom units with an average size of 971 square feet. Amenities will include a pool, fitness center, business center, courtyard lounge, dog park, grilling stations and walking trails. Matthew Pizzolato, Michael Klein and Salvatore Buzzerio of JLL arranged the three-year, floating-rate loan through Wells Fargo on behalf of the undisclosed borrower. Completion is slated for the second quarter of 2024.

PLAYA DEL REY, CALIF. — PSRS has arranged a $22 million cash-out refinance of Laguna Del Rey Apartments, a multifamily property in Playa del Rey. Seth Ludwick secured the non-recourse loan that features a seven-year interest-only term, which includes a six-month forward rate lock and step-down prepay after year three. The loan was financed with one of PSRS’ life insurance correspondents. Laguna Del Rey Apartments features 130 units in a variety of floor plans, common area amenities and open parking spaces.

PHOENIX — Gantry has secured a $20 million permanent loan to refinance a flex industrial building in Central Phoenix. Tim Storey of Gantry arranged the financing on behalf of the borrower, a private investor. The 10-year, fixed-rate loan features interest-only payment terms. One of Gantry’s institutional debt fund lenders provided the loan. A single credit tenant occupies the 100,000-square-foot property, which is customized for use in human and pet pharmaceutical product manufacturing and distribution, on a long-term lease.

INDIANAPOLIS — Eastern Union has arranged $54 million in acquisition financing for a three-property multifamily portfolio totaling 628 units in Indianapolis. Built in 1980, Lake Marina features 348 units across 28 buildings. Lake Marina Realty LLC was the seller. Country Lake Townhomes is a 184-unit property that was built in 1974. Country Lake Apartments LLC was the seller. Zidan Realty Investments sold the 96-unit Fountainview, which was constructed in 1965. Michael Muller of Eastern Union arranged the 10-year, floating-rate loan with interest-only payments for the first five years. Arbor provided the Fannie Mae loan. The borrower was undisclosed.

KALAMAZOO AND OKEMOS, MICH. — Northmarq has arranged a $12.2 million loan for the refinancing of two Staybridge Suites hotels in Michigan. The Kalamazoo property, located at 2001 Seneca Lane, was built in 2006. The Okemos hotel, located at 3553 Meridian Crossing Drive, was built in 2008. Each hotel features 95 rooms and rises three stories. Jeff Dietz of Northmarq arranged the fixed-rate loan, which features a five-year term and a 25-year amortization schedule. A life insurance company provided the loan to the borrower, Hotel Development Services LLC, which will use the loan proceeds to take out maturing CMBS loans. The Staybridge Suites brand targets extended-stay and corporate travelers.

TAMPA, FLA. — JLL has provided $262 million in Freddie Mac loans for the refinancing of a portfolio of six Southeastern multifamily properties totaling 1,494 units. Tampa-based Carter Multifamily owns the properties, which are located in Maryland, Virginia and Alabama. The portfolio comprises all garden-style assets, including: the 326-unit Park at Kingsview Village in Germantown, Md. the 240-unit Stonecreek Club in Germantown, Md. the 336-unit Hunt Club in Gaithersburg, Md. the 220-unit Springwoods at Lake Ridge in Woodbridge, Va. the 180-unit Windsor Park in Woodbridge, Va. the 192-unit Oaks of St. Clair in Moody, Ala. Melissa Marcolini Quinn and Lee Weaver of JLL originated the debt through Freddie Mac. Each of the loans was features a seven-year term and a floating interest rate. JLL, which will service the loans, also secured $40 million in new equity as part of the larger recapitalization of the portfolio. The equity partner was not disclosed. “Despite turbulent debt markets, we were able to facilitate a refinance of the portfolio with favorable senior financing from Freddie Mac, which was attracted to the deal due to the portfolio’s contribution to its mission and the borrower’s strong track record,” says Quinn. — Taylor Williams