WINCHESTER, VA. — Ziegler has arranged $71 million in bond financing for Shenandoah Valley Westminster-Canterbury (SVWC), a continuing care retirement community (CCRC) in Winchester, approximately 75 miles west of Washington, D.C. SVWC was founded in 1982 and provides housing, healthcare and other services to nearly 400 residents on its 87-acre campus through the operation of 218 independent living units (164 apartments and 54 cottages), 48 assisted living units, 12 memory care units and 51 skilled nursing beds. SVWC is completing an independent living unit expansion project known as the Hackwoods, the first phase of which will include 48 new independent living unit apartments. To fund the first phase of the project, SVWC issued two tranches of drawdown bank loans that Atlantic Union Bank and Pinnacle Financial Partners purchased. The first portion of the financing was $51 million in bonds via a 12-year bank commitment, with a variable interest rate. The second portion, totaling $20 million, features a 4.5-year final maturity to be repaid from initial entrance fees to the new independent living units.

Loans

DETROIT — BEB Lending has provided a $6.9 million bridge loan for the acquisition of a 365,000-square-foot industrial property in Detroit’s Brightmoor neighborhood. Built in 1931, the property at 12640 Burt Road was renovated in 2012 and is located within 20 miles of both the Detroit City Airport and the Detroit Metropolitan Airport. The Class B, multi-tenant building is 89 percent leased. The loan features a two-year term and marks BEB’s first financing transaction in Michigan. The borrower was 1029 SFG Equities LLC.

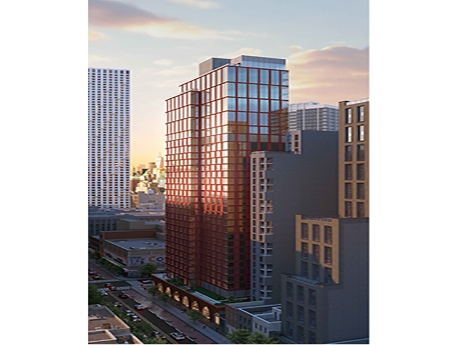

NEW YORK CITY — Cushman & Wakefield has arranged a $134 million construction loan for 15 Hanover Place, a mixed-income residential project that will be located in downtown Brooklyn. The 34-story building will house 314 units, 95 of which will be reserved as affordable housing, as well as 9,000 square feet of commercial space. Gideon Gil, Zachary Kraft and Sebastian Sanchez of Cushman & Wakefield arranged the loan through Santander Bank and City National Bank on behalf of the borrower, locally based developer Lonicera Partners. A tentative completion date has not yet been established.

SAN ANTONIO — Walker & Dunlop has arranged $85.7 million in debt and equity financing for the recapitalization of Bulverde Oaks, a 440-unit apartment community located on the north side of San Antonio. The breakdown of debt versus equity within the capital stack was not disclosed. According to Apartments.com, the property offers one- and two-bedroom units ranging in size from 629 to 1,283 square feet. Residences are furnished with stainless steel appliances, individual washers and dryers and private balconies/terraces. Amenities include a pool, fitness center, clubhouse and event space. Sean Reimer, Sean Bastian and Triston Stegall of Walker & Dunlop placed the loan through Bank OZK on behalf of the borrower, U.S. Living, and secured the preferred equity investment from Mount Auburn Multifamily.

LINDEN AND LOGAN TOWNSHIP, N.J. — Wells Fargo has provided $227 million in construction financing for two New Jersey industrial projects. In the first deal, the San Francisco-based bank provided a $142 million loan for Phase III of Linden Logistics Center, a development in the northern part of the Garden State. Phase III will consist of two buildings totaling 849,235 square feet that are scheduled for a second-quarter 2023 completion. In the second transaction, Wells Fargo provided $85 million for the third phase of Logan North Industrial Park, a project that spans 3.2 million square feet and is located in Southern New Jersey. The two buildings comprising Phase III of Logan North Industrial Park will measure 274,200 and 475,000 square feet and are also slated for delivery in the second quarter of next year. Existing tenants at Logan North include SEKO Logistics and LaserShip Logistics. John Alascio, T.J. Sullivan and Chuck Kohaut of Cushman & Wakefield arranged the financing on behalf of the borrower and developer, a partnership between Advance Realty Investors and Greek Development.

EAGAN AND EDEN PRAIRIE, MINN. — Northmarq has arranged a $15.1 million loan for the acquisition of the South by Southwest Technology Portfolio in suburban Minneapolis. The five-building industrial portfolio is located in the Golden Triangle district of both Eden Prairie and Eagan. Four of the buildings are located in Eden Prairie and were constructed in 1985. The asset in Eagan was built in 1989. Bill Mork of Northmarq arranged the loan on behalf of the buyer, Edina-based Capital Partners. A local bank provided the loan, which features a fixed interest rate of 3.9 percent.

STAMFORD, CONN. — Cushman & Wakefield has arranged a loan of an undisclosed amount for the refinancing of The Residence at Summer Street, a 104-unit seniors housing property in Stamford. The five-story, newly built facility offers assisted living and memory care services. Richard Swartz, Jay Wagner, Jim Dooley and Joseph Carbone of Cushman & Wakefield arranged the financing through VIUM Capital and its affiliate Merchants Bank of Indiana. The borrower was a partnership between Virtus and LCB Senior Living.

Newmark Arranges $64.5M Construction Loan for Advantis Station Apartments in Fort Lauderdale

by John Nelson

FORT LAUDERDALE, FLA. — Newmark has arranged a $64.5 million loan for the development of Advantis Station, a 252-unit midrise apartment community situated within Fort Lauderdale’s Flagler Village. The borrower is a joint venture between Midtown Capital Partners and Prospect Real Estate Group. Dustin Stolly, Jordan Roeschlaub, Daniel Matz, Nick Scribani, Daniel Fromm, Dan Morin and Tim Polglase of Newmark arranged the loan through Forum Real Estate Group and Bank OZK. Advantis Station will be situated on a 1.3-acre site at the intersection of NE 3rd Ave. and NE 6th Street, which is near a Brightline station and Peter Feldman Park. The property will feature studio, one-, two-, three- and four-bedroom units, as well as over 300 parking spaces and ground-floor retail space. The construction timeline was not disclosed.

Hall Structured Finance Provides $43.1M Construction Loan for New Holiday Inn Express Hotel in Nashville

by John Nelson

NASHVILLE, TENN. — Hall Structured Finance (HSF) has provided a $43.1 million construction loan for a new eight-story hotel project in Midtown Nashville. The new Holiday Inn Express will feature 184 guest rooms, as well as an outdoor infinity-edge swimming pool, fitness center, meeting room, convenience market, breakfast area and a business center. Francisco Nacorda of Mag Mile Capital arranged the loan through HSF on behalf of the borrower, Nashville-based SiLa Developments. Triumph Hospitality will manage the Holiday Inn Express when it opens in March 2024.

NEW YORK CITY — New York City-based development and investment firm Innovo Property Group (IPG) has received a $435 million loan for the refinancing of a 900,000-square-foot industrial project in the Long Island City area of Queens. IPG acquired the site, which previously housed the warehouse of online grocer FreshDirect, in January 2019 with Atalaya Capital Management and Nan Fung Group for $75 million. Since then, the development has demolished the existing structures on the site and is targeting a 2024 completion for the new facility, which will feature elevated truck courts and a vertical parking structure. Starwood Property Trust and J.P Morgan provided the loan, and the former originally provided the $155 million in construction financing in early 2021. Eastdil Secured arranged the financing.