KANNAPOLIS, N.C. — BWE has arranged $37.8 million in acquisition financing for Graces Reserve, a 240-unit, garden-style apartment community located in Kannapolis, a suburb of Charlotte. Maxx Carney, Dan Rosenberg, Logan Petersmeyer and James Rogers of BWE originated the five-year loan through a life insurance company on behalf of Guardian Capital, a Chicago-based residential real estate owner and operator, and its partner, New York Life Real Estate Investors. In addition to acquiring the property, Guardian plans to execute a value-add strategy that will optimize the property’s performance. Built in 2021, Graces Reserve offers one-, two- and three-bedroom floorplans ranging in size from 785 to 1,060 square feet, according to Apartments.com. Amenities at the complex include a saltwater swimming pool, electric vehicle charging stations, parcel lockers, a package management system, fitness center and a pet park.

Loans

VALLEY COTTAGE, N.Y. — Walker & Dunlop has arranged a $45 million bridge loan for the refinancing of Lincoln Logistics Center, a roughly 220,000-square-foot industrial property in Valley Cottage, about 30 miles north of New York City. The facility sits on a nearly 20-acre site and features a clear height of 36 feet, 34 loading dock doors, two drive-in doors and 123 car parking spaces foot clear heights. Aaron Appel, Jonathan Schwartz, Keith Kurland, Adam Schwartz, Ari Hirt and Stanley Cayre of Walker & Dunlop arranged the loan on behalf of the owner, a joint venture between PCCP LLC and Lincoln Equities Group. Rialto Capital Management provided the financing.

FISHERS, IND. — Merchants Capital has secured more than $56 million in financing for the acquisition and substantial rehabilitation of Cumberland Crossing, a 232-unit affordable housing property in Fishers developed by Birge & Held. The re-syndication of tax credits will extend Cumberland Crossing’s affordability period for an additional 30 years, with rent restrictions for half of the units at 50 percent of the area median income (AMI) and the other half of the units at 60 percent AMI. Birge & Held acquired the property via transfer of physical assets and assumed the existing $14.4 million HUD 223(f) loan, which was originated in 2019. Merchants Capital simultaneously closed a $17.2 million HUD 241(a) supplemental permanent mortgage for the property that will be drawn as renovations progress. Additionally, Merchants Capital provided $19.9 million in federal low-income housing tax credits and $4.4 million in solar tax credits, with equity bridge loan financing provided by a third-party bank. Cumberland Crossing features one-, two- and three-bedroom garden-style apartment units. The tenant in-place rehab includes the installation of solar power for electricity as well as common area and exterior updates, including new siding and windows, garage and carport repairs, updated landscaping, sidewalk improvements and parking lot …

Priority Capital Advisory Arranges $28M Construction Loan for Apartment Property in West Los Angeles

by Amy Works

LOS ANGELES — Priority Capital Advisory has arranged a $28 million loan on behalf of CityPads, a private equity fund manager and multifamily developer with operations based in Chicago and Los Angeles. The senior debt financing will be used for the development of a 92-unit multifamily property located at 8931-8945 Helms Place in West Los Angeles. Zachary Streit of Priority Capital Advisory, along with Lucas Borges of JLL, arranged the loan. The property will feature 38 studio units (33 market rate and five affordable), 53 one-bedroom units (47 market rate, six affordable) and one affordable three-bedroom unit. Building amenities will include coworking space and a lounge, private patios, onsite parking, 9- to 10-foot ceilings and a fully built-out roof deck with 360-degree views. Construction is underway for the project, which is slated for completion in late 2026.

MARYSVILLE, OHIO — Affinius Capital LLC has provided a $76.3 million loan to finance the acquisition of Scotts Midwest Distribution Center, a 1.3 million-square-foot warehouse and distribution facility in the Columbus suburb of Marysville. Ryan Kieser of CBRE arranged the loan on behalf of the borrower, Sculptor Real Estate. Developed in 2023 by Crawford Hoying as a build-to-suit for The Scotts Co., the property features cross-dock configuration, a clear height of 40 feet, 120 dock doors, four drive-in doors and 388 parking spaces. The facility is leased to The Scotts Co., a subsidiary of The Scotts Miracle-Gro. The property serves as the primary distribution hub for the tenant and is located less than two miles from its main manufacturing facility and global headquarters.

SOUTH WINDSOR, CONN. — JLL has arranged a $9.5 million loan for the refinancing of a 115,800-square-foot industrial building in South Windsor, located northeast of Hartford. The building at 555 Nutmeg Road was constructed on 12.1 acres in 1980 and was fully leased at the time of sale to wholesale tire distributor US Autoforce. Max Custer, Ryan Carroll and Michael Donohoe of JLL arranged the five-year, fixed-rate loan through an undisclosed life insurance company on behalf of the borrower, Snowball Developments.

HYANNIS, MASS. — MassDevelopment and BankFive have provided $11 million in financing for a 45-unit multifamily project in the Cape Cod community of Hyannis. The building at 199 Barnstable Road will house 40 market-rate units and five affordable units that will be earmarked for households earning 65 percent or less of the area median income. Units will have an average size of 550 square feet. The developer, Bratt LLC, is a real estate holding entity owned by Bradley Sprinkle and Timothy Telman; the former’s family-owned contracting business most recently occupied the site. Completion is slated for mid-2026.

JLL Secures $19.5M Refinancing for Villas Las Mandarinas Multifamily Community in Tucson

by Amy Works

TUCSON, ARIZ. — JLL Capital Markets has secured a $19.5 million loan for the refinancing of Villas Las Mandarinas, a multifamily property located at 4250 E. 29th St. in Tucson. Brad Miner and Drew Lydon of JLL arranged the fixed-rate loan through Santander Bank N.A. for the borrower, GDL Asset Management and GDL Property Management. Built in 1977 and renovated in 2023, Villas Las Mandarinas features 322 apartments, averaging 322 square feet, and modern amenities.

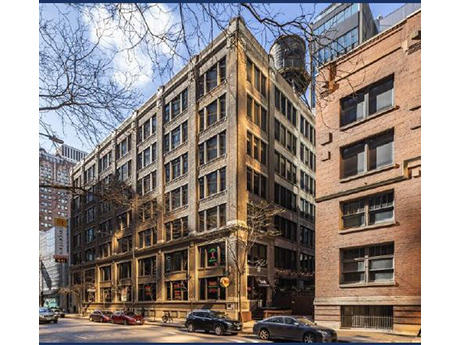

CHICAGO — Associated Bank has provided a $21.1 million construction loan to Wildwood Investments LLC and Concord Capital for the conversion of a 93,707-square-foot office and retail building in Chicago into 72 multifamily units. The seven-story property is located at 230 E. Ohio St. within the Streeterville neighborhood. Plans call for a mix of studio, one-, and two-bedroom units averaging 811 square feet. Existing first-floor retail, including Dao Thai Restaurant & Noodle Palace, Eye Society and YA Skin Studio, will remain open throughout construction. Completion is slated for December 2026. Elizabeth Hozian of Associated Bank handled the loan arrangements and closing.

PASSAIC, N.J. — A joint venture between Los Angeles-based PCCP LLC and Atlanta-based Stonemont Financial Group has received $65.4 million in bridge financing for a 295,506-square-foot industrial property in Northern New Jersey. Built on a 17.7-acre site at 122 Eighth St. in 2024, Passaic Logistics Center features a clear height of 40 feet, 40 dock-high doors, 130-foot truck court depths and parking for 55 trailers and 167 cars. In addition, the building can accommodate a single or multiple users. JLL arranged the financing through TPG Real Estate Credit on behalf of the joint venture. Specific loan terms were not disclosed.