ABINGTON, MASS. — MassHousing has funded a $34.8 million loan for the refinancing of Woodlands at Abington Station, a 192-unit affordable housing property located about 20 miles south of Boston in Abington. The property consists of eight buildings that house 78 one-bedroom apartments and 114 two-bedroom apartments. Amenities include a pool, fitness center, community room, tennis courts and a playground. The borrower, Beacon Communities LLC, will use a portion of the proceeds to fund capital improvements and preserve the property’s affordability status.

Loans

Content PartnerFinance InsightLoansMidwestMultifamilyNortheastSoutheastTexasVideoWalker & DunlopWestern

Web-Based Appraisal Tool Supports Massive Increase in Demand for Multifamily Valuations

Multifamily appraisers are extremely busy as investor interest in the sector is at an all-time high. “In terms of appraisal professionals, there is a supply and demand issue,” explains Meghan Czechowski, managing director and valuation lead for Apprise by Walker & Dunlop. She notes that the industry has greater demand for valuation than it has qualified appraisers. “Apprise is ensuring that we can support our appraisal staff and our local market experts with a tech-enabled process so that they can do their jobs more efficiently and get the values (and market information in general) into our clients’ hands as quickly as possible,” she adds. Czechowski focuses on the ways that web-based multifamily valuations can be streamlined to create a faster and more complete picture of properties. Multifamily experts need information on properties/parcels that comes from “multiple industry-standard resources such as Yardi, REIS, RCA and public record aggregators.” Parcel-level information, unit mix metrics, sale leads, land records and site assessment information are all available through Apprise’s platform via a single sign on to a dashboard that reflects information that is constantly being updated. This means that when an expert uses this platform and picks up the phone to confirm about …

PENSACOLA, FLA. — Marcus & Millichap Capital Corp. has secured $46.4 million in financing for a single-tenant, build-to-suit property in Pensacola. Sunny Sajnani of Marcus & Millichap Capital Corp. arranged the loan, which is structured as a 15-month construction loan followed by a 25-year, self-amortizing loan. The borrower was not disclosed. The Florida Department of Law Enforcement has pre-leased the two-story building. The 77,834-square-foot property is scheduled for completion by early 2023. The facility will be used for training employees, conducting investigations, storing evidence and completing forensic lab work. Located at 5045 Commerce Park Circle, the property is situated close to the Marcus Pointe Golf Club, Five Flags Speedway and Fast Eddies Fun Center.

MORRIS, MINN. — Colliers Mortgage has provided a $7 million Fannie Mae loan for the acquisition of East Point Village Apartments in the western Minnesota city of Morris. The 61-unit, market-rate apartment complex was constructed in 2017. Amenities include a community room, fitness center and patio with gas grills. The 10-year loan features a 30-year amortization schedule. CJK Investments II LLC was the borrower.

WASHINGTON, D.C. — The total amount of commercial and multifamily mortgages originated in the fourth quarter of 2021 were up 79 percent compared to a year prior, according to the Mortgage Bankers Association (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. “The fourth quarter of 2021 was a record end to a record year of borrowing and lending backed by commercial and multifamily properties,” says Jamie Woodwell, MBA’s vice president of commercial real estate research. “Part of the growth from 2020 was a bounce-back from the worst of the recession. However, rebounding property fundamentals and strong valuations, record sales transaction volumes, and low interest rates all fueled commercial and multifamily borrowing and lending activity that easily outpaced previous periods.” The highest increases in commercial and multifamily lending volumes occurred in hotel, office, industrial and retail properties when compared to the fourth quarter of 2020. There was a 167 percent year-over-year increase in the dollar volume of loans for hotel properties, a 122 percent increase for office properties, a 113 percent increase for industrial properties, a 109 percent increase for retail properties and a 57 percent increase for multifamily properties. On the flipside, however, healthcare property loan originations decreased 17 percent …

JERSEY CITY, N.J. — Locally based mortgage banking and advisory firm Progress Capital has arranged a $196.9 million acquisition loan for a 432,000-square-foot office building located at 70 Hudson St. in Jersey City. Tenants at the 12-story building include TD Ameritrade, Gucci, Fidessa and Federal Home Loan Bank of New York, as well as CVS in the ground-floor retail space. Brad Domenico of Progress Capital arranged the loan through Natixis Bank on behalf of the borrower, a partnership between Vision Properties and Hana Financial. David Bernhaut of Cushman & Wakefield brokered the sale of the property. The seller was not disclosed.

NorthMarq Arranges $22.4M Construction Financing for Build-to-Rent Community in Chandler, Arizona

by Amy Works

CHANDLER, ARIZ. — NorthMarq has arranged $22.4 million in non-recourse construction financing for Arizona-based TruVista Development for the development of The Villages at Chandler, a build-to-rent residential community in Chandler. Spanning 8.9 acres, the property will feature 109 units, averaging 886 square feet, in a mix of one- and two-bedroom craftsman, cottage and bungalow style units with private backyards. The gated community will also feature a central greenbelt, dog park, pool and residence club with an indoor amenity area.

Surging payrolls, new household formations, growing barriers to homeownership and multifamily’s role as a hedge for inflation all helped fuel robust apartment fundamentals in 2021. With interest rates expected to rise in 2022, the question becomes: will the appetite for apartment investments remain strong for all types of investors and in which markets? Hilary Provinse, executive vice president and head of mortgage banking at Berkadia, says she sees many reasons to be enthusiastic about the opportunities in multifamily markets this year. “Fannie Mae and Freddie Mac will continue to set the standard for multifamily lending; however, strong life company, bank and debt fund appetites will compete heavily again in 2022. They will fill the needs not met by the government-sponsored enterprises (GSEs) or HUD.” When it comes to accelerating multifamily trends, Provinse sees an expansion in the scope of multifamily interest: “One of the trends we see accelerating (as a result of COVID) is increased investor demand in not only secondary markets, but even tertiary markets. This was a trend we had seen a decade ago, but now it’s on steroids.” “Because people can work from wherever now and because of more flexible work arrangements…we’ve seen this willingness to …

NEW YORK CITY — New York City-based investment management firm Clarion Partners has provided a $415 million mezzanine loan for the refinancing of a national portfolio of 110 industrial buildings totaling 15.7 million square feet. The portfolio consists of properties in 15 markets, including Dallas-Fort Worth, Phoenix, Baltimore and Atlanta. At the time of the loan closing, the portfolio was approximately 93 percent leased to a roster of 300-plus tenants. The borrower was Blackstone.

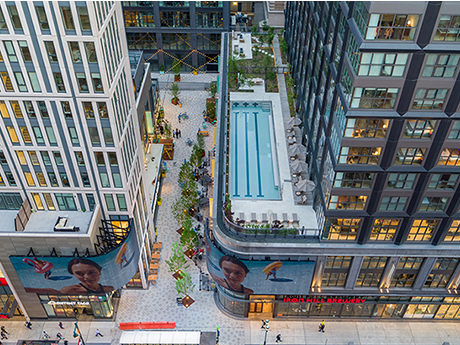

PHILADELPHIA — JLL has arranged a $260 million loan for the refinancing of East Market, a mixed-use project that spans an entire city block in Philadelphia’s Center City neighborhood. East Market consists of two apartment buildings totaling 562 units, 120,000 square feet of retail and restaurant space and a 100-year-old warehouse that has been redeveloped into creative office space. Chad Orcutt and Blaine Fleming of JLL arranged the loan through Pacific Life Insurance Co. on behalf of the borrower, a joint venture led by National Real Estate Advisors. The developer also plans to convert a traditional office building on the site into a boutique hotel and medical facility.