DALLAS — Los Angeles-based Thorofare Capital has provided a $41.9 million loan for the refinancing of a portfolio of 13 office buildings in the Dallas Design District. The buildings total 160,687 square feet. The undisclosed, locally based borrower will use a portion of the proceeds to fund capital improvements. The loan was structured with interest-only payments and a flexible prepayment schedule.

Loans

CHAPEL HILL, N.C. — Ready Capital has closed a $16.4 million acquisition loan for an unnamed student housing property near the University of North Carolina at Chapel Hill. The non-recourse, interest-only, floating-rate loan features a 36-month term, two extension options, flexible prepayment and is inclusive of a facility to provide future funding for capital expenditures. Upon acquisition, the sponsor will implement a capital improvement plan to fix deferred maintenance, renovate unit interiors and exteriors and make common area upgrades.

ST. PETERSBURG, FLA. — KeyBank Community Development Lending and Investment and KeyBank Real Estate Capital have provided a total of $69.8 million for the redevelopment of Jordan Park Apartments in St. Petersburg. Norstar Development USA-CDL, a Buffalo, N.Y.-based affordable housing developer, and the St. Petersburg Housing Authority are working together on the project, the timeline of which was not disclosed. KeyBank provided a $42.7 million construction bond. KeyBank funded the financing via Fannie Mae’s unfunded forward commitment execution that allows KeyBank to issue a mortgage-backed security (MBS) upon completion of the construction that will convert to a permanent mortgage loan. This Fannie Mae execution is referred to as MBS as Collateral for Tax-Exempt Bonds (MTEB), which is available for 4 percent LIHTC transactions. Jordan Park Apartments was originally built in 1939 on land donated by businessman Elder Jordan Sr. The 24-acre site contains single-family, duplex, triplex and quadplex buildings. The property’s former residents will have first right to return as the redeveloped property begins to reopen. The first phase includes the new construction of a six-floor midrise building for seniors ages 62 and older, as well as the rehabilitation of 41 buildings containing 97 units of affordable housing for families. …

CLEVELAND — Cleveland-based KeyBank Real Estate Capital (KBREC) has provided $51.6 million in acquisition financing for three retail centers in Ohio, Oklahoma and Pennsylvania. First National Realty Partners LLC is acquiring the assets. Southland Crossings is a 245,678-square-foot center in the eastern Ohio city of Boardman. Anchor tenants include Giant Eagle, Michaels, Ross Dress for Less and PetSmart. Summit Square is a 166,552-square-foot property in Tulsa that is anchored by Reasor’s Foods, American Freight and Tuesday Morning. The Village at Pittsburgh Mills is a 161,079-square-foot center in Tarentum, Pa., that is anchored by Ross Dress for Less, Michaels, PetSmart and Aldi. Jon Scott of KBREC structured the financing with a five-year term and interest-only payments.

SHAKER HEIGHTS, OHIO — American Street Capital (ASC) has arranged a $3 million bridge loan for the refinancing of a 100-unit apartment building in the Cleveland suburb of Shaker Heights. The six-story property is within walking distance of Shaker Square, a shopping, dining and entertainment district. Units average 576 square feet, and amenities include onsite security, laundry facilities and 82 parking spaces. Kyle Tyrrell of ASC arranged the 18-month loan through a debt fund. An unnamed owner-operator was the borrower.

TULSA, OKLA. — Marcus & Millichap Capital Corp. (MMCC) has placed a $16.8 million loan for the refinancing of Park at Forest Oaks, a 440-unit apartment community in Tulsa. The property, which is located near Oral Roberts University, was built in 1978 near and renovated in 2015. Todd McNeil of MMCC arranged the 10-year loan, which carried a 3.41 percent interest rate, four years of interest-only payments and a 75 percent loan-to-value ratio, through M&T Realty Capital. The borrower was not disclosed.

MIDLOTHIAN, TEXAS — Dallas-based Terrydale Capital has arranged a $13.2 million acquisition loan for a multifamily property located in the southern Dallas suburb of Midlothian. Culby Culbertson of Terrydale Capital originated the financing, which was structured with a 3.65 percent interest rate, a 25-year amortization schedule and 30 months of interest-only payments. An undisclosed bank provided the loan. The borrower and property name were also not disclosed.

NEW YORK CITY — Square Mile Capital Management LLC has provided a $55 million loan for the refinancing of 517 West 29th Street, a 60-unit apartment building located at the confluence of Manhattan’s Chelsea and Hudson Yards neighborhoods. Completed last October, the 10-story building was 80 percent occupied at the time of the loan closing and offers amenities such as a fitness center, outdoor grilling space and a rooftop terrace. Christopher Peck, Peter Rotchford, Phil Cadorette and Ricky Song of JLL arranged the loan on behalf of the borrower, Churchill Real Estate.

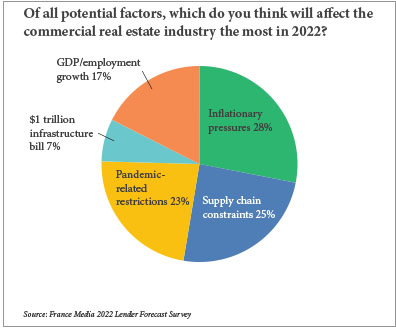

By Matt Valley An overwhelming percentage of direct lenders and financial intermediaries believe the multifamily and industrial sectors provide the most attractive financing opportunities for the lending community today, according to France Media’s 11th annual reader forecast survey. Conversely, the hotel and office sectors offer the least attractive financing opportunities, say survey participants. More specifically, 83 percent of participants in the email survey conducted between Nov. 19 and Dec. 13 indicate that the multifamily sector provides the most attractive financing opportunities, followed by industrial (75 percent), mixed-use (25 percent), retail (17 percent), hotel (14 percent) and office (7 percent). Multiple answers were permitted for this question. On the flip side, 62 percent of respondents believe that the hotel sector provides the least attractive financing opportunities, followed by office (58 percent), retail (27 percent), multifamily (7 percent), industrial (3 percent) and mixed-use (0 percent). Despite the persistence of the COVID-19 pandemic — which as of early January had claimed the lives of more than 830,000 Americans and has hobbled the hotel, office and retail sectors for nearly two years — the real estate fundamentals of the apartment and industrial sectors have remained rock solid. Fueled by strong tenant demand, the national …

GAINESVILLE, FLA. — JLL Capital Markets has secured $37 million for the refinancing of a four-property, 460-unit multifamily portfolio in Gainesville. Elliott Throne, Kenny Cutler and Karim Khaiboullin of JLL worked on behalf of the borrower, American Commercial Realty, to secure the 10-year, fixed-rate Fannie Mae loans. JLL Real Estate Capital LLC, a Fannie Mae DUS lender and a wholly owned indirect subsidiary of Jones Lang LaSalle Inc., will service the loans. The properties include the 141-unit Hammocks by Butler, the 98-unit Hammocks off 6th, the 69-unit Hammocks on 34th and the 152-unit Hammocks on 20th. American Commercial Realty recently completed renovations on all four properties, including updated amenities and new floors, quartz countertops, stainless steel appliances, modern cabinetry and walk-in closets in the units. Community amenities at the portfolio include swimming pools, outdoor grilling stations and fitness centers. The four multifamily communities are located close to Interstate 75, the University of Florida and Shands Medical Center. Three of the four properties are near Butler Plaza, a shopping center development with over 150 stores and restaurants.