YORK, PA. — Berkshire Bank has provided a $33.9 million loan for the refinancing of The Oaks and Reserve at Copper Chase, a multifamily property in York. The development consists of the 132-unit Reserve at Copper Chase, which was built in 1983 and renovated in 2019, and the 107-unit Oaks at Copper Chase, which was delivered last year. Amenities include a pool, fitness center, walking trails, playground, clubhouse and a dog park. Drew Fletcher and Paul Fried of Greystone arranged the loan on behalf of the borrower, New Jersey-based Larken Associates.

Loans

Kam Sang Co. Receives $128M in Financing for JW Marriott Desert Springs Resort & Spa in Palm Desert

by Amy Works

PALM DESERT, CALIF. — Kam Sang Co. has obtained a $128 million loan for the JW Marriott Desert Springs Resort & Spa in Palm Desert. JLL’s Hotels & Hospitality Group secured the five-year, fixed-rate, interest-only loan, which Goldman Sachs Bank USA originated. The owner used proceeds to repay the existing loan, which was scheduled to mature in February 2022. The 884-key hotel underwent a $40 million renovation in early 2020 that resulted in the creation of additional suites and substantial upgrades to all guest rooms. Spanning 286 acres, the resort features five swimming pools; two 18-hole golf courses; a Peter Burwash International Tennis Court; a 47-treatment-room spa facility; an aviary; 35 acres of streams, lakes and cascading waterfalls; a 12,000-square-foot entertainment zone; and more than 234,000 square feet of indoor and outdoor event space. The resort also offers a broad collection of food and beverage outlets, including T&T Innovation Kitchen, Mikado Japanese Steakhouse, Blue Star Lounge, Rockwood Grill and Aquifer65. Mike Huth and Shalin Patel of JLL Hotels & Hospitality represented the borrower in the financing.

SPRINGDALE, OHIO — Northmarq has arranged a $6.3 million loan for the acquisition of Executive Plaza III in Springdale, a northern suburb of Cincinnati. The 89,327-square-foot office building is located at 135 Merchant St. Christina Grimme of Northmarq arranged the 25-year loan, which is fully amortized and features a loan-to-value ratio of 80 percent. A local bank provided the loan. The borrower was not disclosed.

WICHITA, KAN. — American Street Capital (ASC) has arranged a $4.3 million bridge loan for the acquisition of a 180-unit multifamily property in Wichita. Built in 1941 and recently renovated, the community is situated on 10 acres. The property was 88 percent occupied at the time of loan closing. Kyle Tyrrell of ASC arranged the loan, which features a 12-month term and interest-only payments. A debt fund provided the loan. The borrower was not disclosed.

NEW YORK CITY — Greystone has provided a $59.5 million bridge loan for the acquisition of Seaview Estates, a 316-unit affordable housing property in Staten Island. The property offers amenities such as landscaped courtyards, a fitness center and onsite laundry facilities. Miryam Reinitz-Kops of Greystone originated the 24-month, interest-only loan on behalf of the borrower, locally based investment and management firm Iris Holdings Group. Information about specific income restrictions was not disclosed.

PSRS Arranges $28.5M in Financing for Medical Office Portfolio in Southern California, Florida

by Amy Works

LOS ANGELES — PSRS has closed $28.5 million in portfolio financing for three medical office buildings in Southern California and Southern Florida. David Hamilton arranged the financing on behalf of a large medical office landlord. One of PSRS’ debt fund lenders provided the capital. Los Angeles-based PSRS achieved a cash-out refinance on the borrower’s existing portfolio, reducing the equity need for the new acquisitions. The firm also provided the sponsor maximum leverage, three years of interest-only payments and a non-recourse structure.

EDISON, N.J. — JLL has arranged three loans totaling $16.1 million for the refinancing of a portfolio of four industrial properties totaling 389,501 square feet in Northern New Jersey. The buildings, which were 93 percent leased at the time of the loan closing, are situated within Raritan Center Business Park in Edison. Michael Klein, Max Custer and Ryan Carroll of JLL placed the fixed-rate, nonrecourse loans with two different life insurance companies on behalf of the borrower, Summit Associates Inc.

HOUSTON — Miami-based balance sheet lender 3650 REIT has provided a $60.5 million construction loan for The Vic on Park Row, a 363-unit multifamily project that will be located in Houston’s Energy Corridor neighborhood. Amenities will include a game room, entertainment area, business center, conference room, fitness center and a bowling alley, as well as an outdoor recreational area with a pool, dog park and playground. The developer and borrower is locally based firm Hunington Properties. A tentative completion date was not released.

ANDOVER, MASS. — Boston-based mortgage banking firm EagleBridge Capital has arranged $14.6 million in debt and joint venture equity financing for 6 Riverside Drive, a 77,000-square-foot flex building in the northern Boston suburb of Andover. The property sits on 8.6 acres and houses both office and research and development space. Ted Sidel of EagleBridge Capital arranged the financing on behalf of the undisclosed borrower. The breakdown of debt and equity components was also not disclosed.

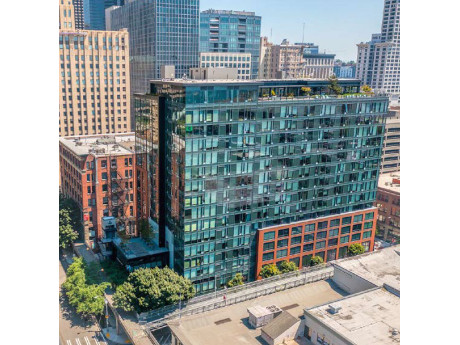

PCCP Provides $75M Acquisition, Repositioning Loan for The Post Apartments in Downtown Seattle

by Amy Works

SEATTLE — PCCP has provided a $75 million senior loan to Griffis Residential for the acquisition and repositioning of The Post, a 16-story multifamily community located at 888 Western Ave. in downtown Seattle. Situated in the Seattle Central Business District, Waterfront and Pioneer Square submarkets, The Post features 208 apartments with quartz countertops, vinyl-plank flooring, steel appliances, floor-to-ceiling windows and views of downtown Seattle, Elliott Bay and the Olympic Mountains. Community amenities include a rooftop deck with grilling areas and a reflection pool, multiple rooftop lounges, a media room, dog run, yoga studio, library and fitness center.