DENVER — JLL Capital Markets has arranged $54.3 million in financing for Civica Cherry Creek, an office property in Denver. Located at 250 Fillmore St., the 116,187-square-foot building features floor-to-ceiling glass, a great room with fireside lounge, private wine cellar, secure bike storage, rooftop terrace, building concierge and underground executive parking. The LEED Silver-certified property was built in 2018. Eric Tupler and Leon McBroom of JLL Capital Markets secured the five-year, floating-rate loan with a national bank on behalf of the borrower, a MetLife Investment Management-managed entity.

Loans

NEWARK, N.J. — JLL has arranged a $110 million permanent loan for an 850,000-square-foot warehouse and distribution center in Newark. Thomas Didio, Thomas Didio Jr. and Ryan Carroll of JLL arranged the nonrecourse loan, which carried a fixed interest rate and a 15-year term, through a correspondent life insurance company. The borrower was not disclosed.

SANTA ROSA BEACH, FLA. — Lument has provided a $48.8 million Freddie Mac conventional loan to refinance Sanctuary at 331, a 264-unit multifamily community in Santa Rosa Beach. Steve Beltran of Lument led the loan transaction on behalf of the borrower, an affiliate of Hunt Cos. The loan features a 10-year term, 30-year amortization schedule and a low fixed interest rate with 60 months of interest-only payments. The loan is a refinance of an existing HUD loan. Sanctuary at 331 features 11 buildings on nearly 32 acres. The apartment property offers one- and two-bedroom floorplans with features such as stainless steel appliances, private patios and in-unit washers and dryers. Community amenities include a 24-hour fitness center, swimming pool, clubhouse, a dog park and garage storage units. Cushman and Wakefield manages the property, which was 97 percent occupied at the time of the loan transaction.

HOUSTON — DLP Capital, a Florida-based investment and finance firm, has provided $74 million in acquisition financing for two Houston-area apartment complexes totaling 1,062 units. Palms at Westheimer totals 798 units and is located on the city’s west side, while Huntington at Stonefield spans 264 units and is located on the city’s north side. The borrower was locally based investment firm Kalkan Capital. The seller was not disclosed.

PHILADELPHIA — New York City-based Square Mile Capital Management has provided a $195 million acquisition loan for 1500 Locust, a 612-unit apartment tower located in Philadelphia’s Rittenhouse Square neighborhood. The 45-story building also houses 7,700 square feet of retail space and was 97 percent occupied at the time of sale. Amenities include a rooftop pool and lounge, fitness center, media room and outdoor grilling stations. Drew Anderman and Alan Blank of Meridian Capital Group arranged the debt. The borrower is a joint venture between Fairstead, a developer with offices along the East Coast, and its undisclosed institutional equity partner. A portion of the proceeds will be used to fund capital improvements. Lizann McGowan, Erin Miller, Marybeth Farris and Chris Koehler of Newmark represented the seller, Barings, in the transaction.

Wharton Industrial, Madison Ventures Receive $224.1M Construction Loan for Industrial Park in Mesa, Arizona

by Amy Works

MESA, ARIZ. — Wharton Industrial and Madison Ventures Plus have received $224.1 million in acquisition and construction financing for The HUB @ 202, a master-planned, 1.5-million-square-foot industrial park in Mesa. John Alascio, Dave Karson, Chris Moyer, Will Strong, Kirk Kuller, TJ Sullivan, Chuck Kohaut and Zachary Smolev of Cushman & Wakefield Capital Markets arranged the financing. Situated on 101 acres, The HUB @ 202 will feature 11 Class A buildings with 28-foot to 36-foot clear heights, ample truck and car parking, grade- and dock-high loading doors and functional divisibility with a variety of bay sizes. Construction is slated to begin in second-quarter 2022.

THE WOODLANDS, TEXAS — Los Angeles-based CIM Group has provided a $127 million loan to The Howard Hughes Corp. (NYSE: HHC) to refinance Hughes Landing, a 649,406-square-foot office campus in The Woodlands, about 30 miles north of Houston. Built in 2015, Hughes Landing consists of a 12- and 13-story building, both of which are located within the 79-acre Lake Woodlands mixed-use development. Amenities include a fitness center, multiple conference facilities and a cafeteria.

NEW YORK CITY — Bank of America has provided a $123 million loan for the refinancing of 767 Third Avenue, a 40-story office tower in Manhattan. Designed by FXFowle, the building spans 310,000 square feet and features an amenity center with games, a movie screen, lounge with TVs and a boardroom. James Millon, Tom Traynor and P.J. Finley of CBRE arranged the debt. The borrower was Sage Realty, the leasing and management division of the William Kaufman Organization. A portion of the proceeds will be used to fund capital improvements and leasing costs.

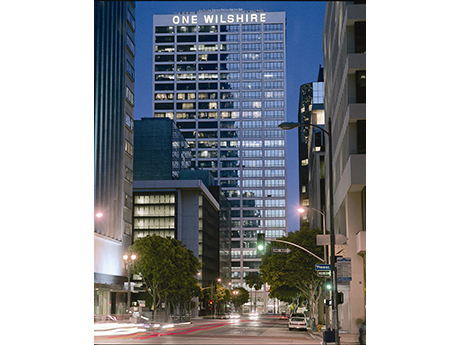

LOS ANGELES — JLL has arranged the $389.2 million refinancing of One Wilshire, a multi-tenant data center located at 624 S. Grand Ave. in downtown Los Angeles. The borrower is GI Partners, an alternative investment firm based in San Francisco. The 30-story, 661,553-square-foot data center features five separate utility power risers and 13 onsite generators with fuel storage for 24 hours of operation, along with separate and redundant data risers. The property also features office space, a multi-tower antenna array and fiber connectivity to the rooftop. Kevin MacKenzie, Brian Torp, Jake Wagner, Samuel Godfrey and Darren Eades of JLL arranged the 10-year, fixed-rate, non-recourse, interest-only loan through Goldman Sachs. “As one of the largest internet exchanges in the world, One Wilshire is truly a best-in-class asset recognized as the premier telecommunications hub of the Western United States,” says MacKenzie. “GI Partners has done an excellent job managing the asset to maximize utilization and creating significant value.” The demand for fast, secure and reliable data storage and delivery is at an all-time high and will continue to escalate for the foreseeable future thanks to the widespread appeal of content streaming services, social media and virtual connectivity. As a data center market, …

MCKINNEY, TEXAS — JLL has arranged a $37.5 million loan for the refinancing of Hidden Springs of McKinney, a 194-unit seniors housing community located on the northern outskirts of Dallas. The property was built in 2020 and offers assisted living, independent living and memory care services. Amenities include a pool, fitness center and a dog park. Joel Mendes and Jason Skalko of JLL arranged the nonrecourse, fixed-rate loan through an undisclosed life insurance company on behalf of the borrower, a joint venture between CREC Real Estate and Madison Marquette.