MIAMI GARDENS AND TAMARAC, FLA. — JLL Capital Markets has arranged a combined $57.5 million in financing for two Publix-anchored shopping centers in South Florida. Matt Casey, Paul Adams, Hunter Rich and Aaliyah St. Louis of JLL’s Debt Advisory team arranged the loans through Synovus Bank on behalf of the borrower, Atlanta-based Jamestown. The first property, Country Club Plaza in Miami Gardens, totals 100,893 square feet and is leased to tenants including CVS and Panera Bread. Cypress Commons in Tamarac — formerly known as Tamarac Town Square — is the second property, which totals 135,128 square feet and is leased to tenants including Humana and Retro Fitness. Jamestown’s current portfolio of grocery-anchored shopping centers includes eight properties across Georgia and Florida, totaling approximately 1.2 million square feet.

Loans

ALHAMBRA, CALIF. — PSRS has arranged $5 million in refinancing for an industrial property in Alhambra. Built in 1980, the 106,266-square-foot bulk warehouse building features a clear height of 25 feet, a showroom area and small office build-out. Additionally, the asset includes 198 surface parking spaces. Michael Tanner and David Sarnoff of PSRS secured the nonrecourse loan, which was structured with an interest-only term, through one of PSRS’ correspondent life insurance company lenders.

BOSTON — A joint venture between BXP (NYSE: BXP), formerly Boston Properties, and Delaware North, a privately owned hospitality and entertainment company, has received a $465 million loan for the refinancing of a portion of The Hub on Causeway. The 1.5 million-square-foot mixed-use development is located in the West End neighborhood of Boston. Situated on the site of the former Boston Garden arena, the original home arena of the Boston Bruins and Boston Celtics, The Hub on Causeway is now a transit-oriented development that features 811,000 square feet of office space and 440 luxury apartments, as well as 250,000 square feet of retail space and a 60,000-square-foot Star Market grocery store. An affiliate of Verizon Communications anchors the development on a 20-year lease. Wells Fargo Bank, Morgan Stanley Bank and Bank of America provided the loan to BXP and Delaware North. The joint venture refinanced The Hub on Causeway’s office tower and “podium,” which is the lower section that houses a food hall, creative office space and a movie theater. “We are pleased to complete this financing, which not only enhances the strength and flexibility of our balance sheet, but also demonstrates our access to attractively priced capital in the secured …

Berkadia Arranges $84.1M Refinancing for Meridian at Eisenhower Apartment Tower in Alexandria, Virginia

by John Nelson

ALEXANDRIA, VA. — Berkadia has arranged an $84.1 million loan for the refinancing of Meridian at Eisenhower, a 369-unit residential high-rise located at 2351 Eisenhower Ave. in Alexandria, a suburb of Washington, D.C. Patrick McGlohn, Patrick Cunningham, Brian Gould, Hunter Wood and Natalie Hershey of Berkadia arranged the 10-year loan on behalf of the borrower, Paradigm Development Co. LLC. The direct lender was not disclosed. Meridian at Eisenhower was 93 percent occupied at the time of the loan closing. Built in 2007, the high-rise offers studio, one- and two-bedroom floorplans ranging in size from 605 to 1,220 square feet. Fifteen units are reserved for households earning 60 percent of the area median income (AMI). Amenities include a rooftop swimming pool and sundeck, fitness center with cardio theater, top-floor clubroom with billiards, a landscaped courtyard and grill area, storage units, package service and 444 parking spaces. The property also includes three street-level retail spaces totaling 10,200 square feet housing tenants including Orangetheory Fitness and Xfinity.

WINCHESTER, VA. — JLL has secured an $81.9 million loan for the refinancing of One Logistics Park Building 2, a 1 million-square-foot industrial facility located at 1251 Coverstone Drive in Winchester, a city in the northern tip of Virginia near the borders of Maryland, Pennsylvania and West Virginia. The property sits along I-81 less than 14 miles from the 161-acre Virginia Inland Port in Front Royal, Va. The borrower, The Meridian Group, delivered One Logistics Park Building 2 earlier this year and recently secured a lease with an unnamed crane, rigging and hauling service provider. Rob Carey, Chris Hew, Gus Caiola and Patrick Wu arranged the construction take-out loan through an entity managed by Argentic Investment Management LLC. The industrial building features 40-foot clear heights, 753 car parking spaces, 177 loading dock positions, 269 trailer parking spaces, 8,000 amps of power, LED lighting and tilt-up concrete walls with textured paint finishes. The building also features 33 dock positions, 67 additional manual dock doors and 77 knockout positions available for future tenant customization.

Walker & Dunlop Provides $47.8M Agency Loan for Mason Stuart Apartments in Southeast Florida

by John Nelson

STUART, FLA. — Walker & Dunlop has provided a $47.8 million Fannie Mae loan for the acquisition of Mason Stuart, a 270-unit apartment community located at 4585 S.E. Federal Highway in Stuart, a city in Southeast Florida’s Martin County. The borrower was Raia Capital Management. Craig West of Walker & Dunlop originated the fixed-rate, interest-only loan. Built in 2023, Mason Stuart features a mix of one-, two- and three-bedroom units, as well as a resort-style pool area, 24-hour fitness center with a yoga and spin room, an outdoor gathering pavilion, fenced dog park and multi-purpose walking trails.

DALLAS — CBRE has arranged an undisclosed amount of permanent financing for a portfolio of 11 medical office buildings totaling roughly 258,000 square feet in the greater Dallas and Houston areas. The portfolio was 81 percent leased at the time of the loan closing to 37 tenants, including St. Luke’s Health System and Texas Children’s Hospital. Zack Holderman, Jesse Greshin, Chris Bodnar, Brannan Knott, Mindy Berman and Cole Reethof of CBRE arranged the debt on behalf of the owner, Pinecroft Realty. The direct lender was not disclosed.

BOSTON — Walker & Dunlop has provided a $356.4 million Freddie Mac loan for the refinancing of a portfolio of four multifamily properties totaling 1,817 units in New England. The portfolio comprises Royal Crest Marlboro, a 473-unit property located west of Boston; Royal Crest Warwick, a 492-unit community in Rhode Island; Waterford Village, a 588-unit asset located south of Boston; and Wexford Village, a 264-unit complex in Worcester. The properties were all built between 1970 and 1974. Craig West led the Walker & Dunlop team that originated the financing on behalf of the borrower, an affiliate of Harbor Group International.

FAIRFIELD, CONN. — Cleveland-based commercial finance firm BWE has funded a $35.3 million Freddie Mac permanent loan for Sturges Ridge of Fairfield, a 99-bed seniors housing complex located in southern coastal Connecticut. The property opened in 2018, houses 88 units and offers assisted living and memory care services. Amenities include game/activity lounges, a fitness and wellness center, private dining room, library with computer stations, full-service salons and a pet therapy program. Taylor Mokris and Ryan Stoll of BWE originated the 10-year, fixed-rate loan on behalf of the undisclosed borrower.

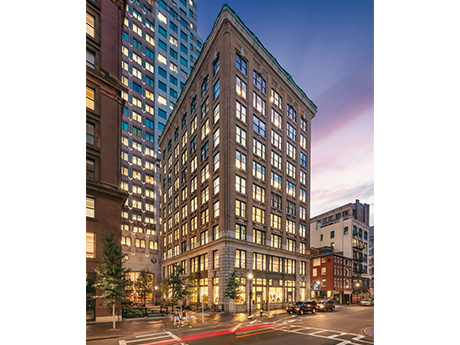

BOSTON — JLL has arranged $8 million in financing for a 75,000-square-foot office building located at 15 Broad St. in downtown Boston. The 10-story building was originally constructed in 1910. Amy Lousararian and Hugh Doherty of JLL arranged the five-year, fixed-rate loan through MountainOne Bank. The borrower, local owner-operator Broder, plans to use proceeds to fund capital improvements, including a redesign of the lobby, upgrading of common areas and the introduction of a new amenity package.