CHARLESTON, S.C. — Walker & Dunlop has arranged a $75 million loan for the refinancing of Society at Laurens, a newly built, 148-unit luxury apartment community located at 31 Laurens St. in Charleston’s historic downtown district. Walker Layne, Matt Wallach and Stephen West led the Walker & Dunlop team that arranged the three-year loan through Aareal Capital on behalf of the borrower, Southern Land Co. The Society at Laurens features studio, one-, two- and three-bedroom apartments, as well as a heated saltwater pool and spa situated on a second-floor deck with views of Charleston Harbor. Other amenities include a high-end fitness center, controlled-access parking and package lockers with 24/7 access.

Loans

Helio Group Receives $92M Construction Loan for Aston Residences in Culver City, California

by Amy Works

CULVER CITY, CALIF. — Helio Group has obtained a $92 million construction loan for Aston Residences, a to-be-built multifamily property in Culver City. Jeff Sause, Chad Morgan, Jacob Michael and Danny Ryan of JLL arranged the floating-rate loan with Affinius Capital for the borrower. Located at 10505 Washington Blvd., Aston Residences will offer 160 one-bedroom and 30 two-bedroom apartments with luxury finishes and smart home technology. Community amenities will include 5,191 square feet of ground-floor retail space, a fitness room, clubhouse, an indoor pickleball court, hot and cold plunge pools, an outdoor kitchen and bicycle parking within a three-floor garage. Completion is slated for first-quarter 2028.

Spectrum Retirement Receives $330M Refinancing for Seniors Housing Portfolio in Midwest, Southwest

by John Nelson

DENVER — Spectrum Retirement, a Denver-based seniors housing owner-operator, has received $330 million for the refinancing of a portfolio of eight seniors housing properties that are located across the Midwest and Southwest United States. Ryan Stoll and Taylor Mokris of BWE, a national commercial and multifamily mortgage banker, arranged the financing on behalf of Spectrum Retirement. The nonrecourse debt was structured with full-term interest-only payments and a “competitive” interest rate. “We are honored that Spectrum chose BWE to represent them in the debt capital markets for such a complex transaction,” says Stoll, national director of BWE’s Seniors Housing and Care team. “It is a privilege to partner with one of the industry’s most respected owners and operators, and Spectrum exemplifies the highest standard of excellence.” The direct lender was not released, but BWE disclosed that the lender was a “global private credit investor.” BWE also said the transaction drew interest from multiple capital sources, including agencies, life insurance companies, banks and private credit firms. The eight-property portfolio spans major metropolitan areas in four states, all of which benefit from attractive demographics and sustained demand for high-quality senior living, according to BWE. The properties include Green Oaks Senior Living and Palos Heights …

Dwight Mortgage Trust Funds $110M Refinancing for LC Line and Low Apartments in Charleston

by John Nelson

CHARLESTON, S.C. — Dwight Mortgage Trust, an affiliate of Dwight Capital, has provided a $110 million bridge loan for the refinancing of LC Line and Low, a new 277-unit apartment development in Charleston. Brandon Baksh, Noah Greenwald and Talisse Thompson of Dwight Mortgage Trust originated the loan on behalf of the sponsor, Lifestyle Communities, which will use the loan to refinance existing construction debt and fund remaining construction expenses. LC Line and Low features a main residential building, train shed with loft-style apartments, historic single-family homes with private courtyards and seven retail suites totaling 15,000 square feet. The retail component houses tenants including The Goat Restaurant & Bar and Morning Ritual Coffee Shop, with another restaurant and a cocktail bar in the planning stages. Amenities include a resort-style pool, clubhouse, fitness center with saunas and cold plunges, coworking lounge and a parking deck.

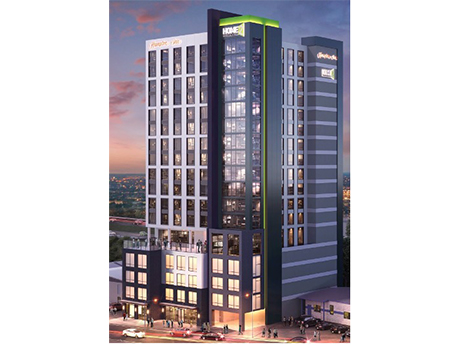

Arriba Capital Provides $67M Construction Loan for Dual-Branded Hotel Project in Nashville

by John Nelson

NASHVILLE, TENN. — Arriba Capital has provided a $67 million construction loan for a dual-branded hospitality project in Nashville’s East Bank district. The hotel development, which will sit adjacent to Oracle’s upcoming $2 billion campus, will feature rooms branded under Hilton’s Home2 Suites and Hampton Inn flags. The borrower is a Southeast-based developer that plans to deliver the hotel project in early 2027.

TAYLOR, TEXAS — JLL has arranged a $32.2 million acquisition loan for a 183,340-square-foot industrial facility in the Central Texas city of Taylor that is fully leased to Tesla. Delivered in 2025, the rail-served facility features four dock-high doors, eight grade-level doors and five cranes. Melissa Rose, Jack Britton, Nicole Barba and Preston Bacon of JLL arranged the three-year, fixed-rate loan through BMO on behalf of the borrower, a managed account of Manulife Investment Management.

EDEN PRAIRIE, MINN. — JLL Capital Markets has arranged joint venture equity and construction financing totaling $55.6 million for The Fox and The Grouse Phase II, a 188-unit apartment development in the Golden Triangle neighborhood of Eden Prairie. Josh Talberg, Scott Loving, Joe Peris, Matthew Schoenfeldt, Colin Ryan and Will Hintz of JLL represented the borrowers, Greco and Eagle Ridge Partners. JLL arranged a $39.1 million three-year, floating-rate loan through MidWestOne Bank and sourced $16.5 million in joint venture equity from Amstar Group. Construction is scheduled to begin immediately. The six-story development will offer a mix of studios, one-, two- and three-bedroom units, with 25 percent of the homes designated as affordable at 50 to 80 percent of the area median income. The project features 167,312 square feet of rentable space and 263 parking stalls. Amenities will include an outdoor pool, golf simulator, wellness center, work-from-home spaces, a theater room, clubroom, private dining area and underground parking. There are more than 9 acres of wetlands. Designed by BKV Group, the project represents the second phase of a transit-oriented development that will be directly connected to the Golden Triangle Station on the Southwest Light Rail Transit Green Line Extension, scheduled to …

FARMINGTON HILLS, MICH. — Bernard Financial Group (BFG) has arranged a $4 million loan for the refinancing of an 89,691-square-foot office property in the Detroit suburb of Farmington Hills. Joshua Bernard of BFG arranged the loan on behalf of the borrower, an entity doing business as HRFG Acquisition LLC. A life insurance company provided the loan.

JERSEY CITY, N.J. — Locally based financial intermediary G.S. Wilcox & Co. has arranged $85 million in financing for Overlook Flats, a 297-unit apartment building located in the Journal Square area of Jersey City. Designed by Michels & Waldron with interiors by Builders Design, the 16-story building houses studio, one-, two- and three-bedroom units, as well as 40,000 square feet of commercial space. Residences are furnished with stainless steel appliances, designer cabinetry and quartz countertops. Outdoor amenities include a rooftop deck with a pool, kitchen, lounge area, picnic areas, bocce ball court and a pet play area. Inside, residents have access to coworking spaces, a children’s playroom, fitness center, golf simulator and a package room. Wesley Wilcox, Al Raymond and Will Gallagher of G.S. Wilcox arranged the five-year, fixed-rate loan through an undisclosed life insurance company.

CEDAR PARK, TEXAS — Newmark has brokered the sale of The Alden at Cedar Park, a 349-unit apartment community located on the northern outskirts of Austin. Built in 2020, the community offers one- and two-bedroom units and amenities such as a pool, clubhouse with a resident lounge and cocktail bar, outdoor entertainment areas with grilling stations and a 24-hour fitness center. Patton Jones and Andrew Dickson of Newmark represented the undisclosed seller in the transaction. Mitch Clarfield and Alec Newman, also with Newmark, originated Fannie Mae acquisition financing on behalf of the buyer, Washington-based Weidner Apartment Homes. The Alden was 95 percent occupied at the time of sale.