ROMEOVILLE, ILL. — Marcus & Millichap Capital Corp. (MMCC) has arranged a $4.1 million loan for the refinancing of Carillon Court, a 29,891-square-foot retail strip center in the Chicago suburb of Romeoville. The property at 444 N. Weber Road is situated near I-55 and is home to a mix of restaurants and service-oriented businesses, including a dental office, salon and insurance agency. Dean Giannakopoulos of MMCC arranged the loan through a local bank on behalf of the private borrower. The three-year loan features one year of interest-only payments and a 25-year amortization schedule.

Loans

KATY, TEXAS — JLL has provided an undisclosed amount of Freddie Mac financing for The Reserve on Kingsland, a 382-unit apartment community in the western Houston suburb of Katy. Built in 2020 and formerly known as Lenox Reserve, the property features 11 three-story buildings with one-, two- and three-bedroom units that have an average size of 882 square feet. Amenities include pools, a fitness center, package lockers, a dog park, business center, demonstration kitchen and a game room. Andy Scott, Michael Cosby, Bo Beidleman, Blake Morrison and Aaron Craig of JLL originated the seven-year, fixed-rate loan on behalf of the owner, Price Realty Corp.

BOSTON — PGIM Real Estate has provided $132 million in financing for The Viridian, a 342-unit multifamily property in Boston’s Fenway neighborhood. The Viridian offers studio, one-, two- and three-bedroom units, as well as penthouses, that are furnished with floor-to-ceiling windows, designer kitchens, spa-inspired baths, walk-in closets and Juliet balconies. Amenities include two rooftop decks with outdoor lounges, a fitness center and coworking and social lounges. Amy Lousararian, Madeline Joyce and Michael Schwarze of JLL arranged the floating-rate financing on behalf of the owner, The Abbey Group.

DENVER — JLL Capital Markets has arranged $27.2 million in refinancing for The Kenyon, a multifamily property at 777 E. 17th Ave. in Denver’s Uptown neighborhood. Kristian Lichtenfels and Mark Erland of JLL secured the financing for the borrower, the single-purpose joint venture entity of Corum Real Estate Group, ProspectHill Group and Geolo Capital. Delivered in May 2024, The Kenyon offers 124 studio, one- and two-bedroom apartments with 40 unique floor plans, including 27 balcony units and 17 split-level mezzanine units. Community amenities include a two-story fitness center, private work pods and a rooftop deck with grills.

SAG HARBOR, N.Y. — JLL has arranged a $54 million loan for the refinancing of Baron’s Cove, a 67-room boutique hotel located in Sag Harbor on Long Island. Built in the late 1950s and renovated in 2015, the property features lofted suites and amenities such as a saltwater pool, lounge, complimentary bicycles and kayaks, a wellness center, tennis court and onsite food-and-beverage options. Kevin Davis, Mark Fisher, Jillian Mariutti and Connor Medzigian of JLL arranged the three-year, floating-rate loan through funds managed by private equity firm Blue Owl Capital. The borrower, a partnership between Blue Flag Capital and Bain Capital Real Estate, will use a portion of proceeds to fund capital improvements.

Interview by John Nelson Commercial Property Assessed Clean Energy (C-PACE) financing is a lending option that is gaining traction in the commercial real estate lending world. This type of financing is beneficial for owners who are looking to finance their new construction or redevelopments with long-term debt. Rafi Golberstein, founder and CEO of PACE Loan Group (PLG), a C-PACE lender with offices in New York City, San Diego, Chicago and Minneapolis, says that what many borrowers are now finding out is how adaptable this loan structure is, especially when paired with traditional bank financing. “C-PACE as a product type is not just living and breathing — it’s expanding,” says Golberstein. Originated in Berkeley, Calif., in 2008, C-PACE financing is now available in 40 states and Washington, D.C. It serves as an alternative funding source for commercial projects that qualify on the basis that they will result in reduced energy and water usage and greater building efficiency. C-PACE is not a federal program as it is overseen at the state or local level, with some states allowing local governments to administer the program. “States are making their legislation more broad, which allows us to get more projects done and larger checks …

First National Realty Completes Refinancing of 231,036 SF Power Retail Center in Metro D.C.

by Abby Cox

BRANDYWINE, MD. — First National Realty Partners (FNRP) has completed the refinancing of Brandywine Crossing, a 231,036-square-foot regional power retail center located in Brandywine, approximately 20 miles southeast of Washington, D.C. The four-year loan includes future funding for approved leasing expenses and the facilitation of the release of escrowed funds held by the previous lender. Since acquiring the center in March 2022, FNRP has increased occupancy from 89 percent to 95 percent by securing 12 new leases and six renewals with tenants including Marshalls, Visionworks and Salon Lofts. The firm also secured a lease with Burlington to backfill a former 25,310-square-foot JOANN Fabric and Crafts store. The next step for Brandywine Crossing will be constructing the build-outs for Burlington, Buffalo Wild Wings ‘GO’ and Another Broken Egg Café. The firm is also pursuing additional tenants and exploring outparcel sale opportunities. Brandywine Crossing sits on a 30-acre site and is anchored by a nearly 60,000-square-foot Safeway grocery store. Other existing tenants include Bonefish Grill, Panda Express, Advance Auto Parts, Truist Bank, Wells Fargo, AT&T and The UPS Store.

Dwight Mortgage Trust Provides $43M Bridge Loan for Avian Apartments in Colorado Springs

by Amy Works

COLORADO SPRINGS, COLO. — Dwight Mortgage Trust, the affiliate REIT of Dwight Capital, has provided a $43 million bridge loan to refinance Avian, a multifamily community in downtown Colorado Springs. Avian features 148 apartments, a parking garage, resort-style pool, gym and work-from-home lounges. Brandon Baksh and Talisse Thompson of Dwight Capital originated the loan for the sponsor, Jackson Dearborn Partners. Dwight closed the loan upon issuance of the initial Temporary Certificate of Occupancy. Proceeds were used to repay the project’s construction loan and fund transaction-related costs.

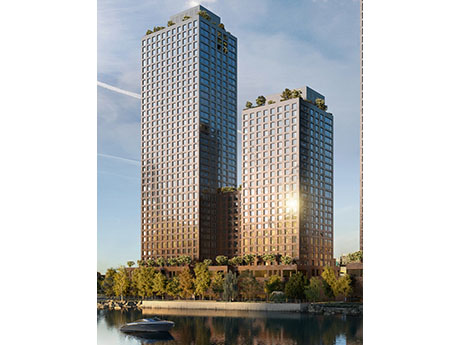

NEW YORK CITY — SCALE Lending, the debt financing arm of New York City-based Slate Property Group, has provided a $305 million construction loan for a new multifamily project in the Mott Haven area of The Bronx. The borrower is locally based development and investment firm The Beitel Group. The unnamed project will comprise two interconnected buildings that will rise 40 and 26 floors and house 755 studio, one- and two-bedroom apartments. Amenities will include an outdoor pool, large outdoor terrace, gym with sauna and steam room, pickleball court, golf simulator, coworking area, party room and children’s play room, as well as 11,500 square feet of retail space. Beitel Group bought the land at 355 Exterior St., which is situated along the Harlem River, last fall and subsequently demolished all existing structures. Prestige Construction NY is serving as the general contractor for the project, which has been vested into the city’s 421a program for inclusion of an affordable housing component. Landstone Capital Group arranged the construction loan, which carries an 18-month term with two six-month extension options, through SCALE Lending on behalf of Beitel Group. Construction is slated for a June 2026 completion. “The Mott Haven submarket of New York …

Bow River Capital Receives $70.3M Refinancing for Park84 Industrial Property in Nampa, Idaho

by Amy Works

NAMPA, IDAHO — Bow River Capital has received $70.3 million for the refinancing of Park84, a Class A industrial property in Nampa, 20 minutes from downtown Boise, Idaho. Leon McBroom, Rob Bova and Ellie Savage of JLL Capital Markets arranged the floating-rate financing for the borrower. Completed in July 2024, Park84 features seven industrial buildings totaling 605,570 square feet on 47.8 acres. The buildings, which are divisible as small as 16,917 square feet, offer 32-foot clear heights, clerestory and LED lighting, ESFR sprinklers, ample 480V power, outdoor storage and trailer parking.