LYNNWOOD, WASH. — IRA Capital has received $58 million in financing for Quail Park of Lynnwood, a 253-unit seniors housing community located at 4015 164th St. in Lynnwood. Alanna Ellis, John Chun and Zach Brantley of JLL Capital Markets Seniors Housing team placed the three-year, floating-rate senior loan with a regional bank. Additionally, Dean Ferris of JLL handled the sale of the property to IRA Capital in June 2024. Built in two phases in 2013 and 2020, the first phase consists of 131 independent living, assisted living and memory care units, and the second phase features 122 independent living and assisted living units, including 26 cottages and 16 enhanced assisted living units for a full continuum of care. Units offer studio, one- and two-bedroom floor plans, averaging 720 square feet with full kitchens. Community amenities include a fitness center, movie theater, putting green, walking trails, bistro and pub, meditation room, sustainable gardening and a host of activities, outings and social celebrations.

Loans

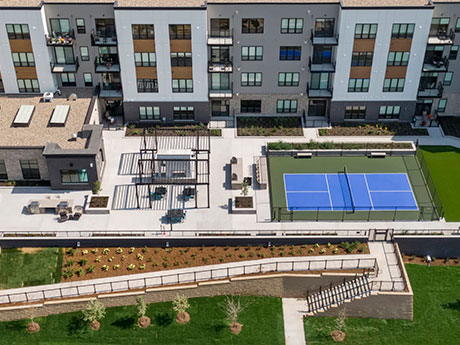

MAPLE GROVE, MINN. — JLL Capital Markets has provided a $33.2 million Fannie Mae loan for the refinancing of Risor of Maple Grove, a luxury 55+ community in the Minneapolis suburb of Maple Grove. The 169-unit property, completed in June 2023, rises four stories with a mix of studios, one- and two-bedroom units averaging 1,002 square feet. Amenities include a clubroom, golf simulator, wine bar, indoor pool and spa, pickleball court and top-floor sky lounge. Scott Loving, Scott Streiff, Gary Marchiori and Will Hintz of JLL originated the five-year, fixed-rate loan on behalf of the borrower, Roers Cos.

JLL, HJ Sims Arrange $239.7M in Tax-Exempt, Taxable Bond Financing for Three-Property Seniors Housing Portfolio in Arizona, California

by Amy Works

BUCKEYE AND YUMA, ARIZ., AND SANTA CLARITA, CALIF. — JLL and HJ Sims have arranged $239.7 million in tax-exempt and taxable bond financing for the Integrated Senior Foundation — Ativo Portfolio, a seniors housing portfolio in Arizona and California. The portfolio includes 430 independent living, assisting living and memory care units. There are two ground-up development communities and one acquisition — Ativo of Sundance in Buckeye, Ativo of Yuma in Yuma and Ativo of Santa Clarita within the Sand Canyon Plaza master-planned community in Santa Clarita. On behalf of Integrated Senior Foundation, JLL’s Seniors Housing Capital Markets team, in collaboration with the bond underwriting team of HJ Sims and JLL Securities, secured fixed-rate financing with a final maturity of 40 years. The financing consisted of $218.2 million of publicly offered tax-exempt senior series 2025A bonds, $5.9 million of taxable senior series 2025B bonds and $15.5 million of tax-exempt subordinate 2025C bonds. Slated for completion in 2027, Ativo of Sundance will feature 102 independent living units, 75 assisted living units and 30 memory care beds, while Ativo of Santa Clarita will feature 51 independent living units, 65 assisted living units and 28 memory care beds, with completion scheduled for later this year. Ativo …

NewPoint Provides $82M Acquisition Loan for Affordable Housing Property in Anaheim, California

by Amy Works

ANAHEIM, CALIF. — NewPoint Real Estate Capital has provided an $82 million Fannie Mae loan to facilitate the acquisition of Park Vista Apartment Homes, a garden-style affordable housing community in Anaheim. Los Angeles-based BLDG Partners purchased the 392-unit property, which is 100 percent mission with all units being affordable at 60 percent of the area median income or lower. Martin Fayer of NewPoint originated the fixed-rate loan, which has a seven-year term with five years of interest-only payments. Originally constructed in 1959 and renovated in 2001, Park Vista consists of 93 two-story buildings spread across 20 acres in southeast Los Angeles. Community amenities include laundry facilities, a pool and barbecue grill, as well as picnic and playground areas.

CHICAGO — Newmark has arranged a $110 million loan for the refinancing of Cityfront Place, a 39-story luxury apartment tower in downtown Chicago. The borrowers, Strategic Properties of North America and Mirae Asset Securities, acquired the 480-unit property in 2020 and implemented a renovation plan, modernizing unit interiors and common areas while maintaining occupancy above 95 percent throughout the improvement period. The renovations contributed to a more than 60 percent increase in net operating income. Positioned along the Chicago River in the Streeterville neighborhood, Cityfront Place offers studio, one- and two-bedroom units. Amenities include a fitness center, indoor pool, rooftop terrace, resident lounge, indoor parking and direct access to the Riverwalk. Charles Han, Henry Stimler, Bill Weber, Matt Mense, Dan Sarsfield and Ricky Warner of Newmark arranged the financing.

PACE Loan Group Provides $22.4M C-PACE Refinancing for Creative Office Building in Los Angeles

by Amy Works

LOS ANGELES — Center Capital Partners and Abramson Investors have received a $22.4 million C-PACE loan from PACE Loan Group to refinance improvements completed on the borrowers’ newly constructed creative office development in Los Angeles. The C-PACE loan will amortize over 30 years, allowing payback for original investments during construction. The loan will be used to retroactively finance energy conservation improvements completed during the building’s construction, including building envelope, seismic retrofits, elevators, lighting, plumbing, HVAC, irrigation and stormwater mitigations. Located at 5237 W. Jefferson Blvd., the three-story, 72,000-square-foot property offers 9,700 square feet of of private terraces, a landscaped rooftop deck with seating and a barbecue area, 176 subterranean parking spaces and open-floor plans with wraparound windows.

Naturally Affordable Housing Receives $10.1M Bridge Loan for Multifamily Property in San Diego

by Amy Works

SAN DIEGO — Naturally Affordable Housing has received $10.1 million in bridge financing for North Park Nest, an apartment community located at 4233 Kansas St. in San Diego. Brad Vansant and Ben Choromanski of JLL Capital Market’s Debt Advisory team secured the short-term floating-rate loan for the borrower. The four-story North Park Nest features 39 studio and one-bedroom units with an average size of 486 square feet and 11-foot ceilings. Amenities include air conditioning, stainless steel appliances, in-unit washers/dryers and a rooftop deck with a barbecue and lounge area.

ANTIOCH, ILL. AND LAKE GENEVA, WIS. — Greystone has provided two Fannie Mae loans totaling $15.4 million for the refinancing of a 253-unit multifamily portfolio in Illinois and Wisconsin. Each of the two garden-style properties received a $7.7 million loan. Geneva Meadows Apartments is a 108-unit community in Lake Geneva, Wis., and Antioch Manor Apartments is a 145-unit property in Antioch, Ill. Kyle Jemtrud and Wilson Molitor of Greystone originated the nonrecourse loans, which feature fixed interest rates, seven-year terms, 30-year amortization schedules and interest-only payments for the entire term of the loan.

JERSEY CITY, N.J. — BHI, the U.S. division of Israel’s Bank Hapoalim, has provided a $35 million construction loan for a 202-unit multifamily project in Jersey City. The development at 277-301 West Side Avenue will be a six-story building that will house 42 studios, 119 one-bedroom units, 32 two-bedroom apartments and nine three-bedroom residences. Ten percent of the units will be reserved as affordable housing, and the building will also feature 5,800 square feet of commercial space. Amenities will include a pool, fitness center, sauna, meditation room, rooftop terrace and outdoor grilling and dining stations. The borrower is Tay Investments.

Lynd Group Secures $132.5M Refinancing for Villas at Tuttle Royale Apartments in South Florida

by John Nelson

ROYAL PALM BEACH, FLA. — The Lynd Group has secured a $132.5 million bridge loan from MF1 Capital to refinance the construction loan for The Villas at Tuttle Royale, a multifamily project in the Royal Palm Beach suburb of West Palm Beach. New York-based S3 Capital originally provided a $126 million construction loan to Lynd Group in March 2023 for the development. Situated at 11200 Nicole Drive, The Villas at Tuttle spans 26 buildings and comprises 401 units, including 55 townhomes with private two-car garages. The garden-style community offers one-, two-, three- and four-bedroom floorplans up to 2,035 square feet in size. Amenities include a two-story clubhouse with a sauna, fitness and wellness center, coffee bar, private dining areas, game room, community catering space, two lounges, coworking pods, a business center and a panoramic outdoor terrace. Additional outdoor offerings include a recreation deck with a resort-style pool, cold plunge, spas, cabanas, fire pits, pickleball courts, bike path and a playground. The Villas at Tuttle is located within the 200-acre mixed-use Tuttle Royale project.