AIRWAY HEIGHTS, WASH. — Dwight Capital has closed a $22.5 million HUD 223(f) loan for Skyview Heights, a garden-style apartment community in Airways Heights, a suburb of Spokane. Proceeds of the loan were used to pay off the existing debt, cover closing costs, fund a replacement reserve for future capital improvements and provide a sizable cash out. The refinance also qualified for a reduced Green Mortgage Insurance Premium (MIP) to 25 basis points due to the property’s GreenPoint Rated New Home Silver Level Certification for sustainable design. McBride Capital arranged the transaction. The property features 128 apartments spread across 16 two-story buildings. The unit mix includes 32 one-bedroom units, 80 two-bedroom apartments and 16 three-bedroom units. Each apartment features granite countertops, stainless steel appliances, fireplaces and private balconies or patios. Skyview Heights also offers a single-story clubhouse and lounge, a barbecue area, pool and spa and a fully equipped fitness center.

Loans

SEATTLE — Gantry has arranged a $16.2 million permanent loan to retire acquisition financing for the Highlander Apartments in Seattle’s Pinehurst/Northgate neighborhood. The borrower is a private real estate investor, which acquired the asset in 2023 as a vacant assisted living facility and fully renovated the property into market-rate apartments. Located at 11501 15th Ave. NE, the community features 121 studio and one-bedroom apartments. Highlander offers 10,000 square feet of amenity space, including a resident lounge, media room, fitness center and furnished outdoor gathering spaces. Mike Wood, Mike Taylor and Tim Brown of Gantry secured the loan for the borrower. Highlander Apartments is currently fully leased at rents below 80 percent of the area median income, qualifying the loan for a Fannie Mae Sponsor Dedicated Workforce Housing loan.

CHAMPAIGN, ILL. — Cushman & Wakefield has arranged limited partner (LP) equity financing for the development of 505 S 5th Street, a Class A student housing project in Champaign serving students attending the University of Illinois’ Urbana-Champaign campus. The project will be located adjacent to campus and in the heart of Campustown. The development site is fully entitled and shovel-ready, with groundbreaking slated for this month. Completion is anticipated ahead of the 2026-2027 academic school year. The community will feature 241 beds and amenities such as a fitness center, yoga studio, sauna, study rooms, business center, clubroom and outdoor lounge area. Kristian Brown, Travis Prince, Shawn Lubic, Victoria Marks, Susan Tjarksen and Brendon Urban of Cushman & Wakefield arranged the financing on behalf of Hartman Capital, a Champaign-based firm specializing in student housing at the University of Illinois. Quilvest Capital Partners, a global private investment firm, provided the LP equity.

ROCHESTER, N.Y. — Northmarq has provided a $14 million Fannie Mae loan for the refinancing of Windsor Gardens, a 296-unit apartment community in Rochester. Built in 1972 and renovated in 2002, Windsor Gardens offers studio, one-, two- and three-bedroom units. Amenities include a fitness center, conference room, clubhouse, video library and onsite laundry facilities. Robert Ranieri of Northmarq originated the 10-year loan on behalf of the borrower, an entity doing business as Windsor Associates LP.

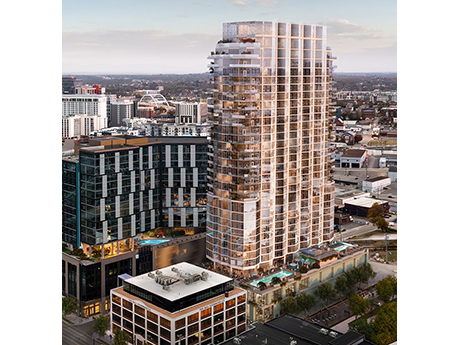

Walker & Dunlop Arranges $253M Construction Loan for Pendry Nashville Hotel and Condominium Tower

by John Nelson

NASHVILLE, TENN. — Walker & Dunlop (NYSE: WD) has arranged a $253 million construction loan for the development of the Pendry Nashville and Pendry Residences Nashville, a luxury 30-story hotel and condominium tower located in the city’s Gulch district. Pendry Hotels & Resorts, in partnership with investment and development firms SomeraRoad and Trestle Studios, plan to immediately break ground on the project. Upon completion, Pendry Nashville will include 180 guestrooms and suites, while 146 for-sale residences will be offered at Pendry Residences. The Pendry Nashville Hotel & Residences development is part of Phase III of the Paseo South Gulch master-planned micro-neighborhood, a 1 million-square-foot mixed-use district developed by SomeraRoad. Aaron Appel, Keith Kurland, Jonathan Schwartz, Adam Schwartz, Michael Diaz, Sean Bastian and Jackson Irwin of the Walker & Dunlop New York Capital Markets team arranged the loan. Bank OZK and InterVest Capital Partners provided the financing package on behalf of SomeraRoad and Trestle Studio. Jay Morrow and Carter Gradwell of the Walker & Dunlop Hospitality team represented SomeraRoad throughout the financing process, working in collaboration with the firm’s New York Capital Markets team. “Having worked with SomeraRoad to capitalize prior phases of their Paseo South Gulch master-planned development, we are …

NEWARK, N.J. — Merchants Capital has secured $120 million in construction financing for Museum Parc, a 250-unit, mixed-income multifamily project in Newark. The financing consists of a $62 million construction loan provided by parent company Merchants Bank and a $58 million Freddie Mac 9 Percent Low-Income Housing Tax Credit forward permanent loan. Museum Parc will be a two-building complex in the downtown area that will also house a 4,120-square-foot Newark Museum of Art gallery and approximately 2,300 square feet of ground-floor retail space. Twenty percent of the units will be reserved as affordable housing. Of those 50 residences, 45 will be reserved for households earning 50 percent or less of the area median income (AMI), and the other five will be reserved for households earning 30 percent or less of AMI. Amenities will include a fitness center, coworking space, game room, speakeasy lounge, commercial kitchen area and a rooftop terrace. Michael Milazzo of Merchants Capital handled the transaction on behalf of the developer, a partnership between an affiliate of L+M Development Partners and local housing operator MCI Collective.

CapMatrix Secures $37.1M Senior Loan for Optima McDowell Mountain Multifamily Property in Scottsdale

by Amy Works

SCOTTSDALE, ARIZ. — Phoenix-based CapMatrix Ltd., acting as exclusive capital markets advisors to Optima, secured a $37.1 million senior loan to provide financing for ongoing land and horizontal infrastructure improvements at Optima McDowell Mountain in Scottsdale. At completion, Optima McDowell Mountain will feature six residential towers offering more than 1,330 units of for-sale condominiums and rental units. The project is located at the southeast corner of Scottsdale Road and Loop 101 freeway. Western Alliance Bank provided the financing, which represented the first deal between Optima and Western Alliance.

Greysteel Arranges Construction Financing for Venture at Port City Apartments in Wilmington, North Carolina

by John Nelson

WILMINGTON, N.C. — Greysteel has arranged construction financing for Venture at Port City, a 225-unit apartment development in Wilmington. The borrower and developer, Indianapolis-based Millstone, expects to deliver the midrise community in spring 2027. Chris Wilkins led the Greysteel team to secure a three-year, floating-rate loan through an unnamed regional bank and an undisclosed amount of joint venture equity from an institutional real estate investment fund for Millstone. Venture at Port City will offer one-, two- and three-bedroom apartments, as well as a resort-style saltwater pool, gas grilling stations, an upscale clubhouse and a large outdoor cabana with a poolside lawn area.

NEW YORK CITY — A partnership between Brisa Builders Development LLC and PMG Affordable has received $51.7 million in financing for a 92-unit affordable housing project that will be located in the Far Rockaway area of Queens. The financing package primarily consists of $28.4 million in construction financing from Bank of America; a $12.9 million supportive housing loan from the New York City Department of Housing Preservation & Development; and $8.3 million from the New York State Homes & Community Renewal. The capital stack also includes $23.7 million in Low-Income Housing Tax Credit equity. The nine-story building at 19-19 Cornaga Ave. will offer studio, one- and two-bedroom residences ranging in size from 331 to 652 square feet, with 60 units to be designated as supportive housing units and the other 30 to serve as Federal Housing Trust units. Amenities will include a fitness center, lounge, computer room and a multi-purpose room to accommodate community programs, classes and recreational activities, as well as an outdoor courtyard with a playground. Urban Atelier Group is the general contractor for the project, and Paul Castrucci Architects is handling design. Completion is slated for late 2026.

BRAINTREE, MASS. — Atlantic Capital Partners, the debt and capital advisory arm of regional firm Atlantic Retail, has arranged a $22.2 million acquisition loan for Marketplace at Braintree, an 85,134-square-foot retail property located on the southern outskirts of Boston. The property is a three-suite condo that is currently leased to Nordstrom Rack and Ulta Beauty, and an undisclosed grocery operator has committed to leasing the third space. Stephen Joseph and Stephen Hassenflu led the Atlantic Capital team that placed the debt on behalf of the borrower, local investment firm Waterstone Properties Group. The direct lender was not disclosed.