EAST PROVIDENCE, R.I. — Lument has provided a $45.9 million FHA loan for the refinancing of Tockwotton on the Waterfront, a 156-unit seniors housing property in East Providence. Nonprofit organization Tockwotton Home Inc. owns and operates the facility, which consists of 52 skilled nursing beds, 73 assisted living units and 31 memory care units. Aaron Becker of Lument originated the loan, which was structured with a fixed interest rate and a 35-year term.

Lument

Lument Funds $25.1M in Fannie Mae Financing for Affordable Housing Portfolio in Colorado

by Amy Works

LAKEWOOD, ARVADA, DENVER AND FOUNTAIN, COLO. — Lument has closed five Fannie Mae conventional multifamily housing loans totaling $25.1 million to refinance the Archway Portfolio, five affordable housing communities near Denver and Colorado Springs. The borrower is Archway Communities, which manages the portfolio. Andrew Ellis of Lument led the transactions. Fountain Ridge, the largest of the portfolio, received a 10-year loan with a fixed interest rate and a 30-year amortization schedule. The other four loans feature fixed interest rates, 12-year terms, two years of interest-only payments and 30-year amortization schedules. The portfolio includes the 72-unit Foothills Green in Lakewood, the 60-unit Willow Green in Arvada, the 65-unit Sheridan Ridge in Arvada, the 60-unit Arapahoe Green in Denver and the 111-unit Fountain Ridge in Fountain.

SANTA ROSA BEACH, FLA. — Lument has provided a $48.8 million Freddie Mac conventional loan to refinance Sanctuary at 331, a 264-unit multifamily community in Santa Rosa Beach. Steve Beltran of Lument led the loan transaction on behalf of the borrower, an affiliate of Hunt Cos. The loan features a 10-year term, 30-year amortization schedule and a low fixed interest rate with 60 months of interest-only payments. The loan is a refinance of an existing HUD loan. Sanctuary at 331 features 11 buildings on nearly 32 acres. The apartment property offers one- and two-bedroom floorplans with features such as stainless steel appliances, private patios and in-unit washers and dryers. Community amenities include a 24-hour fitness center, swimming pool, clubhouse, a dog park and garage storage units. Cushman and Wakefield manages the property, which was 97 percent occupied at the time of the loan transaction.

WASHINGTON, D.C. — Lument has provided two Freddie Mac tax-exempt loans (TEL) totaling $16.9 million for the development of 1515 North Capitol Apartments, a 15-story affordable housing development in Washington, D.C. Construction for the project is slated to be complete in 27 months. The borrower is So Others Might Eat (SOME), a Washington, D.C.-based local nonprofit organization that provides services to those facing poverty and homelessness. 1515 North Capitol will feature 136 affordable studio units, with 75 units subsidized through D.C.’s Local Rental Supplement Program (LSRP), 61 units restricted to tenants earning 50 percent of area median income (AMI) and three units reserved for staff. The units features will include vinyl plank flooring, ranges with vented hoods, microwave ovens and garbage disposals. Community amenities will include a community room, conference and meeting rooms, classrooms, library, computer room, fitness center, bike storage, two roof terraces and a laundry room on every residential level. Lument structured two portions of debt for the Freddie Mac TEL. The first part of financing was in the amount of $11.8 million and featured a 17-year term and 40-year amortization schedule. The other loan was in the amount of $5.1 million based on the LSRP overhang to …

ATLANTA — Lument has provided a $17.5 million proprietary bridge loan to refinance The Peach, a recently renovated, 68-unit high-rise apartment community in Midtown Atlanta. R.J. Guttroff of Lument led the transaction. The loan features a two-year term with two six-month extension options, along with a floating interest rate. The sponsor was not disclosed. Originally built in 1964 as an office building, The Peach underwent a renovation earlier this year to reposition the property to multifamily. The Peach offers one- and two-bedroom floor plans with a monthly rent range of $1,525 up to $6,500, according to Apartments.com. Unit features include luxury flooring, stainless steel appliances, wood cabinetry, in-unit washers/dryers and patio and balconies with views of Atlanta’s Midtown and Buckhead neighborhoods. Community amenities include a business center, conference rooms and a pet play area. Located at 1655 Peachtree St. NE, The Peach is located less than a half-mile from Savannah College of Art and Design (SCAD), 1.6 miles from the Georgia Tech campus and 3.2 miles from downtown Atlanta.

DALLAS — Lument has provided $47.1 million in financing for The Oaks, a mixed-income seniors housing project in Dallas. The package consists of $25 million in short-term bonds and $22.1 million in Freddie Mac permanent financing. The Oaks will consist of 260 units for residents aged 62 or older. Over 90 percent of the units will have income or rent restrictions, with 216 units serving seniors earning at or below 60 percent of the area median income (AMI) and 27 units serving seniors earning at or below 30 percent of AMI. Construction is expected to be complete in 2023. Upon stabilization, the Freddie Mac loan and tax credit equity will be used to pay off a $35 million construction loan from a national bank. The borrower is a partnership between DHA Housing Solutions for North Texas and the Volunteers of America National Services. Tracy Peters and Dale Giffey led the transaction for Lument.

Affordable HousingContent PartnerFeaturesLumentMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasVideoWestern

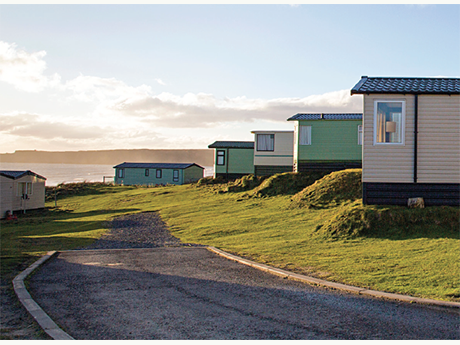

Manufactured Housing Communities Garner Investor Interest

Interest in affordable paths to homeownership and the growing popularity of lower density living are raising the profile of the manufactured housing option among American households and investors. At the same time, the government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac are making concerted efforts to better serve this historically underfinanced market at both the individual homeowner and community levels. The combination of robust cash flow growth (particularly in Sunbelt and Western markets), cap rate compression, and liquidity provided by the GSEs makes a compelling case for manufactured housing community (MHC) acquisitions and refinances. As increased competition has left market participants looking for an edge amidst compressing cap rates, the importance of working with an experienced MHC lender with access to short- and long-term loan programs has become more apparent. The following provides an in-depth analysis of the recent performance of rental MHCs, sales volume and pricing trends, and loan and underwriting trends in the MHC space. The Performance of the Site Rental Market The COVID-19 pandemic affected American housing preferences in profound ways. Increasingly, households are seeking lower density options with larger floor plans, home offices, and dedicated space for entertaining or distanced learning. This phenomenon …

KINGWOOD, TEXAS — Lument has provided a $37.8 million loan for the refinancing of Paramount at Kingwood, a 372-unit apartment community in the northern Houston suburb of Kingwood. The property offers one-, two- and three-bedroom units and amenities such as a pool, fitness center and a clubhouse. The loan carried a fixed interest rate and a three-year term. The borrower, San Antonio-based investment firm LYND Co., will use a portion of the proceeds to fund capital improvements. Marc Suarez led the transaction for Lument.

NEW YORK CITY — New York City-based Lument has launched an investment sales and advisory group dedicated to affordable housing. Cliff McDaniel will head the initiative and serve as senior managing director. McDaniel’s team includes managing directors Derek DeHay and Chris Bergmann. They will join Timothy Bracken, also a managing director, who moved to Lument earlier in 2021, as founding members of the group. Lument is a commercial real estate finance company comprised of legacy firms Hunt Real Estate Capital, Lancaster Pollard and RED Capital Group. Lument is an FHA, Fannie Mae, Freddie Mac and proprietary lender. The investment sales and advisory functions of the new group will complement existing financial services. According to McDaniel, the affordable housing team will provide access to thousands of lending, asset management and LIHTC relationships that Lument has established over the years.

PORTER, TEXAS — Lument has provided a $32.3 million bridge loan for the acquisition of Villas at Valley Ranch, a 312-unit apartment community located in the northeastern Houston suburb of Porter. Units feature one- and two-bedroom floor plans, and amenities include a pool, clubhouse, fitness center, conference room and a theater room. The loan carried a fixed interest rate and a three-year term. The borrower, San Antonio-based investment firm LYND Co., will use a portion of the proceeds to fund capital improvements. Marc Suarez of Lument led the transaction.