— By Richard Schwartz of SRS Real Estate Partners — The Inland Empire industrial market has undergone significant recalibration over the past 24 months, moving from the “too hot” environment of 2022 and 2023 marked by record construction and rent escalation to a period of normalization. Construction-driven vacancy has pushed the market into a digestion phase, marked by softening rents, adjusting sale prices and a reset in landlord-tenant expectations. These dynamics will unlock new opportunities as we enter 2026. Limited New Development Creates Breathing Room CoStar data compiled by SRS shows that new construction peaked in 2023 with about 29.5 million square feet delivered. This was followed by 17.8 million square feet in 2024 and an expected 16 million square feet in 2025. Deliveries are projected to fall to roughly 10 million square feet in 2026, making it the lightest post-pandemic year of new supply. This delivery includes several notable projects, such as Amazon’s 2.5-million-square-foot “middle-mile” facility in Hesperia, a 650,000-square- foot storage facility in Desert Hot Springs and a 1.2-million-square-foot facility in Apple Valley that’s leased to Lecangs. This means that more than half of the Inland Empire’s 2026 construction pipeline is already pre-leased, reducing speculative exposure while accelerating the rise …

Market Reports

— By J.C. Casillas of NAI Capital — The Inland Empire office market continues to show signs of recovery, with broad-based tenant demand pushing occupancy higher and absorbing vacant direct space. While landlords are holding asking rents steady to capitalize on the improving environment, direct vacant space decreased 3.2 percent quarter over quarter and 16.4 percent year over year. Vacant sublease space fell a solid 4.5 percent quarter over quarter, though it nearly doubled year over year to 135,149 square feet at year-end. Renewed tenant activity continues to chip away at vacant space, reinforcing the recovery. In fourth-quarter 2025, net absorption — driven primarily by direct space — totaled about 557,000 square feet for the year, marking a meaningful milestone in the market’s rebound. The vacancy rate edged down 10 basis points quarter over quarter, supported by 106,095 square feet of space coming off the market. It now stands at 4.7 percent, 80 basis points lower than a year ago. Stabilization has been supported by shifting workplace strategies and evolving remote work patterns. Since the economy reopened following the pandemic, occupied office space has increased by nearly 2.1 million square feet, surpassing pre-pandemic levels. Sublease vacancy has fallen 22.5 percent …

— By Cray Carlson of CBRE — The Inland Empire multifamily market remains one of the premier markets to invest in across Southern California, benefiting from ample land availability and less restrictive regulations than many neighboring markets. Still, like many markets, there was a disconnect between buyers and sellers in 2024 and 2025 due to interest rates. It remains psychologically difficult for investors to sell a property with an existing 3.5 percent interest rate and complete a 1031 exchange into an asset carrying a 6 percent rate. That spread creates a meaningful mental hurdle, and has prevented many owners from disposing of their properties. That hesitation, however, has not erased opportunity. There are still great opportunities in the market, even with a 6 percent interest rate. The economic fundamentals remain strong, and cap rates have increased even amid higher interest rates. Cap rates have climbed since last year, and there are still great returns to be had. While many investors continue to struggle with the reality of higher borrowing costs, escalated interest rates are not going anywhere in the near term. In 2024, the Inland Empire recorded 74 multifamily transactions of eight units or more. As of the beginning of …

— By Bill Asher of Hanley Investment Group Real Estate Advisors — The Inland Empire continues to demonstrate its resilience as one of Southern California’s most dynamic retail investment markets. In the third quarter of 2025, transaction activity accelerated, pricing held firm and cap rates compressed, underscoring investor confidence in the region’s long-term fundamentals. Even with vacancy rising and rent growth moderating, investment trends point to a market adjusting as capital continues to favor necessity-based, internet-resistant formats. According to CoStar, 73 retail properties traded in third-quarter 2025 compared to 48 in the same quarter of 2024. Average cap rates declined from 7.2 percent to 6 percent year over year, signaling stronger pricing and heightened demand. Single-tenant net lease properties led the surge, with 46 transactions in third-quarter 2025 versus 28 a year earlier. Average cap rates tightened to 5.9 percent, down from 6.8 percent in third-quarter 2024. Multi-tenant retail also showed healthy demand, with 22 properties sold in third-quarter 2025 versus 20 in third-quarter 2024, and average cap rates compressed from 7.4 percent to 6.2 percent. This momentum reflects a convergence of factors that shaped the second half of 2025. Pent-up demand and impatient capital deployed equity as many sellers …

— By Sebastian Bernt of Avison Young — The San Diego office market is beginning to stabilize in 2025. However, recovery remains uneven amid elevated vacancy, rising sublease availability and evolving workplace strategies. While quarterly leasing activity has improved modestly— up roughly 7 percent year over year through the second quarter — overall fundamentals remain challenged. San Diego’s total office availability rate stands at 18.2 percent as of the second quarter. This is flat from the previous quarter but still up more than 500 basis points from pre-pandemic norms. Sublease availability exceeds 2.2 million square feet, a lingering effect of corporate downsizing and the continued shift toward hybrid work models. Sublease inventory is most concentrated in suburban nodes such as UTC and Sorrento Mesa, as well as Downtown San Diego. Demand remains strongest for Class A assets in suburban submarkets like UTC, Del Mar Heights and Sorrento Valley where tenants prioritize modern, amenity-rich properties. Even within these markets, average deal sizes have declined by 20 percent to 30 percent compared to 2019 levels, with users often consolidating space and seeking shorter lease terms. Downtown San Diego continues to face pronounced headwinds, with vacancy topping 25 percent in several Class B …

— By Bryce Aberg and Brant Aberg of Cushman & Wakefield — Optimism is returning to the San Diego industrial market after a few quarters of recalibration. Buyer appetite has resurfaced in core submarkets like Otay Mesa, Miramar and Carlsbad, which has created a ripple effect across the Greater San Diego industrial market. With an inventory of 162 million square feet as of the second quarter, San Diego is beginning to see the benefit of limited supply. Natural barriers like Mexico, the Pacific Ocean, Camp Pendleton and the nearby mountains are driving the San Diego industrial market toward full build-out. There is currently only 2.4 million square feet of inventory under construction, with not much more proposed. Following the all-time highs in rent growth and positive absorption seen in 2021 and 2022, San Diego’s enduring fundamentals and built-in advantages have kept it in place as one of the most stable and competitive in Southern California. With a diversified tenant base, high barriers to entry and a strategic position on the U.S.-Mexico border, fundamentals have held while others in the Southern California region have struggled in comparison. Bid-ask spreads are also starting to narrow as buyer and seller sentiments begin to …

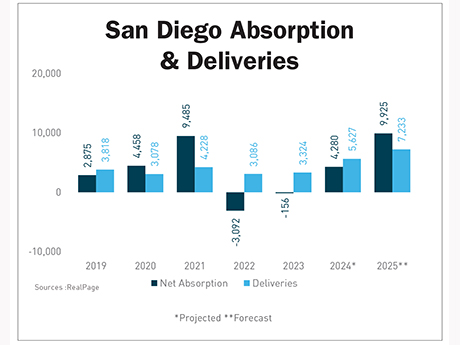

— By Berkadia — San Diego’s apartment market is poised to strengthen in 2025, with demand poised to set a record and fundamentals outperforming most other major California metros. This is a welcome change from 2024, where a slower leasing environment for Class A properties led to more concessions. The big story is demand. More than 9,900 net units are expected to be leased this year, surpassing the previous high of 9,500 in 2021. This figure will also outpace what is likely to be a record year for new deliveries, with 7,233 units slated to debut this year across the metro. By year-end, occupancy is projected to climb to 96.3 percent, up 90 basis points from 2024 and above the market’s 10-year pre-pandemic average. That puts San Diego ahead of Los Angeles, San Francisco-Oakland and San Jose on the occupancy leaderboard. Effective rent is expected to rise 3.1 percent year over year to a projected $2,868, marking a solid improvement from last year’s flat performance. Fundamentals Point to a Solid Year Employment growth remains a tailwind. The metro added 16,200 new jobs between May 2024 and May 2025, pushing total employment to nearly 1.6 million. That economic momentum is supporting …

— By Bryan Cunningham of JLL — The retail sector continues to be a bright spot for commercial real estate in San Diego County. Despite financial headwinds that include interest rates, construction costs and increases in operating costs like labor and insurance, the resiliency of the consumer has allowed retailers and restaurants to continue to generate substantial sales volumes. Both national and regional retail and restaurant tenants continue to expand, although more cautiously than in years past. Retail vacancy rates in San Diego continue to hover around 5 percent, with the more desirable coastal communities closer to 3 percent. The lack of new development due to geographical constraints, as well as interest rates and construction costs, is driving expanding tenants to look purely at second-generation retail centers. While the retail tenant pool is somewhat shallow due to bankruptcies by Bed Bath & Beyond, 99 Cents Only, Party City, JoAnn Stores and the like, the lack of new product is keeping well-positioned shopping centers in high demand. Most grocery- and big box-anchored shopping centers are enjoying rents at record levels with very little vacancy. Retail centers continue to be at the forefront of interest from investors as well. While interest rates …

— By Chris High, Steve Bruce and Conor Evans of Colliers — We’re in the middle of a market recalibration. On the office side, leasing has slowed significantly, with tenants downsizing footprints and pushing for shorter terms as hybrid work remains a dominant driver. In life sciences, we saw explosive growth from 2020 to mid-2022, but that pace has tapered off. VC funding is more selective, and some developers who stretched to convert commodity office and flex properties into lab space, often with less-than-ideal infrastructure, during the boom years, are now rethinking those strategies. Still, demand for high-quality, fitted lab space remains, especially in well-located projects by experienced owners like Longfellow, BioScience Properties, Sterling Bay, Healthpeak, BioMed, and ARE. These firms are adapting with thoughtful repositioning and delivering product that aligns with where tenant demand is today. In the near term, we expect continued headwinds. Commodity office space will face pressure on rents and absorption, while high-end life science campuses with strong sponsorship will be better positioned to attract demand. We expect Life Science to rebound in the next 12 to 18 months as capital markets settle and merger/acquisition (M&A) activity returns. Distressed office sales may continue as debt maturities …

— By Kalli Knight of Colliers — The Los Angeles multifamily market faces several headwinds, including rising expenses, the aftermath of recent fires, insurance exclusions and Measure ULA. These factors impact transaction volumes, leading many investors to remain on the sidelines. However, Southern California and Los Angeles will continue to have strong fundamentals, attracting a unique pool of buyers. This includes qualified, high-net-worth family offices eager to take advantage of limited competition to acquire new construction at prices below replacement costs or favorable debt terms. Management companies are increasingly critical in supporting property stabilization post-pandemic, with a growing urgency to enhance operations and increase net operating income. As construction loans mature, their impact on property stabilization is significant. Though the concession rate of 0.7 percent is significantly less than the national concession rate of 1.1 percent, many developers now offer four to six weeks of concessions to lease properties and meet projected rents outlined in their financial analyses. Some developers have also opted for creative strategies, such as providing customized closets to attract renters at higher luxury price points instead of relying solely on weekly concessions. Vacancy rates in the market vary, but have generally improved since 2024. They have …

Newer Posts