More than seven months have passed since Liberation Day, where the Trump administration declared a sweeping package of tariffs for foreign trade partners and specific commodities, including steel and aluminum. Since the announcement in early April, there has been a boon in the amount of multibillion-dollar advanced manufacturing, life sciences, semiconductor and data center investment announcements around the country, with the markets along the I-85 Industrial Corridor being no exception. To name a few: Toyota has recently begun production at its $13.9 billion battery plant in Liberty, N.C.; Rivian broke ground on its $5 billion electric vehicle plant near Social Circle, Ga.; JetZero is planning to create 14,500 jobs for an aerospace manufacturing facility in Greensboro, N.C.; Eli Lilly is developing a $5 billion pharmaceutical manufacturing facility in the Richmond suburb of Goochland County, Va.; and Google is developing a trio of data centers in metro Richmond’s Chesterfield County. “We have incredible momentum bringing business back into the United States, which is going to drive industrial growth, particularly in the Southeast,” says Jim Anthony, CEO and founder of APG Companies. “We’re not unionized, we have lower taxes, fewer regulations and lower cost of energy, which is huge factor in site …

Market Reports

AlabamaGeorgiaIndustrialMarket ReportsNorth CarolinaSouth CarolinaSoutheastSoutheast Market ReportsVirginia

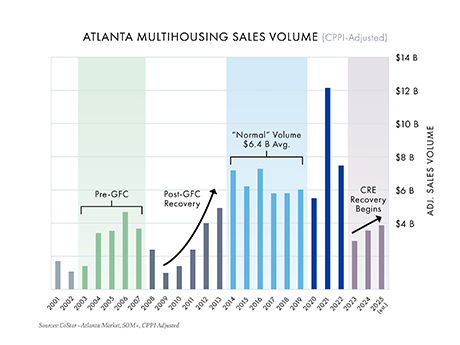

Atlanta’s multifamily market has been in a slump that would even make Braves fans wince. After peaking with record-breaking sales in 2021, volumes slid as borrowing costs climbed and supply piled up. But just like any good ballclub, the fundamentals matter, and the data suggests momentum is quietly building for a 2026 comeback season. Sales volume trends According to research from CoStar Group, institutional multifamily sales in Atlanta (transactions of $50 million or more) peaked in 2021 at $12.8 billion, driven by record pricing, historically low borrowing costs and robust rent growth. Since then, record supply, rising expenses and a sharp increase in borrowing costs have pushed sales volumes down by more than 70 percent, averaging just $3.5 billion annually over the past three years. While the broader U.S. economy has surged since 2022 — the S&P 500 has climbed 45 percent since fourth-quarter 2022 — commercial real estate has been searching for its bottom. Data now suggests that Atlanta has reached this inflection point, and history indicates increased activity and rising values in the years ahead. Parallels to the GFC Looking back at the global financial crisis (GFC) provides valuable context. The chart above (inflation-adjusted using Real Capital Analytics’ …

If you’ve spent any time driving around Atlanta recently, you’ve probably noticed something. More development sites are returning with bulldozers and developers are taking down land parcels in the suburbs the size of small European countries. But this time, the approach is more strategic than ever. Gone are the days when a developer would carve out a shopping center for base rents less than $40 per square foot and call it a day. Today, some metro Atlanta developers are assembling larger tracts and creating hybrid projects that include multifamily housing, storage and even industrial uses in the back of the parcel, saving the front-facing road frontage for ground leases, build-to-suits and limited shop space. Automotive and restaurants concepts are clamoring for pads. The result? Those once-overlooked “front and center” pad sites and strip centers are suddenly the belle of the ball. The downside is paying too much on the buy side for the dirt for aggressively low caps rates. But all I can say for the rental rates that I’m seeing is “Wow.” Restaurants still lead In Atlanta’s retail market, restaurants continue to be the leading driver of leasing activity. According to observations, excluding junior box space, food-and-beverage deals made …

After several years of breakneck growth, Atlanta’s industrial sector has clearly shifted into a mid-cycle recalibration. Vacancy has climbed to 8.4 percent, well above the 10-year average of 5.8 percent, as a record wave of big-box deliveries collides with softer demand. Twelve-month net absorption turned negative for the first time since 2011, dropping 453,000 square feet despite 14.9 million square feet of new deliveries over the past year. Developers and tenants alike are adjusting, but the region’s logistics advantages and diverse economy keep long-term fundamentals intact. Supply and demand The pandemic-era surge of speculative construction has decisively slowed. Construction starts have fallen roughly 70 percent from the five-year average, leaving 16.3 million square feet under construction, with just 25 percent available — down from 60 percent a year ago. Most large projects are now data centers, such as a 1.5 million-square-foot QTS facility in Fayette/Coweta County and a 1.2 million-square-foot Microsoft data center near Hartsfield-Jackson Atlanta International Airport. Vacancy is rising fastest in submarkets that saw heavy new supply. Kennesaw/Acworth, for example, has added over 9 million square feet since 2023 and now posts about 13 percent availability for buildings sized 200,000 square feet and larger. Sublease availability has grown …

Atlanta’s commercial office market is at a pivotal moment, caught between signs of stabilization and the lingering effects of a post-pandemic reset. Vacancy remains elevated, absorption is improving and tenant preferences continue to evolve — but fundamentals are beginning to shift as the market adjusts to the new workplace. Signs of a bottom? Hybrid work models, space optimization strategies and cautious expansions have elevated metro Atlanta’s office vacancy rates. Direct vacancy rates surpassed 24 percent for the first time and are hovering near all-time highs. Meanwhile, sublease availabilities have declined over 25 percent from their peak in 2023, and quality space remains difficult to find. The slowing pace of vacancy increases suggests the market may be nearing a turning point after recording negative annual absorption in four of the past five years. Net absorption, a key indicator for overall office sector health, totals negative 438,000 square feet, according to Colliers’ second-quarter 2025 report. While still in the red, this marks a significant improvement over previous years. Recent leasing activity suggests even more positive movement in the second half of the year, indicating that tenant departures are tapering and space givebacks are moderating. Leasing: quality vs. quantity Despite economic headwinds, leasing …

Five years after the world shut down, the national multifamily market is still on a roller coaster ride. After the highs of 2021 quickly turned into the lows of 2023, the dust settled in 2024. Today, the market has begun to reactivate while continuing to grapple with the aftereffects of the run-up. While national multifamily transactions soared 22 percent in 2024, Atlanta transaction volume was flat year-over-year as the investment community shifted a favorable view of Atlanta toward ambivalence. Perceptions surrounding new supply and non-paying tenants contributed to the city falling out of vogue with some investors, but Atlanta is a resilient market. With new deliveries having peaked in 2024 and property-level fundamentals rapidly turning the corner, Atlanta may be beaten up, but the light at the end of the tunnel is coming into focus: Atlanta is still a long-term winner. Days of peak supply are over While Atlanta experienced a record 24,000 units delivered in 2024, that figure represents just 4 percent of its total inventory. When compared to other Sun Belt markets like Charlotte (10 percent of total inventory delivered in 2024), Nashville (8 percent) and Dallas (5 percent), the number doesn’t seem as jarring. Looking ahead to …

Tenants are battling it out for Atlanta’s top-tier office space as trophy availability tightens and new office construction draws to a halt. With no end to the flight-to-quality trend in sight, Class B assets accounted for a whopping 70 percent of the market’s overall negative absorption (-736,682 square feet total net) in the first quarter of 2025, while Trophy assets recorded positive absorption (+114,579 square feet). Furthermore, office buildings that delivered between 2016 and 2021, which amount to almost 14 million square feet of space, currently average 92 percent occupancy. This underscores the growing divide between the haves and have-nots in Atlanta’s office market. Premium space in demand As office leasing activity reaches its highest level since 2019, decision-makers face a rapidly evolving landscape where securing the right space requires a highly motivated and strategic approach. With rising attendance mandates, workforce expansion and a limited supply of premium office space, competition for the best locations is intensifying. In Atlanta, submarkets like Midtown and Central Perimeter continue to outperform. Mini submarkets surrounding mixed-use districts like Avalon and The Battery (i.e. “urban-edge” in the suburbs) are also in high demand among tenants craving walkability and upscale amenities in the metro’s most sought-after …

The last four quarters in the Atlanta industrial market were something akin to a good old-fashioned roller coaster ride at the historic Southeastern Fairgrounds! The absorption, activity and new construction sectors all went for a somewhat bumpy ride this past year. What’s happening? First, the quarterly absorption numbers for the Atlanta industrial market have been anything but steady. Eight quarters ago there was 7.9 million square feet of positive net absorption, followed by five negative quarters in a row (totaling 13.2 million square feet), then came two positive quarters (totaling 7 million square feet) and then back down to 2.8 million square feet of negative net absorption for the first quarter of 2025. The annual absorption numbers were up and down as well. The last four quarters yielded 2.2 million square feet of positive net absorption, but a year ago, at this same time, the absorption numbers plummeted down to a negative 11.3 million square feet. Two years ago, the industrial market experienced 32.5 million square feet of positive net absorption. Second, the activity numbers also were up and down. The second quarter of 2024 recorded 14.4 million square feet of activity, but that number dropped to 13.6 million …

Atlanta’s retail market is proving it knows how to adapt, evolve and outperform, even in the face of macroeconomic headwinds. Despite a moderation in leasing and investment sales activity in recent quarters, the city’s fundamentals remain strong. Vacancy rates are at historic lows, rent growth is outpacing the national average and population and income growth continue to fuel long-term demand. Demand and demographics With vacancy rates consistently under 4 percent, Atlanta remains one of the tightest retail markets in the country. The appetite for well-located retail space hasn’t waned, even as broader economic uncertainty has slowed transaction velocity. In fact, strong absorption numbers and a limited supply pipeline have bolstered landlord confidence and pricing power across the metro. What’s driving this resilience? A booming population, rising household incomes and a steady influx of corporate relocations. Employers like Microsoft, Google and Cisco are expanding their footprints, bringing with them jobs, workers and spending power. Some of this growth has been particularly noticeable in Midtown. Redevelopment playbook Instead of ground-up development, Atlanta’s growth strategy has increasingly focused on reinventing aging retail centers in prime locations. With construction costs high and land increasingly scarce, developers opt to reimagine what already exists. These projects …

Atlanta remains one of the most desirable markets in the country for investors due to its diverse economy, below-national average unemployment rate, steady increase in jobs and population growth. These market fundamentals have translated to a well-performing multifamily market that, despite short-term macro challenges, is in a unique favorable position due to its relatively low supply compared to other peer Sunbelt markets. Demand for multifamily has seen a rebound in 2024 and Atlanta has been resilient in the middle of a multi-year supply wave. Over the past two years, the market delivered approximately 35,000 units and that number is expected to drop to just 9,000 units in 2025 and less than 4,000 units in 2026. This will lead to tightening occupancies and strong rent growth. The city has already recorded its seventh consecutive quarter of net positive net absorption as of the second quarter of 2024, which is a quarterly high since mid-2021 at 5,799 units. New development, on the other hand, has been a bit more challenging due to the higher return on cost requirements, flat rent growth and a lack of meaningful relief on construction costs. Market valuations for newly constructed assets are near current replacement cost, which …

Newer Posts