Atlanta’s office market feels like a story of winners and losers. Tenants continue to pay increasing rents for the best located, highest-quality spaces while the sector overall experiences negative office absorption. Those big, shiny objects, so to speak, offer quite a contrast to the results of continued office sector adversity brought on by reduced office attendance, a downsizing leasing trend and swelling sublet space. Who’s in the best position to win? Well-capitalized owners with stabilized debt (or none) that can meet the increasing tenant demands for skyrocketing tenant improvement costs and other rental concessions. With continued construction cost increases and downward pressure on base rental rates, fiscally sound landlords with longer-term business plans are in the best position to transact. And, of course, the newest buildings with the best location, amenity package and a reasonable commute for the majority of the workforce continue to thrive. CoStar Group reports that during the past 12 months, net absorption in office buildings completed before 2020 was negative 4 million square feet compared to 1.1 million for newer properties. The Atlanta office market has produced some sizable transactions this year, fueling some optimism among landlords with larger blocks of space for lease. The most …

Market Reports

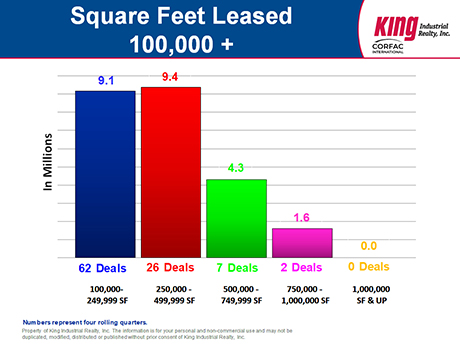

As the Atlanta industrial market continued its slowdown as of the end of the second quarter in 2024, there were three main stories to consider. First, the biggest news was that the Atlanta industrial market experienced four quarters of negative net absorption of 8.8 million square feet during this past year (we have had five quarters in a row.) At the same time in 2023, we reported 17.2 million square feet of positive net absorption, and in 2022, we reported 42.7 million square feet of positive net absorption, so these latest negative absorption numbers were a huge drop from the previous positive absorption numbers. The second biggest news story was that the Atlanta industrial market saw a dramatic slowdown in big-box deals. There were only nine transactions that were consummated over the past four quarters that were 500,000 square feet or larger, and none of those deals were over 1 million square feet. In contrast, in 2023, 21 big-box transactions were completed that were over 500,000 square feet, and 11 of those deals were 1 million square feet or larger. The year-over-year decline was 15 million square feet less. The third biggest news story was that the new construction …

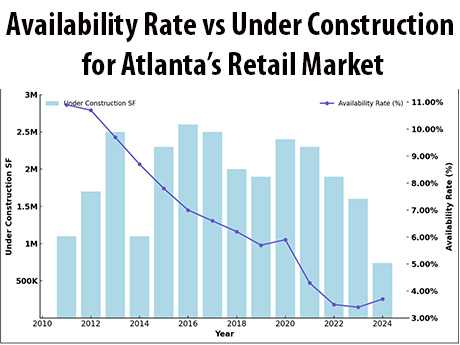

The Atlanta retail market continues to thrive with significant growth driven by a combination of strong demand, minimal new construction and low inventory levels. Long regarded as a key hub for commerce in the Southeast, metro Atlanta has seen its population increase rapidly over the years, which has, in turn, bolstered retail demand. As a result, Atlanta’s retail availability has hit record lows and has created a competitive market for tenants looking to secure high-quality spaces. Rental rates have increased, and investment sales volume has continued at a healthy pace as tenants vie for a limited amount of inventory. Rising rents, investment sales One of the standout trends in Atlanta’s retail market is the consistent increase in rental rates. Retail rents in the metro area have grown steadily over the past few years, with average rents rising from $21.07 per square foot in first-quarter 2023 to $22.83 per square foot by third-quarter 2024. This represents an impressive 5.2 percent year-over-year growth, significantly outpacing the national average of 2.4 percent. The city’s growing population and economic development have spurred greater demand for retail spaces, especially in high-traffic areas. Retailers are willing to pay premium rates to secure space in desirable locations, …

FloridaGeorgiaMarket ReportsNorth CarolinaSouth CarolinaSoutheastSoutheast Market ReportsStudent Housing

Universities, Student Housing Properties in Southeast Contend with Hurricane Helene

by John Nelson

Hurricane Helene made landfall in Northwestern Florida on Thursday, Sept. 26, after being upgraded to a major Category 3 storm that afternoon. Widespread damage across a number of Southeastern states followed in its wake, with many areas experiencing flooding, downed trees, power outages and road closures. At least 175 people have died across six states, according to reports by CNN and The New York Times, and officials fear that the death toll is likely to rise with many remaining missing. Hundreds of roads remain closed across the Southeast — especially in Western North Carolina and East Tennessee, which were hit particularly hard by the hurricane — hampering the delivery of supplies, and more than 2 million customers remain without power. Student Housing Business reached out to universities, owners, operators and students across the Southeast to check in on how they fared during the storm and their experience in the aftermath. Owners, Operators Weigh In Denver-based Cardinal Group tracked its communities in Alabama, Arkansas, Florida, Georgia, Kentucky, North Carolina, South Carolina, Tennessee, Virginia and West Virginia through Hurricane Helene. “Of those communities, four experienced power outages and several had minor roof leaks and flooding, with the largest impact felt in Asheville and Boone, North Carolina,” says Jenn Cassidy, president of property operations …

Remember the “retail apocalypse”? Fast forward to today and it seems to be quite a different story. Retail is currently viewed by many as the most attractive sector within the commercial real estate industry, due in part to an all-time low vacancy rate and increasing rental rates. Atlanta’s retail vacancy rate has dropped to 3.6 percent, which is the lowest rate on record according to CoStar Group. The low vacancy rate coupled with an extremely limited amount of new retail space under development due to high construction costs has created a market unlike anything we have seen in a long time. Increased construction costs along with higher interest rates have made it cost-prohibitive to build traditional retail power centers; however, grocery-anchored retail is the anomaly with Publix taking the lead. Several mixed-use developments that include a large retail component are underway as well, including High Street in Dunwoody, Medley in Johns Creek and Centennial Yards in downtown Atlanta, just to name a few. Additionally, some retail space has been taken off line as malls reinvent themselves. Examples include the partial demolition of North DeKalb Mall in Decatur to make way for a new mixed-use development known as Lulah Hills; Northlake …

By Charlie Adams and Walker Adams of NAI Brannen Goddard Industrial real estate in Atlanta is in limbo as of the second quarter of 2024. Certain submarkets in Atlanta have been overbuilt and tenant demand with historically active users (third-party logistics, wholesale, e-commerce, etc.) has decreased in comparison to what was seen over the last four years. As a result of the space grab during COVID-19, many logistics tenants are sitting on excess inventory within their buildings. Consumer demand has cooled, increased interest rates have dampened the economy as a whole and rents have risen 14.5 percent year-over-year, according to CBRE’s most recent report. The impact of these headwinds for traditional industrial (warehouse and distribution) real estate is positive. Developers haven’t had the fundamentals allowing overbuilding to a point of hyper-supply. Industrial construction starts have been few and far between over the past 12 months, and we believe this lack of new supply will keep Atlanta’s fundamentals healthy through this limbo we’re currently experiencing. With 4 million square feet of net absorption in first-quarter 2024 and 15.9 million square feet under construction, we should see 2025 vacancy in line with current vacancy, assuming absorption continues at a similar pace. Therefore, …

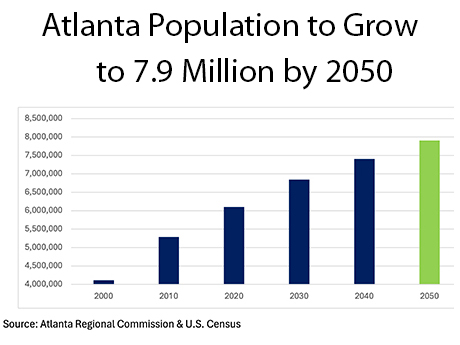

By Will Mathews and Mike Kidd of Colliers What is the reason behind Atlanta’s explosive growth over the last 20 to 30 years? Simply put, it’s been the exponential increase in population driven by an influx of new residents from the Northeast, Midwest and Mid-Atlantic. Atlanta is home to 17 Fortune 500 companies (the third-largest market in the nation), numerous high-paying jobs, a culturally diverse population and multiple prestigious universities, laying a strong foundation for incredible net migration. Multifamily investors are drawn to Atlanta, evidenced by the region’s high volume of multifamily transactions. According to MSCI Real Capital Analytics, Atlanta is currently ranked No. 4 in the country behind New York City, Dallas and Los Angeles in transactions. Despite challenges related to new supply and systematic traffic problems, the future of Atlanta’s multifamily market is very bright for a number of reasons. 7.9 Million by 2050 According to the Atlanta Regional Commission, the population of Atlanta will grow to 7.9 million, or an increase of 1.8 million people from 2020 to 2050. One of the direct beneficiaries of population growth is multifamily rent growth. Reflecting recent population trends, rent growth is forecasted to peak in the suburban counties east of …

Atlanta’s industrial sector and its historically strong performance have fortified the city as a strategic Southeast location and gateway market nationwide. Activity, which has decreased since peak demand during the COVID-19 pandemic, is now returning to normalized levels. The net new requirement pipeline remains robust primarily due to the influx of manufacturing, advanced manufacturing, life sciences, automotive, alternative energy and data center projects. How owners and tenants invest in industrial properties has also shifted. Owners are seeking properties with short weighted average lease terms and investments below replacement cost. Meanwhile, occupiers are making moves to crisis-proof their networks with onshoring and nearshoring of production that was previously conducted overseas, and they’re adjusting their overall supply chain and logistics strategies to diversify and avoid dependence on one region or vendor. Players in the market remain cautiously optimistic, which has subdued demand, but that is expected to be short-lived once macro-economic conditions stabilize. High inflation and rising interest rates over the past 12 to 18 months have significantly contributed to decreased demand in Atlanta. However, with continued population growth and Atlanta’s central location in the Southeast, the metro area’s compressed demand will be short-lived. With that said, Atlanta’s industrial market remains strong …

In recent years, Atlanta has become a top choice for corporate relocations, causing double-digit multifamily rental rate growth, an increase in pricing and a general benefit to the industry as a whole. In 2021, rental rates rose at an average of 11.7 percent and last year that number reached 16.8 percent. As a result, from 2021 through much of 2022 the metropolitan area experienced a record amount of investment activity, with $20.8 billion and $14.8 billion trading hands, respectively. During the first six months of 2023, however, transaction activity slowed and began returning to more typical levels, dropping approximately 82 percent year-over-year from those highs. Much of the decline in transaction activity experienced today can be accredited to the Federal Reserve’s sizable interest rate hikes over the past 18 months, resulting in a significant expansion in cap rates and a divide between buyer and seller pricing expectations. During the first half of 2023, approximately 54 transactions occurred, compared to 172 recorded for the same period last year for assets valued at $5 million or more. Much of this activity was driven by smaller deal sizes and private capital as institutional investors embrace a “wait and see” agenda in hopes of …

Savannah’s industrial real estate market is experiencing exceptional growth and now totals 113.7 million square feet, of which 98.2 million square feet (86 percent) is dedicated to bulk distribution (tracking facilities sized 100,000 square feet or larger). Year-to-date net absorption as of the end of the second quarter was 6.3 million square feet, which suggests another solid year ahead. Additionally, the vacancy rate remains low at 4.6 percent, a historically favorable level. The development community has been quick to respond to robust demand, delivering 19 buildings totaling nearly 10 million square feet in the second quarter, with the majority of it already leased. The market is primed for additional growth, with a significant amount of new construction underway. More than 16 million square feet is currently under construction, not including the Hyundai plant that will span 17 million square feet itself, along with related supplier facilities covering an additional 1.9 million square feet as of this writing. The $5.5 billion Hyundai plant will employ 8,100 people and be the company’s first dedicated electric vehicle (EV) mass-production plant. It is expected to begin full production in early 2025 and will produce over 300,000 vehicles per year. The effects of Hyundai on …