While the health of the retail market along the Magnificent Mile continues to recover incrementally with a rebound in foot traffic following a prolonged downturn, Chicago’s neighborhoods and suburbs are bustling with leasing activity. In fact, limited retail supply in the suburbs and throughout most of the city’s neighborhoods is one of the biggest challenges facing the market, according to Michael Flinchbaugh, an associate director with Chicago-based Bradford Allen. He says the dynamic has pushed up rents, leading to more national retailers entering corridors that have historically been occupied by local stores. “Groups that are not as well capitalized are struggling to find affordable space for lease,” says Flinchbaugh. The Loop, on the other hand, is sitting at a vacancy rate around 30 percent, according to Flinchbaugh. He says the hope is that the number of office-to-residential conversions slated to occur in the next two to three years will bring retailers back to the submarket as it becomes more of a live-work community. The Loop is located south of the Chicago River, while the Magnificent Mile is situated on the city’s Near North Side. Long known for its high-end shops, hotels and restaurants, the one-mile section of Michigan Avenue referred …

Market Reports

By Marc Hale, DarwinPW Realty/CORFAC International The Chicagoland industrial market continues to stand out as one of the most important in the country. Its location at the center of the U.S. transportation network gives companies the ability to reach nearly one-third of the nation’s population within a single day’s drive. Six Class I railroads, an abundance of intermodal facilities and seven major interstate highways all converge here, making it one of the most efficient distribution platforms in North America. Chicago O’Hare International Airport also ranks among the top cargo airports in the world, adding critical global connectivity. These advantages are reinforced by a large and diverse labor pool, which has long supported the region’s position as a major hub for manufacturers, distributors and logistics providers. The area’s role as a manufacturing hub is further reinforced by its proximity to major steel mills and primary metal production facilities, the depth of its skilled workforce and plentiful access to water from Lake Michigan, which has long supported heavy industry and advanced manufacturing across the region. The market’s vacancy rate has been trending higher, moving from 5.2 percent in the third quarter of 2024 to 5.9 percent in the third quarter of 2025. …

By Nicole McAleese, Urban Innovations As autumn arrives, Chicago’s commercial real estate market continues to evolve in response to changing workplace strategies and a growing return-to-office (RTO) movement. With major employers tightening in-office attendance policies, both landlords and tenants are adapting to new demands around space, flexibility and location. Shift in tenant behavior Over the past year, Chicago has seen a noticeable shift in how companies are approaching their office needs. Where many tenants once sought short-term lease extensions or downsized footprints during the height of hybrid experimentation, 2025 has brought renewed interest in long-term planning and, in some cases, expansion. Several high-profile lease transactions underscore this trend. Stripe recently doubled its Chicago office space to 89,000 square feet, while law firm Arnold & Porter relocated from the Loop to a new 40,000-square-foot lease, according to Crain’s Chicago Business. While some firms continue to downsize or consolidate, there’s a clear cohort of companies reinvesting in physical office environments that support collaboration, talent attraction and cultural cohesion. These trends mirror national patterns. According to CRE Daily, a growing number of U.S. employers are enforcing stricter in-office attendance, accelerating the shift away from a purely remote or hybrid-first mindset. The Archie RTO …

By Ben Azulay, Bradford Allen As summer approaches, I’m noticing Chicago’s downtown buzzing with renewed energy, and new signs that the Loop’s office market is heating up as well. In fact, research by my firm, Bradford Allen, suggests a Chicago office market nearing its bottom and poised for recovery. Improved leasing activity, strategic landlord adaptations and discounted sales are reshaping downtown Chicago’s market, particularly in high-demand submarkets like the West Loop and Fulton Market. Client certainty Office tenants in downtown Chicago are demonstrating increased confidence about their space needs, as reflected in significant expansion deals and long-term commitments. In fact, office expansions drove at least five of the 10 largest leases signed during the first quarter, including Stripe more than doubling its footprint at 350 N. Orleans from 45,000 to 89,000 square feet and Blue Owl’s second expansion at 150 N. Riverside from 27,000 square feet to 54,000 square feet. Large new leases included BP renewing 240,000 square feet at the CME Center, and Goldman Ismail signing a 43,000-square-foot deal at 191 N. Wacker. Leasing volume totaled 1.7 million square feet, up from 1.3 million square feet year-over-year, with the West Loop alone securing 916,760 square feet of leasing activity. …

By Lee Kiser, Kiser Group Multifamily real estate investment in the Midwest in 2025 presents a compelling opportunity, driven by strong fundamentals, favorable market dynamics and emerging trends. Here’s an overview of the key trends and outlook. Strong rent growth Midwestern cities are experiencing some of the fastest rent increases in the nation. Cleveland leads with a 5.1 percent year-over-year rent growth, while other metros like Chicago, Kansas City and Detroit rank among the top 10 for rent gains, outperforming the national average. This surge is attributed to steady demand and limited new supply, allowing landlords to continue raising rents. Much of the rent growth is due to declining construction activity. Nationally, multifamily construction is expected to decline by 11 percent in 2025, with completions projected to fall to 317,000 units. The Midwest has a significantly smaller pipeline than the national statistics, with only 3.4 percent of inventory currently under construction versus 6 percent nationally. Workforce housing stock The Midwest is recognized for its affordability, with monthly multifamily rents averaging $1,405, which is lower than the national average of $1,823 and more than 10 percent less than the Sun Belt average. Midwest transaction velocity is shifting toward Class B and …

By Steven Bauer, Colliers The office towers that define Chicago’s landscape have unique histories and personalities, but not all are created equal in the eyes of the tenant. Buildings seeing the highest demand, classified even higher than Class A, are “trophy buildings” — buildings with high-quality finishes, newer and more efficient construction, and are often amenity rich with exclusive lounges, rooftop decks, fitness centers and private bars. It’s especially important in today’s market to distinguish between the two distinct building categories because while Chicago’s real estate market is a vibrant and complex one, there is more to the story than what you see in the headlines. While the overall vacancy rate in the Loop remains at a historic high above 25 percent, trophy space vacancy is under 10 percent, and demand continues to be robust. The story of flight to quality and flight to trophy assets has been told repeatedly since the COVID pandemic — complete with statistics that back the trend up. In the fourth quarter of 2024 alone, owners of trophy class buildings finalized anchor tenant renewals with Mayer Brown and PwC, both of whom kept roughly the same square footage as they had previously leased. With the …

By Trina Sandschafer, AIA, Project Management Advisors Adaptation and reinvention are core parts of what makes American cities great, and Chicago is a prime example. Whether rebuilding, reimagining space for modern usage or creating new neighborhoods from formerly empty lots, the city has become known for its unique ability to bring new energy and life to formerly underutilized areas. Chicago knows how to reimagine the built environment and is leading the way with several transformative development strategies. Adaptive reuse: A well-tested Chicago tactic Chicago’s long history of adaptive reuse began with the pioneering residential loft developers. In the wake of nationwide manufacturing declines, these enterprising developers saw opportunity in the city’s largely vacant warehouses and manufacturing buildings. The success of these early loft conversions encouraged further reimagining of Chicago’s aging industrial and office stock into condominiums, apartments, offices, entertainment venues and hospitality spaces, which continue to this day. Now, adaptive reuse strategies are helping to increase the supply of housing and restore economic viability to communities dealing with the lingering impact of the pandemic on local businesses. Converting legacy structures to new and better uses is more environmentally sustainable and can be more cost-effective than demolishing older buildings and starting …

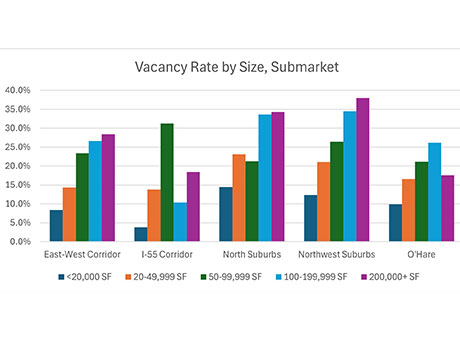

By Adam Johnson, NAI Hiffman For years, you’ve read headlines saying the U.S. office market is struggling with record-high vacancy that threatens to push many owners into default. And that is absolutely true. But there’s another side to the story that isn’t getting as much attention, and is playing out not only in Chicago, but also in metros across the country: that smaller, multi-tenant office properties — particularly in suburban locations closer to where workers live — continue to not only survive but thrive following the pandemic. Throughout suburban Chicago, office buildings with less than 50,000 square feet have considerably higher occupancy rates than larger ones. For instance, at the smallest buildings — those under 20,000 square feet — vacancy was as low as 3.8 percent as of the second quarter of 2024, whereas for the largest properties over 200,000 square feet, vacancy climbed as high as 38 percent, according to NAI Hiffman research. By comparison, mid-size, office buildings between 20,000 to 50,000 square feet reported vacancy rates ranging from 14.3 percent in the western suburbs to 23.1 percent north of the city. Small tenants, big impact We’ve all heard about larger office properties going back to their lenders. Look …

By Mary Lamie, Bi-State Development, St. Louis Regional Freightway The St. Louis regional industrial market continues to be a magnet for investment, with significant capital investment dollars flowing into four target industry sectors that remain key drivers of the bi-state economy. These sectors include metals, advanced manufacturing, food and AgTech, and chemicals. They are legacy industry sectors poised for continued innovation, job creation and economic diversification, in part due to the region’s exceptional logistics and transportation assets and established talent pipelines. Metals The St. Louis metropolitan area ranks second in the United States for mineral and ore exports. With more than $2.9 billion exported in 2022, the figures prove the market is well established for metals manufacturing, processing and shipping. The metals market is expected to grow with nearly 17,000 metals industry workers already in the region, and with copper supplier Wieland making a $500 million investment at its East Alton, Illinois, facility — a move that will retain 800 jobs in the region. “Wieland is committed to a sustainable future and is taking significant steps to modernize its East Alton facility,” says Greg Keown, president of Wieland Rolled Products North America. “This effort solidifies our ability to supply the …

By Chris Mergenthaler, DarwinPW Realty/CORFAC International The Windy City, as Chicago is often dubbed, has long been a vital hub of commerce and industry. Boasting 19 intermodal facilities operated by six Class I railroads, a top 15 worldwide cargo airport, and sitting at the confluence of seven interstate highways that allow goods to reach 25 to 30 percent of the U.S. population within one day’s drive, Chicago’s central location makes it a key logistics and transportation hub. The robust labor force of over 4.7 million nonfarm employees, according to a first-quarter 2024 U.S. Bureau of Labor Statistics report, coupled with Chicago’s location and infrastructure, lay the foundation for a fundamentally strong industrial market. While the long-term outlook of the Chicago industrial market remains positive, the Windy City is facing some headwinds as the market progresses through 2024. Uncertainty, whether positive or negative, has been a common theme of the Chicago industrial market since early 2023 as the market reacts to changing macroeconomic and geopolitical factors. Uncertainty in the global supply chain, trade relations with other countries, as well as one of the longest freight market recessions in recent history, have led to an increase in direct and sublet space on …

Newer Posts