By Grant Mechlin, Sansone Group The St. Louis retail market showed impressive resilience in the second quarter of 2024, thanks to strong consumer spending and growing demand across various sectors. Despite challenges such as higher borrowing costs and persistent inflation, the market tightened considerably, with availability dropping to a record low 4.8 percent and well below the five-year average, according to CoStar. This strong absorption has persisted for nine consecutive quarters, highlighting the market’s ongoing strength. A major factor behind this is the limited new supply — only 770,000 square feet of retail space was added in the past year, with nearly all of it quickly absorbed, according to CoStar. This scarcity has fueled development, especially in areas like quick-service restaurants, banks and discount retailers, as tenants are forced to explore new construction as the only viable option to combat a lack of supply in the market. Meanwhile, the overall prices of goods and services in the St. Louis area saw a 3.4 percent rise over the past year, according to the Consumer Price Index. While food costs came down slightly, there was a 5.4 percent increase in energy costs and 4.3 percent for all other consumer expenditures. Despite …

Market Reports

By Mary Lamie, Bi-State Development, St. Louis Regional Freightway The St. Louis regional industrial market continues to be a magnet for investment, with significant capital investment dollars flowing into four target industry sectors that remain key drivers of the bi-state economy. These sectors include metals, advanced manufacturing, food and AgTech, and chemicals. They are legacy industry sectors poised for continued innovation, job creation and economic diversification, in part due to the region’s exceptional logistics and transportation assets and established talent pipelines. Metals The St. Louis metropolitan area ranks second in the United States for mineral and ore exports. With more than $2.9 billion exported in 2022, the figures prove the market is well established for metals manufacturing, processing and shipping. The metals market is expected to grow with nearly 17,000 metals industry workers already in the region, and with copper supplier Wieland making a $500 million investment at its East Alton, Illinois, facility — a move that will retain 800 jobs in the region. “Wieland is committed to a sustainable future and is taking significant steps to modernize its East Alton facility,” says Greg Keown, president of Wieland Rolled Products North America. “This effort solidifies our ability to supply the …

By Kellen Cushing, Carmody MacDonald PC Commercial and residential construction projects are inherently complex undertakings involving numerous parties working under tight deadlines and limited budgets. Change is inevitable and unpredictable in these projects, most often due to changes in project scope, incomplete or incorrect design, and unforeseen physical conditions. When something doesn’t go according to plan, it can impact the other parties’ abilities to perform their jobs in a timely manner and lead to litigation. Claims and litigation can be costly, time consuming and stressful for all parties, and may damage the relationship and reputation of the parties involved. Proper contractual planning among project owners and contractors can reduce the likelihood of litigation. Making preliminary management plans and incorporating them into the project’s contracts provides effective ways to address changes that can occur during a project and keep things moving forward. While preparation cannot always prevent roadblocks in construction projects, preemptive planning can make for much smoother sailing, even in the face of unpredictable circumstances. The best ways to avoid or minimize costly and time-consuming lawsuits include the following: Know your contract. Create a clear and comprehensive contract that defines the scope, schedule, budget, quality and responsibilities of …

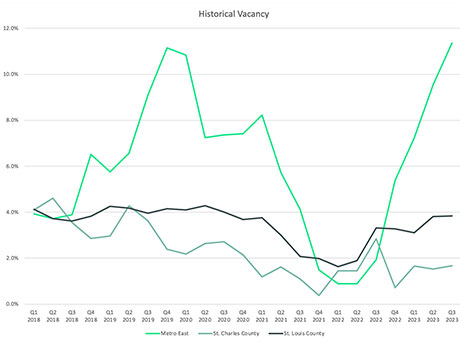

By Matt Hrubes and Joshua Allen, CBRE St. Louis is located at the crossroads of the U.S. at the intersection of I-55 (north/south) and I-70 (east/west), making it a prime location for industrial real estate users and developers alike. The Greater St. Louis area is separated by the Mississippi and Missouri rivers, giving it a natural division of industrial submarkets. Each side of the Mississippi River tells a different story as it relates to industrial real estate. Metro East To the east of the Mississippi River is the Metro East industrial submarket, which was the first in the area to offer real estate tax abatement, resulting in larger industrial developments ranging in size from 500,000 square feet to over 1 million square feet. Over the last decade, this area has seen some of the largest speculative developments in the region from national developers such as Panattoni, NorthPoint and Exeter, as well as local developers like TriStar. Absorption had been at all-time highs with groups like Amazon, World Wide Technology, Geodis, Sam’s Club, P&G and Tesla leasing space as buildings were being completed. That is, until 2023 when a wave of space became available either through sublease, speculative development completions or …

By Nick Fiquette, Sansone Group Lingering effects of COVID-19 In the aftermath of the global pandemic, the St. Louis real estate market finds itself at a crossroads, continuing to see the persistent impacts of COVID-19. Corporate strategies are evolving as companies evaluate their real estate footprints to accommodate the changing work environment and desires of employees. As lease expirations loom, businesses are engaged in a delicate dance of evaluating their physical space needs. The pendulum of work-from-home policies, initially adopted to streamline footprints, appears to be swinging back. Recently, Edward Jones listed a 227,000-square-foot Class A building that it owns on the market for lease and is planning on occupying it instead. This example could serve as a positive indicator for the future of the office market. The market is transforming as companies look to accommodate employee demands, prioritizing safe, walkable areas and amenity-rich buildings. This shift is particularly evident in the struggle faced by commodity real estate, as businesses increasingly gravitate toward locations that contribute positively to the employee experience. As a result, investors are remaining cautious about purchasing office assets due to surging interest rates and uncertainties surrounding the future of the office market. Corporate giants reevaluate real …

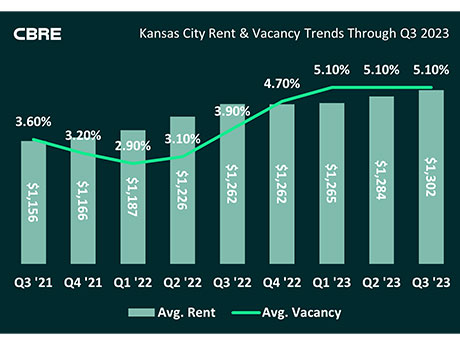

By Max Helgeson, CBRE As the national real estate landscape undergoes transformative shifts, Kansas City has emerged as one of the region’s most attractive multifamily markets. There are a myriad of attributes making Kansas City an unrivaled destination to deploy capital in the heart of the Midwest. Here are six key areas that propel the market to the forefront of real estate investors’ considerations. Economic anchors, diversification Kansas City has one of the nation’s most diverse economies with no sector comprising more than 15 percent of overall employment. A national leader of several durable industries provides unmatched economic stability and significant risk mitigation for investors. Moreover, the metro’s strategic location in the heart of the U.S. and strong transportation infrastructure make it a favored logistical hub for corporations across the world. Finally, the market is a base for startups and entrepreneurs drawn to the area’s abundant talent pool and competitive office space rates. Strategic infrastructure, connectivity Infrastructure is a cornerstone of Kansas City’s rise to prominence. The city’s strategic network of highways, interstates, railways, fiber networks and a major airport not only facilitates connectivity but positions it as a hub for commerce. This strategic infrastructure acts as a magnet, pulling …

By John Faur, Newmark Zimmer The Kansas City industrial real estate market has been on a historical run since 2020 with over 40 million square feet of inventory added in that time frame. This run of new construction has catapulted Kansas City to the 15th largest industrial market in the country by square footage, despite only being the 31st largest MSA by population. During most of this period, the strong market dynamics which exist in Kansas City, such as strategic highway infrastructure, a centralized location, four Class-1 railroads, availability of bulk land sites and an active development community, were further amplified by the low-interest rate climate and record levels of tenant activity. The continued high pace of speculative industrial construction starts in 2022 positioned 2023 to experience a healthy amount of new deliveries, with almost 8 million square feet of speculative industrial space delivering to the market. While the financial markets presented opportunity during this run of growth, continuous rate hikes in 2023 created challenges that resulted in a significant decrease in year-over-year speculative construction starts (3.5 million square feet of speculative construction has occurred year to date in 2023 as compared with more than 13 million square feet in …

By Scott Bluhm, Newmark Zimmer Since 2016, the Kansas City industrial market has been on a hot streak. We observed more opportunities and increased user activity. There have been consistent years of record positive space absorption and the delivery of Class A buildings, whether speculative or build-to-suit. The peak of that hot streak was in 2022. The year concluded with records in positive absorption, vacancy and rental growth. By the end of 2022, Kansas City became the 15th-largest industrial market in terms of square footage, surpassing Seattle. Significant statistics for 2022: •Over 16 million square feet of positive absorption •A vacancy low of 3.6 percent •A 10.6 percent increase in rental rates The year 2023 has been unique due to economic conditions and uncertainty. New speculative construction starts are down approximately 70 percent, with around 2.5 million square feet breaking ground in 2023. Most of the speculative buildings delivering in 2023 were projects that began construction in 2022. Annual net absorption has decreased to 2.5 million square feet in the first and second quarters. For reference, the fourth quarter of 2022 saw a record-setting net absorption of approximately 7.3 million square feet, and the third quarter of 2022 had 3.2 …

By Mary Lamie, Bi-State Development The industrial real estate market continues to show its strength in the St. Louis region as new investments by industrial developers hold steady. Coming off a record year in 2022, with more than 7 million square feet of completions entering the market and 6.5 million square feet absorbed, the region’s new construction has leveled off a bit, with 1.1 million square feet of industrial space delivered so far in 2023 and 3.6 million square feet of space still under construction, according to the latest numbers from Colliers. Speculative construction rates remain high, with 65 percent of construction since 2019 being speculative builds. This growth in industrial construction is being fueled by national and regional developers who believe St. Louis has the industrial activity levels needed to drive construction investments. Data included in the “St. Louis Regional Industrial Real Estate Market Indicators & Workforce Report,” released by the St. Louis Regional Freightway in May, shows the St.Louis region now has 182 million square feet of space available. According to the report, the region offers the largest amount of manufacturing space available on the market compared to other Midwestern cities, along with one of the lowest triple …

By Scott Dunwoody, Cushman & Wakefield It’s not too much of a stretch to say that St. Louis’ life sciences sector dates back to Lewis & Clark’s Corps of Discovery and all the scientific findings revealed upon their return to the city in 1806. More than two centuries later, St. Louis remains at the forefront of life sciences. The region is a center of plant science research and a cornerstone of global agriculture technology, with institutions such as Washington University in St. Louis (WashU) and St. Louis University playing critical roles in the biotech and medical fields. These factors translate into significant economic development benefits for the region and a positive impact on the area’s commercial real estate market. St. Louis is home to the largest concentration of plant scientist PhDs in the world. All that talent supports and drives more than 750 plant and medical science organizations across the region, including large employers such as Bayer (formerly Monsanto), Bunge, Benson Hill, IFF, Novus and Pfizer, and has led to significant investments throughout the region. What’s more, St. Louis ranks No. 14 nationally in National Institutes of Health funding, having secured more than $3.3 billion in the past five years. …