By Sam Rolfe, The Lerner Company It seems Omaha’s retail market shows no signs of slowing down from a position of strength, which received a tangible boost when the metro-area population hit the magic 1 million mark. It’s funny that this population hurdle opens the eyes of retailers so much more than 970,000 would, but there’s no doubt that it does, and the market has reacted accordingly, with year-over-year asking rents up 5.4 percent. The seemingly rapid growth and development have not vastly affected the city’s historically strong fundamentals and high occupancy rates however, with the vacancy rate in the metro at 4.4 percent. This low vacancy is partially a byproduct of the historically low supply that has plagued the market in recent years. Over the last decade, we have seen vast westward growth and somewhat stagnant activity in the urban core and central region. Although the westward march continues, it is now coupled with large amounts of urban development, making the city’s retail market strong within eastern submarkets. The old adage “retail follows rooftops” has held true throughout this growth cycle, as retail developments follow the suburban growth of both homes and apartments. One example of this is at …

Market Reports

By Mike Homa, R&R Realty Group Five years later and businesses are still adjusting to the new work environment brought on by the COVID pandemic. Omaha’s office space market is seeing a shift in how companies attract employees back into the office. With remote and hybrid work now widely accepted, developers and employers have realized that providing traditional office spaces is no longer enough to entice workers. Instead, they are focusing on creating environments that offer a blend of professional, personal and recreational amenities, transforming office spaces into lifestyle destinations. To make coming to the office more attractive, developers are offering amenities that cater to employees’ holistic needs. In some office parks, facilities such as onsite daycare centers are becoming a reality. These allow working parents the convenience of dropping off their children close to where they work, reducing commute time and providing peace of mind. It’s an amenity that goes beyond the typical office needs, addressing a significant aspect of employees’ personal lives. Green spaces are another amenity we see being increasingly incorporated into the surroundings of new buildings and broader development areas. We see outdoor spaces in office parks like Fountain Ridge Office Park, which offers amphitheater-style seating …

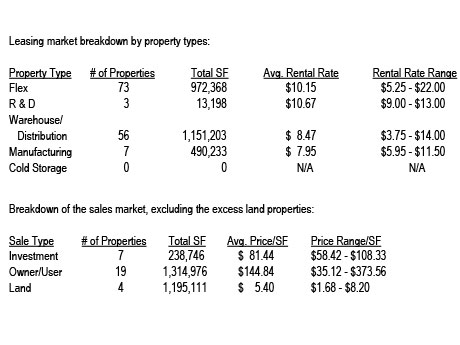

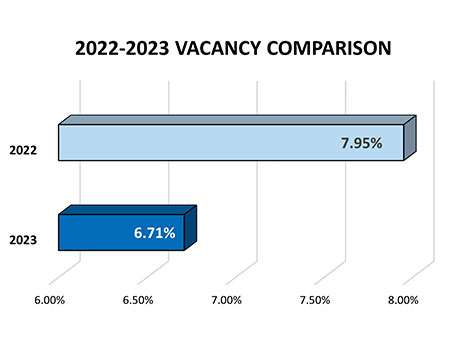

By John Dickerson, OMNE Partners Omaha continues to be strong economically. The Omaha-area population is nearing the 1 million mark, and Omaha has been rated in the top 10 of cities to move to. Unemployment is less than 3 percent compared with about 4 percent nationally, and employment growth is about 2 percent per year. In commercial real estate, business news generally says that Omaha is doing better than larger cities in the U.S. Of the key sectors, industrial has performed very well. Leasing pace Per CoStar information, Omaha’s vacancy rate is 3 percent. The total industrial square footage is 108 million square feet, and there is approximately 4 million square feet under construction. A large share of construction is due to Google, Facebook and other large users adding facilities. About 1.7 million square feet has been absorbed in the last year. Currently, per market information gathered from Crexi listings, there is approximately 2.6 million square feet available for lease in Douglas and Sarpy counties. (See chart for a breakdown by property types.) One other thing to note is that in the 139 properties with space for lease, there appears to be only 20 spaces for lease with 2,000 square …

By Tom D’Arcy and Brad Soderwall, Hines The Omaha market has experienced strong growth in recent years, with $8 billion in commercial real estate development currently underway driven by consistent migration of new residents and professionals to the area. The city’s attractiveness is attributed in large part to its high quality of life and attractive cost of living, both of which present compelling opportunities for new development that further incentivizes in-migration, and cultivates and enhances the unique lifestyle that makes Omaha a desirable place for families and young professionals to put down roots. Shifting demographics drive growth in Omaha Omaha’s low unemployment rate (at 2.6 percent as of July 2024, per the Nebraska Department of Labor), quality of life, affordable cost of living and expanding cultural opportunities are driving migration into the area. The Omaha-Council Bluffs metropolitan area saw its strongest population growth since pre-pandemic (2019) in 2023, with an increase of 0.8 percent, substantially outpacing the national average of 0.5 percent, per the U.S. Census Bureau. 2023 also saw a net migration of over 3,400 residents to the area. This population growth is fueling demand in the multifamily market, where we saw a record-setting year for development in 2023 …

By Kristi Andersen and Melissa Torrez, CBRE The office market remains one of the most uncertain commercial real estate sectors across the country. Facing declining asset values, rising interest rates and the increase of remote and hybrid work, many of the nation’s office markets are struggling. Key indicators that typically track the health of the market include net absorption, rental rates and vacancy rates. Not surprisingly, given the recent challenges, net absorption of office space nationwide is currently negative, rents have gone down and vacancy is high. However, Omaha continues to buck those trends. A solid, steady economy The midwestern city boasts a diverse economy with agriculture, food processing, insurance, transportation, healthcare and education all being leading drivers. Warren Buffett calls Omaha home, as do several Fortune 500 corporations such as Berkshire Hathaway, Union Pacific Railroad, Mutual of Omaha and Peter Kiewit Sons’ Inc. The Omaha economy consistently outperforms other metro areas, particularly during economic downturns. In December, the U.S. Bureau of Economic Analysis released 2022 Gross Domestic Product (GDP) data for counties and metropolitan areas. Douglas County, the most populous county in Nebraska, had the highest annual GDP growth at 9.2 percent for U.S. counties with populations greater than …

By Mandi Backhaus, The Lerner Co. As we finish out the first quarter of 2024, we reflect on the Omaha retail real estate market with consideration to the internal and external factors of trends, challenges, opportunities and the state of the economy. It can be said that the Omaha metropolitan area remains steadfast throughout difficult times. With its robust and diverse nature, anchored by industries such as healthcare, technology and finance, Omaha, although sometimes called a “flyover city,” remains a hidden gem for those looking for a steady yet vital lifestyle at an attractive cost. This favorability trickles down to how real estate is valued and utilized in the area. According to a Merrill Lynch article, approximately $84 trillion in assets is set to change hands over the next 20 years, from baby boomers onto their children and so on. While the various generations may invest differently, one constant remains: real estate. From a national standpoint, the unstable scenario results from a blend of factors, with inflation, interest rates and the collapse of banks in early 2023 being particularly prominent. This perfect storm had left the industry in a precarious position. The Mortgage Bankers Association revealed a 56 percent drop …

By Mike Rensch, Investors Realty The Omaha office market is facing an increasing amount of sublease space, which is having a significant impact on what spaces tenants prefer to lease right now. This is directly affecting all aspects of the overall office market as well. As the second quarter came to a close, the direct vacancy rate was 7.4 percent, compared with 7.6 percent in the second quarter of 2022. With that said, those numbers do not paint the whole picture because they do not account for the amount of sublease space on the market. The availability rate (which includes direct space and sublease space available) was at 9.8 percent compared with 8.4 percent in the second quarter of 2022. We see this trend continuing for the time being as companies grapple with whether or not to bring their employees back to the office. At the end of the second quarter, there was 841,000 square feet of sublease space available in Omaha, up from 723,000 square feet at the end of the second quarter of 2022. This represents a 14 percent increase in sublease space over the past year. It reached its peak of 919,000 square feet of available …

By Sara Hanke, The Lerner Co. Eternally optimistic is the state most commercial real estate brokers find themselves in, particularly when it comes to the retail sector. We must be, as the conditions of the retail market are quite often painted in negative broad strokes. The predictions that online sales would be the demise of physical retail proved wrong. Retailers that are digitally native continue to open brick-and-mortar locations after realizing the limits of online customer acquisition and growth. Most recently, the pandemic has shown us that retail can weather the storm of restrictions and limitations. Now we are in a post-pandemic world where the restrictions and upheaval of the way we consume has shifted our mindset. Shoppers have returned to their daily shopping, eating and entertainment needs. Navigating the complexities of the retail real estate market continues to keep us all on our toes. The first and third quarters were healthy with vacancy dipping below 5 percent. So far, the third quarter has proven strong due to new-to-market concepts looking to do multiple location rollouts as well as existing retailers looking to add additional locations. As the year progresses, we are not without challenge. There has been a shortage …

By Eric Rose and Erick Tjarks, Cresa The Omaha office market proved to be somewhat insular from the effects of the many factors the real estate industry has experienced since 2020 (COVID-19, the hybrid work-from-home model, discussions of impending recession to name a few). Although down year-over-year, which given the recent interest rate hikes is expected, market sales volume remains above-average over the surveyed period going back to 2007. Though, this transaction volume dropped precipitously in the second half of 2022 and has continued to be slow in early 2023. However, the local market has seen pockets of increased activity, as Northwest Omaha saw heightened transactional volume, with Midtown Omaha, downtown Council Bluffs and suburban West Dodge following suit. As showcased above, market cap rates have largely accounted for interest rate hikes and are currently stable but subject to future interest rate increases. These statistics all point to a stable market, with fundamental performance on solid footing. However, it should be noted that, according to CoStar, 2022 is only the second year on record when demolitions outpaced gross deliveries, with only 93,000 square feet of net deliveries Omaha ranked in the bottom 10 of the top 60 office markets …

By Holly Jones and Trey MacKnight, Cushman & Wakefield/The Lund Co. The world of retail real estate in the Midwest has been rapidly evolving over the past few years, with the pandemic serving as a catalyst for more change. As we move further into 2023, it’s becoming increasingly clear that the retail landscape is different than in years past, yet healthy in numbers. In this article, we’ll explore and explain some of the latest trends, developments, absorption and vacancy, and how this is impacting the industry as a whole. Whether you’re a retailer, landlord or investor, it’s essential to stay up to date with the current market and future developments. Omaha’s retail market recorded 350,931 square feet of positive absorption in the fourth quarter, bringing the year-to-date absorption total to 1 million square feet. Throughout 2022, there were 34 buildings delivered, increasing the retail inventory by 379,733 square feet. At the close of the year, more than 86 percent of the new construction was occupied, creating a very healthy environment. While there were sizable deals inked throughout the year, just over 85 percent of the new leases signed were under 5,000 square feet. Many of the leases were signed by …

Newer Posts