Raleigh-Durham’s office market entered the year on a positive note as 2024 ended strong. Vacancy was largely flat in the fourth quarter, net absorption neared 300,000 square feet and move-outs were sparse. After years of uncertainty and short-term renewals dominating the landscape, companies are now committing to longer leases. Clarity around business drivers, a growing labor pool and new market entrants are all contributing factors to this decisive turn. Firms are confidently making long-term real estate decisions, bringing lease terms back to the five- to 10-year range. While the vibrancy of the pre-pandemic era has not fully returned, data shows a steady recovery throughout 2024, and 2025 is poised to bring even stronger growth. In 2024, Raleigh-Durham welcomed several notable commitments from companies establishing a foothold in the market, like Jewelers Mutual, JTL and Amgen. Leasing activity stayed strong through the fourth quarter, supporting the net absorption of nearly 160,000 square feet of office space over the course of the year. Rents have seen some downward corrections overall, but well-located, highly amenitized assets have retained rent stability. Recent recommitments from major companies like Nutanix and Hitachi highlight the area’s enduring appeal. Vacancy closed out December at 17.3 percent but was …

Market Reports

The secret is getting out about Apex, a western suburb of Raleigh that also lies 20 miles south of Chapel Hill. In 2018, Realtor.com ranked the city as the No. 1 fastest growing suburb in the United States. This was aided by the master planning of local homebuilder/developer ExperienceOne Homes, which debuted its large-scale Sweetwater residential development in 2016. The allure of Apex didn’t stop there as the local schools within the Wake County Public School System have long been considered top-notch. As more and more families moved to the once-sleepy town, the need for community-serving retail became apparent. And not just any sprawling shopping center would suffice. Retail Strategies of N.C. Inc., on behalf of development partner The Kalikow Group, a multifamily and mixed-use development firm based in Westbury, New York, and the aforementioned ExperienceOne, set out to create a sense of place that would resemble village towns in Northeast states such as Maine and Massachusetts. What all of these hamlets have in common is they are built up over decades around a town center, thus the idea of Sweetwater Town Center was established. East Side The “hard part” was essentially in the rearview mirror as ExperienceOne had already …

For all Top 50 NMHC third-party management firms, the subject of managing rising operating costs is a topic that has come to be front and center in many recent client conversations. “As 2025 budget discussions were taking center stage toward the end of 2024, our clients increasingly highlighted the issues of rising operating costs,” says Lisa Narducci-Nix, director of business development at Drucker + Falk. “This trend”, she adds, “underscores our need for strategic planning and cost management to navigate the continued challenges ahead.” The multifamily sector is facing unprecedented headwinds as operating costs continue to rise, driven by factors ranging from inflation and labor shortages to increased insurance premiums and energy expenses. As a result, multifamily operators are working to find ways to maintain profitability while providing quality living spaces for their residents. “In this challenging environment, it is clear to us that adapting to these rising costs will require a multifaceted approach — one that blends innovation, strategic marketing, operational efficiency and technological adoption,” says Narducci-Nix. Challenges of rising costs Across its 11-state footprint spanning over 42,000 units, Drucker + Falk has seen operating costs for many of its managed assets surge in recent years. The supply chain …

Multifamily Supply Hits Record High in Raleigh-Durham as Development Pipeline Empties

by John Nelson

This year, multifamily housing starts nationally are on pace to hit their lowest levels since 2014, a period marked by the national economy’s gradual recovery from the Great Financial Crisis. Year to date, multifamily deliveries have exceeded starts by 218,500 units, creating a substantial shortfall that signals a significantly reduced apartment supply by 2026. The same trend is taking effect in Raleigh-Durham, where completions exceeded starts by 4,935 units. This is a key consideration for most apartment investment strategies today, explaining why many buyers are willing to accept Year 1 challenges such as softness or negative leverage. As the current supply wave peaks in the Triangle, the future pipeline of multifamily construction is shaping up quite different. Of the identified units that are scheduled for delivery in 2024, nearly 42 percent of units have been delivered as of this writing. Of the approximately 18,600 apartments currently under construction across the Triangle, 13,343 of those are expected to be delivered by the end of third-quarter 2025, with a majority in Central and Southeast Raleigh. However, new activity has slowed significantly — inventory growth by 2027 is projected to drop by more than 85 percent, plummeting to a 3.6 percent rate compared …

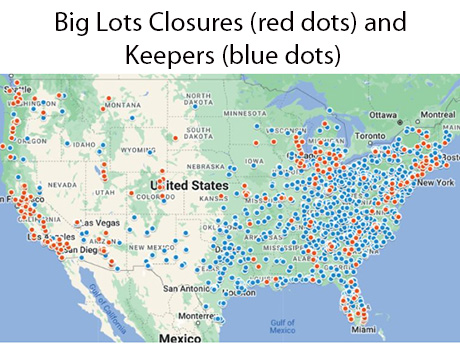

As someone who has closely observed retail trends in the Southeastern United States for decades, I’ve witnessed the inevitable ebb and flow of the industry. From periods of rapid expansion to challenging market corrections, and of course, global pandemics that disrupted every sector of real estate, it often feels as though I’ve ‘seen it all.’ Once again, I find myself watching the market adjust, particularly among big-box retailers, in high-growth areas like Raleigh. This ongoing shift signals both challenges and opportunities, reminding me of the resilience and adaptability required to thrive in this dynamic environment. When news broke in September that Big Lots Inc. had filed for Chapter 11 bankruptcy protection and that it would be closing more than 300 stores across the country, it wasn’t all that shocking, given the sheer number of Big Lots that one comes across just driving across their own towns. The Big Lots announcement follows similar moves by companies such as rue21, Express, The Body Shop, 99 Cents Only Stores, LL Flooring, Conn’s, and Red Lobster. Retailers like Rite Aid and Bed Bath & Beyond, which filed for bankruptcy last year, have closed hundreds of stores, causing vacancies in the retail real estate market. …

FloridaGeorgiaMarket ReportsNorth CarolinaSouth CarolinaSoutheastSoutheast Market ReportsStudent Housing

Universities, Student Housing Properties in Southeast Contend with Hurricane Helene

by John Nelson

Hurricane Helene made landfall in Northwestern Florida on Thursday, Sept. 26, after being upgraded to a major Category 3 storm that afternoon. Widespread damage across a number of Southeastern states followed in its wake, with many areas experiencing flooding, downed trees, power outages and road closures. At least 175 people have died across six states, according to reports by CNN and The New York Times, and officials fear that the death toll is likely to rise with many remaining missing. Hundreds of roads remain closed across the Southeast — especially in Western North Carolina and East Tennessee, which were hit particularly hard by the hurricane — hampering the delivery of supplies, and more than 2 million customers remain without power. Student Housing Business reached out to universities, owners, operators and students across the Southeast to check in on how they fared during the storm and their experience in the aftermath. Owners, Operators Weigh In Denver-based Cardinal Group tracked its communities in Alabama, Arkansas, Florida, Georgia, Kentucky, North Carolina, South Carolina, Tennessee, Virginia and West Virginia through Hurricane Helene. “Of those communities, four experienced power outages and several had minor roof leaks and flooding, with the largest impact felt in Asheville and Boone, North Carolina,” says Jenn Cassidy, president of property operations …

By Tom Kolarczyk of JLL The overall U.S. economic slowdown, rising interest rates and the looming threat of inflation had a negative effect on all segments of Raleigh-Durham’s commercial real estate market last year — and retail was no exception. According to JLL research, there were just 11 retail trades over $5 million between January and December, totaling some $131 million in value. This is a notable drop from the 33 transactions recorded in 2022 valued at $582 million. On the flipside, however, fundamentals remained incredibly strong with occupancies ending out the year at the near record-setting level of 98 percent. This led to leasing spreads of anywhere between 20 and 40 percent on new leases and helped flip the tables to favor landlords for the first time in decades, where getting space back is generally a positive. Rents grew 3 to 6 percent in 2023, with an average year-end asking rate of $24.93 per square foot. This represents a year-over-year increase of 6.45 percent from 2022. While about 80 percent of all retail trades last year were acquired through private capital, an increasing number of REITs are becoming more active via mergers and acquisitions and strategic one-off acquisitions and …

By Lisa Narducci-Nix of Drucker + Falk As a third-party manager of more than 7,000 multifamily units in the Raleigh-Durham metropolitan area, the question we’ve been asked the most lately is, “What do you see for 2024 in terms of rent growth and occupancy?” Alongside other concerning variables such as liability insurance and payroll, rent and occupancy performance seem to be front and center in most conversations. Rents have notably cooled from the unprecedented growth enjoyed most of 2022. According to a multifamily market report on Raleigh by Yardi Matrix, rent growth was negative 0.2 percent in third-quarter 2023 compared to the second quarter and down 1.5 percent on a year-over-year basis. We expect that those numbers represent a market correction of sorts from the unsustainable growth in 2022 as employment and population growth remain strong in the Raleigh-Durham market. In recent headlines, Apple is planning to begin its first phase of its 281-acre office campus, which will add 3,000 jobs at full build-out, and VinFast will begin developing its $4 billion electric vehicle plant in nearby Chatham County in 2025. Additionally, the U.S. Census Bureau found that the population of the Raleigh-Durham MSA grew by 2 percent in 2021 …

By Derek Jacobs of Avison Young Through the financial uncertainty and confusion of the past four years, Raleigh-Durham has stood out as an exemplary industrial market that has strengthened in economic diversity and stability despite greater national and global market trends and challenges. The outlook for Raleigh-Durham is very positive thanks to local and state governments that support business, an excellent central East Coast location and a market environment where industrial demand heavily outweighs supply. Triple-net rents in Raleigh-Durham grew by nearly 39 percent since first-quarter 2020, while total vacancy has remained below 4 percent. The most affordable Class C product has an exceptionally low vacancy rate of 2.7 percent due to lower rent costs outweighing the opportunity costs of moving into a nicer, newer building that will be more expensive in most cases. The newest and most costly Class A industrial product in Raleigh-Durham has also shown strong demand, with a vacancy rate (5.7 percent) lower than the vacancy rate for all industrial product classes combined across the country (6.1 percent). Industrial occupiers and residents in Raleigh-Durham work, do business in various industries and provide services that supply further market growth. Around half of the industrial property in Raleigh-Durham …

In the wake of the COVID-19 pandemic, Charlotte’s retail segment has experienced a remarkable revitalization, fueled by a convergence of factors that have reinvigorated the city’s economic landscape. With a thriving job market, affordable cost of living and a surge in adaptive reuse, mixed-use and infill projects, Charlotte has become a hotbed for retail activity. As the city emerges from the challenges of the pandemic, it has embraced innovative approaches to urban development, transforming once-vacant spaces into vibrant hubs of commerce. Several macro-economic trends have impacted retail growth in Charlotte. Population growth in the city has spurred an increase in consumer demand, leading to a vibrant retail market. In a May 18 article from the Charlotte Business Journal, it was noted Charlotte added more than 15,000 people to its population count between 2021 and 2022, the nation’s fifth-highest numeric increase during that span, according to the latest estimates from the U.S. Census Bureau. As more people choose to settle in Charlotte, the demand for goods and services has risen, prompting retailers and restaurants to expand their operations and invest in new locations. Additionally, the rise of e-commerce and the shift toward online shopping have compelled retailers in Charlotte to adapt …