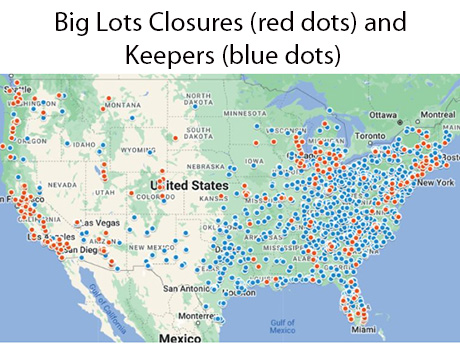

As someone who has closely observed retail trends in the Southeastern United States for decades, I’ve witnessed the inevitable ebb and flow of the industry. From periods of rapid expansion to challenging market corrections, and of course, global pandemics that disrupted every sector of real estate, it often feels as though I’ve ‘seen it all.’ Once again, I find myself watching the market adjust, particularly among big-box retailers, in high-growth areas like Raleigh. This ongoing shift signals both challenges and opportunities, reminding me of the resilience and adaptability required to thrive in this dynamic environment. When news broke in September that Big Lots Inc. had filed for Chapter 11 bankruptcy protection and that it would be closing more than 300 stores across the country, it wasn’t all that shocking, given the sheer number of Big Lots that one comes across just driving across their own towns. The Big Lots announcement follows similar moves by companies such as rue21, Express, The Body Shop, 99 Cents Only Stores, LL Flooring, Conn’s, and Red Lobster. Retailers like Rite Aid and Bed Bath & Beyond, which filed for bankruptcy last year, have closed hundreds of stores, causing vacancies in the retail real estate market. …

Market Reports

FloridaGeorgiaMarket ReportsNorth CarolinaSouth CarolinaSoutheastSoutheast Market ReportsStudent Housing

Universities, Student Housing Properties in Southeast Contend with Hurricane Helene

by John Nelson

Hurricane Helene made landfall in Northwestern Florida on Thursday, Sept. 26, after being upgraded to a major Category 3 storm that afternoon. Widespread damage across a number of Southeastern states followed in its wake, with many areas experiencing flooding, downed trees, power outages and road closures. At least 175 people have died across six states, according to reports by CNN and The New York Times, and officials fear that the death toll is likely to rise with many remaining missing. Hundreds of roads remain closed across the Southeast — especially in Western North Carolina and East Tennessee, which were hit particularly hard by the hurricane — hampering the delivery of supplies, and more than 2 million customers remain without power. Student Housing Business reached out to universities, owners, operators and students across the Southeast to check in on how they fared during the storm and their experience in the aftermath. Owners, Operators Weigh In Denver-based Cardinal Group tracked its communities in Alabama, Arkansas, Florida, Georgia, Kentucky, North Carolina, South Carolina, Tennessee, Virginia and West Virginia through Hurricane Helene. “Of those communities, four experienced power outages and several had minor roof leaks and flooding, with the largest impact felt in Asheville and Boone, North Carolina,” says Jenn Cassidy, president of property operations …

By Tom Kolarczyk of JLL The overall U.S. economic slowdown, rising interest rates and the looming threat of inflation had a negative effect on all segments of Raleigh-Durham’s commercial real estate market last year — and retail was no exception. According to JLL research, there were just 11 retail trades over $5 million between January and December, totaling some $131 million in value. This is a notable drop from the 33 transactions recorded in 2022 valued at $582 million. On the flipside, however, fundamentals remained incredibly strong with occupancies ending out the year at the near record-setting level of 98 percent. This led to leasing spreads of anywhere between 20 and 40 percent on new leases and helped flip the tables to favor landlords for the first time in decades, where getting space back is generally a positive. Rents grew 3 to 6 percent in 2023, with an average year-end asking rate of $24.93 per square foot. This represents a year-over-year increase of 6.45 percent from 2022. While about 80 percent of all retail trades last year were acquired through private capital, an increasing number of REITs are becoming more active via mergers and acquisitions and strategic one-off acquisitions and …

By Lisa Narducci-Nix of Drucker + Falk As a third-party manager of more than 7,000 multifamily units in the Raleigh-Durham metropolitan area, the question we’ve been asked the most lately is, “What do you see for 2024 in terms of rent growth and occupancy?” Alongside other concerning variables such as liability insurance and payroll, rent and occupancy performance seem to be front and center in most conversations. Rents have notably cooled from the unprecedented growth enjoyed most of 2022. According to a multifamily market report on Raleigh by Yardi Matrix, rent growth was negative 0.2 percent in third-quarter 2023 compared to the second quarter and down 1.5 percent on a year-over-year basis. We expect that those numbers represent a market correction of sorts from the unsustainable growth in 2022 as employment and population growth remain strong in the Raleigh-Durham market. In recent headlines, Apple is planning to begin its first phase of its 281-acre office campus, which will add 3,000 jobs at full build-out, and VinFast will begin developing its $4 billion electric vehicle plant in nearby Chatham County in 2025. Additionally, the U.S. Census Bureau found that the population of the Raleigh-Durham MSA grew by 2 percent in 2021 …

By Derek Jacobs of Avison Young Through the financial uncertainty and confusion of the past four years, Raleigh-Durham has stood out as an exemplary industrial market that has strengthened in economic diversity and stability despite greater national and global market trends and challenges. The outlook for Raleigh-Durham is very positive thanks to local and state governments that support business, an excellent central East Coast location and a market environment where industrial demand heavily outweighs supply. Triple-net rents in Raleigh-Durham grew by nearly 39 percent since first-quarter 2020, while total vacancy has remained below 4 percent. The most affordable Class C product has an exceptionally low vacancy rate of 2.7 percent due to lower rent costs outweighing the opportunity costs of moving into a nicer, newer building that will be more expensive in most cases. The newest and most costly Class A industrial product in Raleigh-Durham has also shown strong demand, with a vacancy rate (5.7 percent) lower than the vacancy rate for all industrial product classes combined across the country (6.1 percent). Industrial occupiers and residents in Raleigh-Durham work, do business in various industries and provide services that supply further market growth. Around half of the industrial property in Raleigh-Durham …

In the wake of the COVID-19 pandemic, Charlotte’s retail segment has experienced a remarkable revitalization, fueled by a convergence of factors that have reinvigorated the city’s economic landscape. With a thriving job market, affordable cost of living and a surge in adaptive reuse, mixed-use and infill projects, Charlotte has become a hotbed for retail activity. As the city emerges from the challenges of the pandemic, it has embraced innovative approaches to urban development, transforming once-vacant spaces into vibrant hubs of commerce. Several macro-economic trends have impacted retail growth in Charlotte. Population growth in the city has spurred an increase in consumer demand, leading to a vibrant retail market. In a May 18 article from the Charlotte Business Journal, it was noted Charlotte added more than 15,000 people to its population count between 2021 and 2022, the nation’s fifth-highest numeric increase during that span, according to the latest estimates from the U.S. Census Bureau. As more people choose to settle in Charlotte, the demand for goods and services has risen, prompting retailers and restaurants to expand their operations and invest in new locations. Additionally, the rise of e-commerce and the shift toward online shopping have compelled retailers in Charlotte to adapt …

When reflecting on Charlotte’s multifamily market over the past few years, several major trends drove unprecedented transaction volume — record-level rent growth, positive absorption despite a consistently robust pipeline of deliveries, strong population growth from high in-migration and rapidly increasing homeownership costs pricing residents out of the market. Charlotte has been a popular relocation destination for individuals and families, particularly from the Northeast, Midwest and other parts of the Southeast who are drawn to the low cost of living, warm climate and strong economy. Zillow ranks Charlotte as the No. 1 housing market for 2023, signaling a continued rise in home values and subsequent increased demand for rental housing from the growing population. In-migration has made Charlotte experience explosive growth and bolstered the population to over 2.7 million residents by year-end 2022, a 5.6 percent increase since 2018 compared to the national rate of 1.3 percent. Equally impressive is regional job growth, with non-farm payrolls increasing 7.9 percent over the same time frame. Much of Charlotte’s multifamily growth is attributed to capital investment from new employers across the metro, including Albemarle Corp.’s $180 million investment into a new research campus in University City bringing 200 new jobs, as well as …

Despite shifts toward remote and hybrid work, office rents continue to rise in North Carolina’s Triangle region. Among the 25 largest office markets in the country, Raleigh experienced the second-highest rent growth between 2019 and 2022 — a testament to continued tenant demand. We’re also seeing renewed interest in trophy assets, where the average asking rent has reached an all-time high of $43.35 per square foot. Additionally, the first quarter showed a 280,000-square-foot increase in total office supply, indicating investor confidence in Raleigh’s resilience. Compared to rival markets, Raleigh wasn’t overbuilt pre-pandemic. The market doesn’t have millions of square feet of vacant space downtown and is more balanced than its competitors, leaving plenty of opportunity for future growth. Another indicator of Raleigh’s growth trajectory is the 32 percent year-over-year increase in tours given by JLL’s Office Agency Leasing team this year. Given the current economic headwinds, we know that prospects are taking longer to make decisions about their space. However, we also know they are actively evaluating their options and making long-term plans for their team’s future needs. At buildings within our portfolio, badge swipes last quarter reached a post-pandemic peak utilization of 68 percent – just 13 percent shy …

Raleigh-Durham’s multifamily market has solidified itself as a top performer in recent years. After a rapid economic recovery in 2021 and early 2022, occupancy rates and rent growth soared. Year-over-year effective rent growth reached 13 percent in third-quarter 2022, well above the national average, and totaled 15 percent in Class A product. The region continues to be nationally ranked for real estate prospects, competitive incentives and taxes, education and quality of life. The impressive list of job wins the Triangle has been awarded continues to grow, including major job announcements from Wolfspeed, Apple and VinFast, to name a few. The region’s status as one of the nation’s leading tech and life science hubs has also lured giants such as Grifols, Pfizer, IBM and Red Hat. Population growth is one of the Triangle’s strongest apartment market fundamentals and it continues to surge, as approximately 5,000 new residents move to the region each month. Raleigh and the surrounding metropolitan areas are expected to increase in population at the second-fastest rate in the country, behind only Austin. Municipalities outside of the Triangle’s metro areas are also some of the fastest-growing locations in the state. Johnston and Franklin counties, for example, are expected to …

The retail market across the Raleigh-Durham region, also known as the Triangle, soared to new heights in 2022 despite significant global economic headwinds. Spurred by population growth and major economic development announcements, 2022 was filled with the groundbreaking and opening of new retail and mixed-use projects across the region. For the second consecutive year, North Carolina witnessed record-breaking economic development activity. New and expanding companies announced more than 12,700 jobs and more than $11 billion in new investments in the Triangle region alone. While the urban sectors lagged through 2020 and 2021, they saw a resurgence in 2022 with major tenant announcements for Smoky Hollow (Kane Realty Corp.) such as Midwood Smokehouse, The Crunkleton, Madre, Dose and New Anthem Beer Project. Downtown Raleigh also featured the delivery of 301 Hillsborough at Raleigh Crossing (Barings), Tower Two of Bloc 83 (City Office REIT) and construction of Seaboard Station (Hoffman & Associates). Downtown Durham boasted major groundbreaking, retailer and restaurant announcements as well, including the groundbreaking of Novus (Austin Lawrence Partners), encompassing 23,000 square feet of ground-floor retail space and 27 floors of high-end residential. American Tobacco Campus reimagined its restaurant mix to announce Five Star, Press, Queen Burger and the soon-to-open …